After 80 companies expressed in the project last year, the shortlist has been whittled down to two with billionaire Andrew ‘Twiggy’ Forrest’s Fortescue Future Industries (FFI) facing off against gas giant Woodside. The pair are now entering final negotiations to develop the reportedly AU$4.5 billion project.

Southern Green Hydrogen, which proposed the megaproject, is a joint venture between New Zealand power providers Meridian Energy and Contact Energy. It was set up in June last year to explore the opportunity of producing green hydrogen on New Zealand’s southernmost tip following the announcement Rio Tinto would close its Tiwai Point aluminium smelter, primarily powered by a Meridian hydroelectric plant.

The vision is to build a 600 MW facility which would use the power from Meridian’s Manapouri hydro scheme to energise hydrogen electrolysers, producing green hydrogen or green ammonia for export. According to Meridian Energy CEO Neal Barclay, the proposals received from both FFI and Woodside made it clear a Southland hydrogen facility would be both technically feasible and commercially sound, and both companies would be capable of delivering it.

FFI and Woodside have now been asked to provide more detailed proposals to Southern Green Hydrogen by the end of August, with the final selection of lead developer to be announced soon after.

Fortescue Future Industries (FFI)

It’s worth noting Rio Tinto has since wavered on its decision to close the Tiwai Point smelter, though New Zealand media have quoted Meridian’s Barclay as saying his company does not plan to continue Rio Tinto’s current energy contract, even if it wanted to keep its smelter operating. Likewise, spokespeople for Meridian have said the Southern Green Hydrogen project is not contingent on the smelter closing.

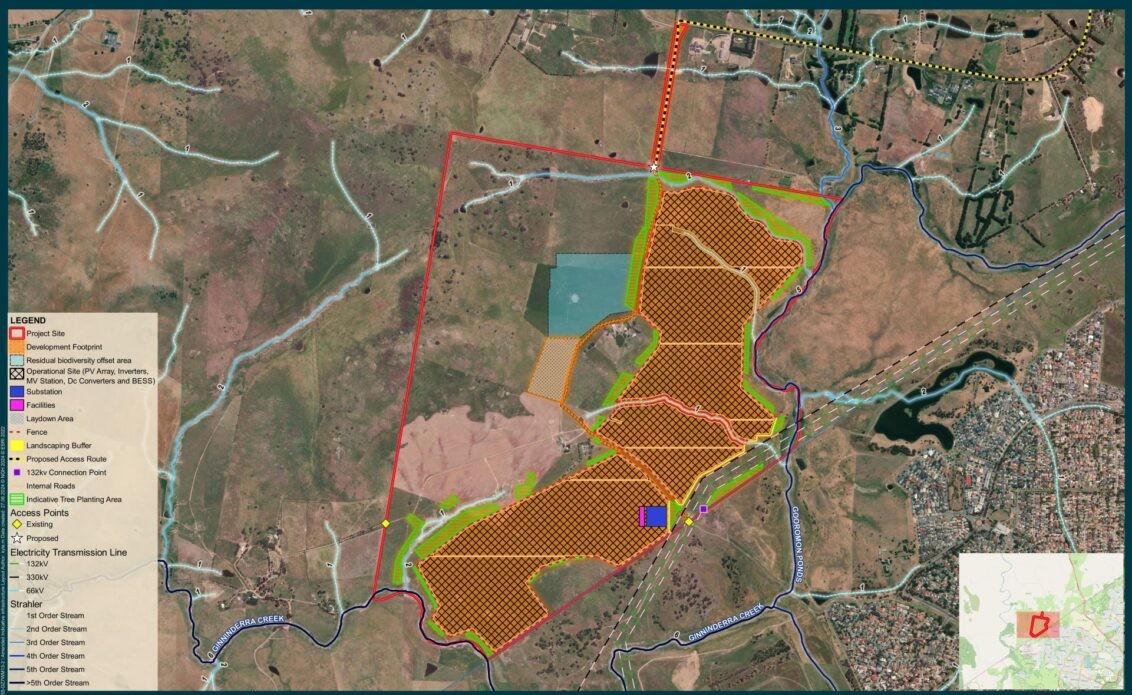

Hokonui representative and Ngāi Tahu lead for the green energy programme, Terry Nicholas, who has been closely involved with the project, believes the facility and its wider infrastructure could cost around NZ$5 billion (AU$4.5 billion). According to him, four potential sites for the facility have been identified.

Like Australia, New Zealand is keen to secure some of the green hydrogen market. Its government and private sector have committed around NZ$200 billion (AU$1.8 billion) to support the development of the burgeoning industry.

The allure of a project with an already secured and established renewable energy input is no doubt vast – especially for FFI which is hoping to live up to the hype its created around itself, targeting 15 million tonnes of green hydrogen production by 2030.

The allure also holds true for Woodside, which is facing sharp and renewed criticism over its Scarborough gas project, a sustained focus environmental group Greenpeace. Woodside is looking to stay relevant through its move into hydrogen, but is notably pursuing both blue (hydrogen made from fossil gas) as well as some green, renewable projects.

This earned it the ire of FFI last November, which mocked Woodside’s greenwashing of its H2Perth hydrogen and ammonia project on Twitter.

Image: Fortescue Future Industries / Twitter

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Hello Bella

Both sides of the existing energy contract saying they don’t need each other. It looks to an outsider that Tiwai Point has threatened closure and Meridian has called their bluff. There are ample opportunities for renewable energy infrastructure now which can only be a good thing.

Best

Harry