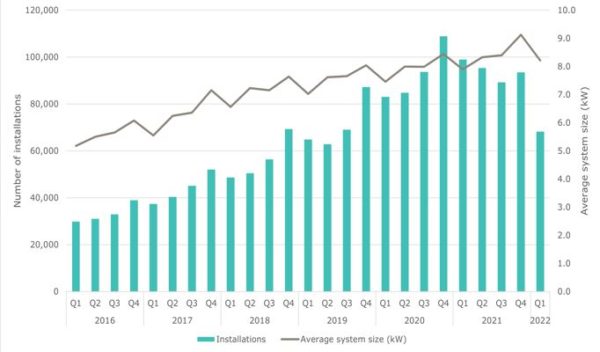

After five consecutive years of growth, Australia’s rooftop solar PV market experienced a drop-off in the first quarter of 2022 with the Clean Energy Regulator (CER) revealing the installed capacity in Q1 this year is 561MW, well below the 782MW rolled out in the same period last year.

Figures published by the CER in its latest Quarterly Carbon Market Report show an estimated 68,250 rooftop solar systems with an average system size of 8.2kW were installed in the first quarter of 2022, a 31% reduction on the nearly 99,000 systems installed in Q1 2021.

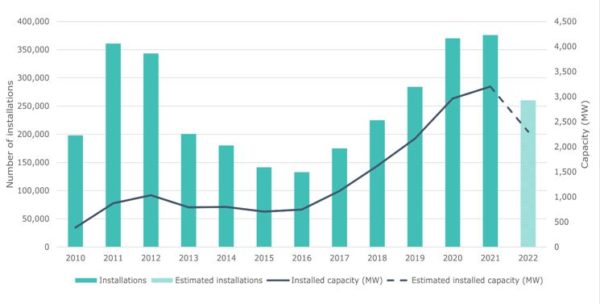

The downturn follows five years of consecutive growth from 2016 where the annual added capacity of rooftop solar averaged 35% year on year growth, from 750MW to a record 3.2GW in 2021.

While there has been a slowdown in the roll out of rooftop solar, CER chair David Parker said if the current monthly installation rate continues installed capacity in 2022 will still exceed more than 2GW.

“We estimate added installed rooftop solar capacity in 2022 will be about 2.3GW. This is still the third highest annual capacity ever and is higher than pre-pandemic installation rates,” he said.

Image: CER

Parker said it had always been anticipated the uptake of rooftop solar would eventually slow, attributing the decline in installations to the COVID-19 pandemic, during which international borders were closed and many Australians had brought forward their investment in rooftop solar as discretionary spending in other areas was reduced.

“The decline this year is in line with the decline in home improvements spending which boomed during the first two years of the pandemic,” he said.

The CER said lower feed-in tariffs for households from energy retailers, concerns about future increases in interest rates and cost-of-living pressures were other reasons given for the slowdown of rooftop solar installations.

But with power prices soaring, the CER said the downturn could be short-lived as those who don’t have solar switch to the renewable energy to slash their power bills.

“If the prevailing narrative becomes that increasing wholesale prices are flowing through to increased electricity bills, then that may become a consumer consideration that moves the sector back to growth,” the regulator said.

While the small-scale sector has witnessed a downturn, the large-scale sector continues to grow strongly with investment in new wind and solar projects trending up.

Image: CER

Parker said the first quarter of 2022 was the third consecutive quarter with 1.3GW of utility scale wind and solar projects reached final investment decision (FID).

“Achieving more than 3GW of new projects reaching FID in the 2022 calendar year cannot be ruled out,” he said.

If that eventuates, it will be the third consecutive year where FID capacity has increased year-on-year.

The regulator suggested that its estimate of 3GW capacity reaching FID in this calendar year could well be conservative with rising wholesale electricity prices likely to trigger a surge in large-scale renewables industry investment.

The CER’s latest Market Report also showed there were record levels of cancellations of carbon certificates and units in the first quarter of the year.

Parker said Large-scale Generation Certificates (LGCs) had the largest year-on-year Q1 increase in both absolute numbers and percentage change with 1.2 million certificates cancelled, almost four times the previous Q1 record from 2021.

The number of Australian Carbon Credit Units (ACCUs), surrendered in the first quarter was also up, with 283,000 ACCUs voluntarily cancelled in the quarter, an increase of 62% on the same time last year.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Hmm pretty sure weeks of torrential rain over the whole 1Q in Sydney and Brisbane may also have had something to do with the reduced installations…

Sydney got 200mm more rain over the 1Q than it normally does for the whole year!!