The Australian Energy Market Operator (AEMO) has released its annual modelling of potential market shortfalls known as the 2022 Electricity Statement of Opportunities report, framing the need for new generation, storage and transmission projects in Australia this decade as “urgent.”

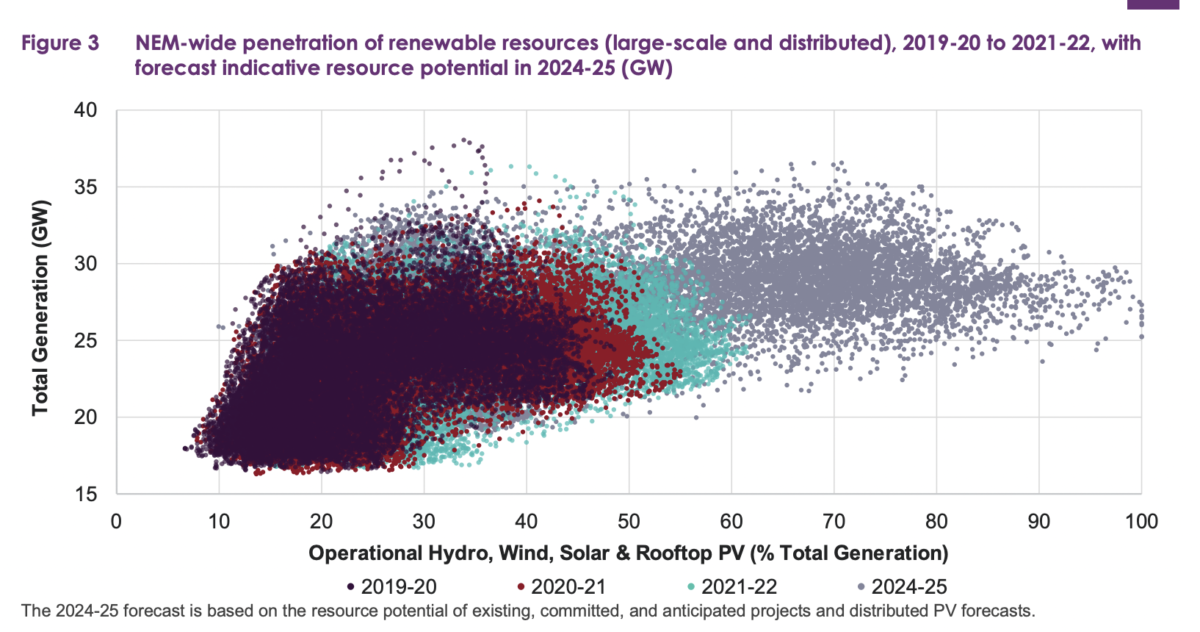

This urgency is due to the fact the National Electricity Market (NEM), the grid which serves New South Wales, Victoria, South Australia, Queensland, and Tasmania, is set to have 14% of its capacity withdrawn with the retirement of five coal power stations, which account for 8.3 GW of generation.

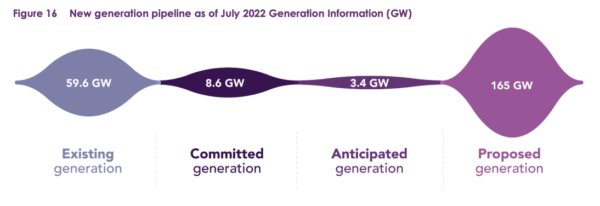

This loss of capacity, and with it the system strength which comes from a network dominated by thermal generation, is worrying for AEMO as it considers Australia has just 8.6 GW of committed replacements. While slightly more than the lost capacity, this number is tight and is – as the agency frequently notes – subject to potential delays.

