At its heart, Energy Estate’s proposal released this morning, to create Australia’s first hydrogen valley in the New South Wales Hunter region, is a simple, elegant plan to put power transmission underground in the form of hydrogen pipelines, linking some of New South Wales’ biggest renewable energy producing zones to the electricity-ravenous industrial ring of the coastal city of Newcastle, and to the world.

But the plan, which has been a couple of years in the making, says Energy Estate Principal, Vincent Dwyer, has also picked its moment — that of a knife-edge state by-election that threatens to squeeze Liberal Premier Gladys Berejiklian’s slim majority, of the polarising gas peaker plant forced by the Federal Government at Kurri Kurri, of significant energy hubs in development throughout the state — to present “an alternative narrative”.

“We looked at the pinch points in the transition,” Dwyer told pv magazine Australia this morning. “Given that we need to decarbonise heavy industry, transport and the chemical sector, we need massive investment in the transmission system, which has been a real headache for people.”

Not only is transmission build-out constrained by long-lead-time processes such as the Regulatory Investment Test for Transmission (RIT-T), it most often represents an investment risk in that it could in the meantime be superseded by other technologies — such as more flexible virtual transmission based on battery storage, or, indeed, ever more viable hydrogen supplies swishing through pipelines.

Transmission also raises the ire and objective of communities and landowners bound to live in its shadow.

The Hunter Valley, a region questing for an alternative employment and renewed industrial base to replace coal mining and departing fossil-fuel power stations is, says Dwyer, “an area of particularly complex social licence, between vineyards and horses and mines”.

But where transmission infrastructure means towers and a 60-metre easement, pipes are underground, and require only a 20-metre easement — “it’s a small, buried pipeline, so it hasn’t got quite the same level of social license issues as 500 kV transmission lines,” suggests Dwyer.

Joining the core constituent dots

Energy Estate, an energy consultancy as well as a renewable energy developer, already had many of the connections to envisage emerging hydrogen as an alternative solution to transporting electrons from new areas of green generation to traditional areas of high usage.

It is an adviser to Idemitsu Australia Resources, which is re-envisaging the future of its Muswellbrook Coal acquisition as a potential pumped-hydro energy storage site and an adjacent clean-energy-powered industrial precinct.

Energy Estate’s massive Walcha Energy Project on which it is partnered with MirusWind, is gradually jumping through the regulatory hoops of co-locating pumped hydro that repurposes Dungowan Dam with up to 700 MW of solar on the Salisbury Plains; up to 700 MW of wind power at Winterbourne Wind Farm (acquired by Vestas in 2019); and a 100 MW battery energy storage system (BESS).

Its Hydrogen Growth platform has joint ventures and advisory roles around the country, among them the partnership with Hills International College to develop a hydrogen plant at its Jimboomba campus in Queensland.

It has been in discussion with Atlassian’s Mike Cannon-Brookes-backed Beyond Zero Emissions think tank on BZE’s latest campaign to gather participants and momentum for re-envisioning the Hunter and Gladstone as Renewable Energy Industrial Precincts.

“Then we thought, if we’re going to deliver this, let’s pull together someone who knows pipelines” — enter APA Group; “someone who knows gas generation” — AGL is the participating energy utility; someone who knows the route to market for global export of ammonia — Trafigura and Idemitsu are keen; “and large renewable energy developers” — WalchaEnergy, of course, and another partner of Energy Estate, RES Australia.

Stepping stones to advantageous market developments

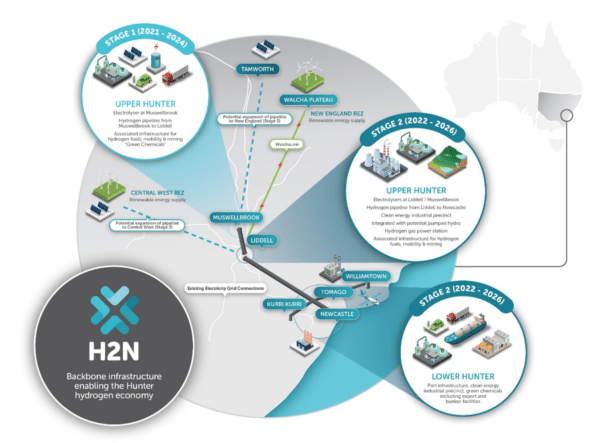

The resulting Hunter Hydrogen Network (H2N) project is envisaged in two stages, with the second a little looser than the first, to take advantage of emerging cost advantages and market developments in a constantly changing energy landscape.

As Dwyer says, “There is such a variety of uses for hydrogen — in transport, in chemical plants to create caustic, to create ammonia and chlorine through electrolysis, you can use it to create all sorts of green plastics, it can be used drive gas-peaker plants — we want to remain open to all these derivative markets as they evolve.”

The first stage of the project aims to produce green hydrogen in Muswellbrook, and transport it via short pipeline to the site of Liddell Power Station, which AGL is scheduled to close in April 2023, and could be repurposed for a variety of green hydrogen-utilising activities, such as chemical facilities and/or a second gas peaker plant.

The Walcha Energy Project also plans to bring the majority of its 4.5 MW of renewable energy via a privately developed transmission line, Walcha Link, to the Liddell vicinity where it can be used for hydrogen production, or be distributed using existing network infrastructure, throughout the National Electricity Market (NEM).

Independently of its H2N project, Energy Estate is “out in the market with Walcha Link right now,” says Dwyer, “discussing the opportunities associated with that.”

Dwyer envisages supplying the future H2N hydrogen product of the Muswellbrook/Liddell ecosystem as green feedstock for mining, hydrogen fuel-cell vehicles and other industrial uses.

Image: Energy Estate / H2N

The pipes of peace

Stage 2 will see a pipeline connecting the Muswellbrook/Liddell production hub to Newcastle, “with laterals to Kurri Kurri for the gas peaker, if that’s how Snowy Hydro chooses to fuel it, out to Williamtown to fuel army operations or to the Tomago industrial precinct,” says Dwyer.

He says that the consortium assembled under H2N could deliver competitively priced green hydrogen today, but that the pipeline and potential port infrastructure to ship the product to international markets is where the project will require government support.

Unable to conscience policies promoting renewable electrons, the Federal Government is much more likely to be able to wrap its National Hydrogen Roadmap around a plan to boost the Hunter region, especially given this Saturday’s knife-edge state by-election in which a YouGov poll found no candidate had more than 25% of the vote (Layzell is on 25%, Labor’s Jeff Drayton polled 23%) — in the traditionally safe Nationals seat.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

How will this hydrogen plant impact the price of real estate in Stockton NSW 2295, and surrounding area’s?

How safe is it for local residents?