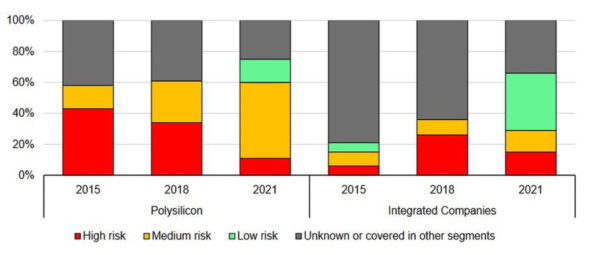

The International Energy Agency (IEA) has revealed that more than 30% of the integrated companies operating in the solar module manufacturing business worldwide are at medium or high risk of bankruptcy.

In the Special Report on Solar PV Global Supply Chains, the agency stressed that only 15% of these manufacturers are at high risk of bankruptcy and that in 2018 that share was about 28%. As for polysilicon suppliers, about 11% of them are currently at a high risk of bankruptcy, while another 49% are estimated to have a medium risk.

“Owing to high polysilicon prices, the bankruptcy risk of polysilicon businesses dropped considerably in 2021,” the report says. “A return to low polysilicon prices could, however, reverse this change.”

According to IEA analysts, the support that the Chinese government is awarding to polysilicon manufacturers in the form of financing and subsidies makes this market segment particularly vulnerable from a financial point of view.

“For instance, the largest polysilicon company posted net losses between 2018 and 2020 despite government support,” they state without naming the producer.

“From a security-of-supply perspective, consistently poor financial performance within and across the solar PV value chain reinforces supply chain vulnerability to bankruptcies and underinvestment, which can reduce its resiliency, raise prices and limit PV deployment.”

The agency warned about possible changes in subsidy regulations for the PV industry in China, claiming these may lead to higher bankruptcy risks, even for the most competitive manufacturers.

Image: International Energy Agency

“Should competitive companies go bankrupt, this could lead to broader price increases and supply impacts, in addition to loss of the subsidy,” the IEA says.

The report examines solar PV supply chains from raw materials all the way to the finished product, covering areas such as energy consumption, emissions, employment, production costs, investment, trade and financial performance.

The paper describes thoroughly the main vulnerabilities of the global PV supply chain while highlighting the need for a wide geographical diversification of the industry.

“China has been instrumental in bringing down costs worldwide for solar PV, with multiple benefits for clean energy transitions,” the IEA analysts emphasize.

“At the same time, the level of geographical concentration in global supply chains also creates potential challenges that governments need to address.”

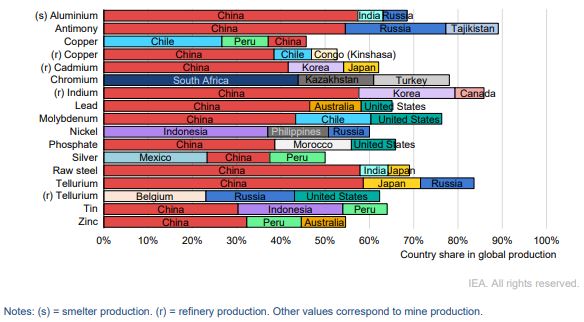

Global manufacturing capacity for solar panels has increasingly moved out of Europe, Japan and the United States over the past decade and into China, which has taken the lead on investment and innovation.

Image: IEA

China’s share in all the key manufacturing stages of solar panels exceeds 80% today, according to the report, and for key elements including polysilicon and wafers, this is set to rise to more than 95% in the coming years, based on current manufacturing capacity under construction. According to IEA estimates, the world will almost completely rely on China for solar panel production through 2025.

“China has been instrumental in bringing down costs worldwide for solar PV, with multiple benefits for clean energy transitions,” IEA executive director Fatih Birol said in a statement. “At the same time, the level of geographical concentration in global supply chains also poses potential challenges that governments need to address.

“Accelerating clean energy transitions around the world will put further strain on these supply chains to meet growing demand, but this also offers opportunities for other countries and regions to help diversify production and make it more resilient.”

Wafer manufacturing is the most concentrated supply chain segment, with China accounting for 97% of global capacity in 2021. An estimated 85% of cell production is located in China while module-manufacturing capacity is more distributed globally but it is still relatively concentrated with China home to 75% of the world’s module-making capacity.

“This level of concentration in any global supply chain would represent a considerable vulnerability; solar PV is no exception,” the report states.

The report encourages governments to move solar panel supply chain diversification up the policy agenda as an integral part of advancing clean energy transitions, and to facilitate needed investments through measures such as finance and tax policies.

Countries “need to ensure that their transition towards a sustainable energy system is built on secure foundations,” Birol said.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

10 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.