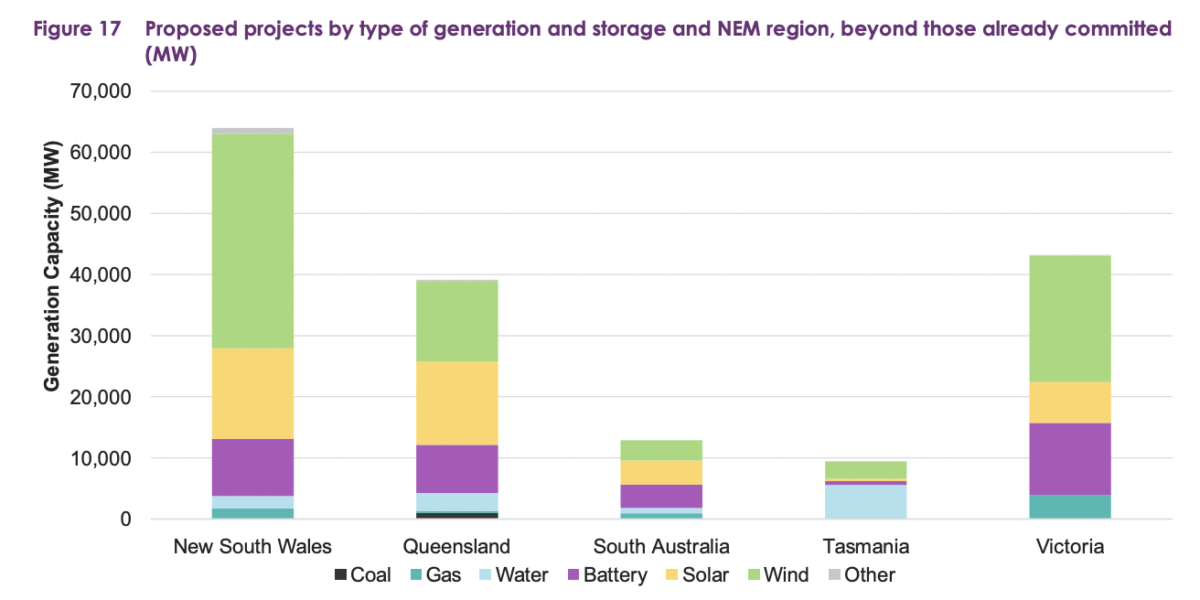

Australia does, however, have a pretty hefty pipeline of projects in planning – of which AEMO deems 3.4 GW ‘anticipated’ – likely to be built – and another 165 GW simply ‘proposed.’

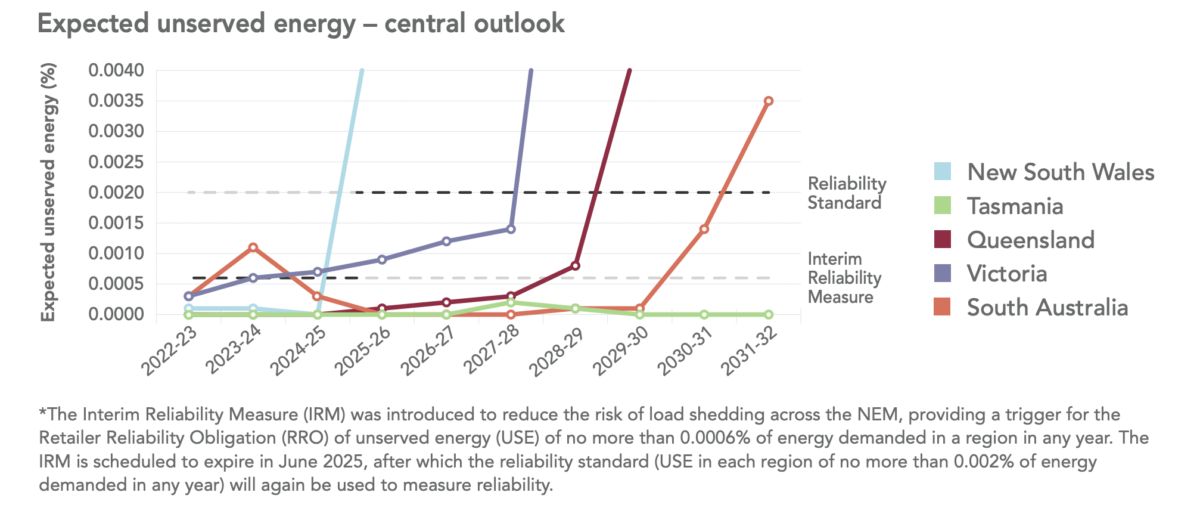

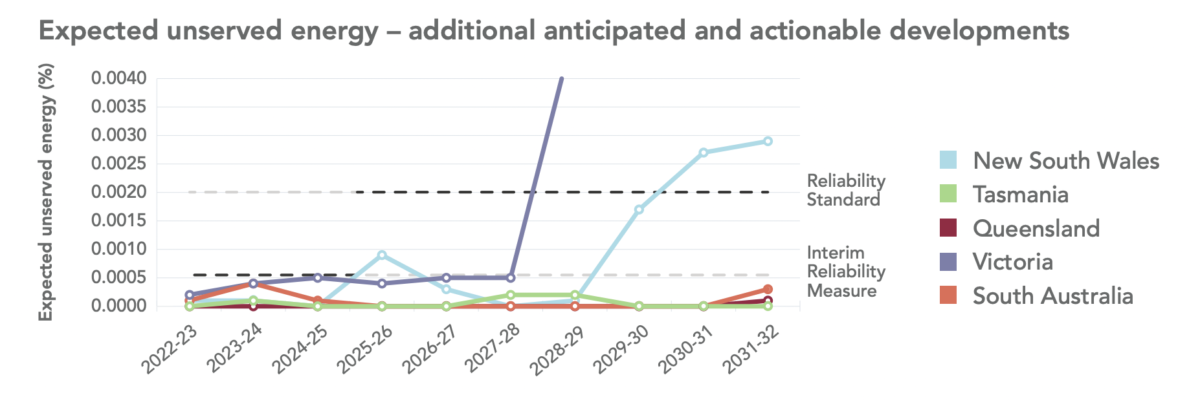

With AEMO considering only existing and “committed” projects (certainly a conservative outlook), it forecasts reliability gaps could occur in South Australia as early as next year, with Victoria following suit from 2024-25.

Slightly further down the line and on a more serious note, AEMO says New South Wales is forecast to “breach the reliability standard” from 2025-26, followed by Victoria (2028-29), Queensland (2029-30) and South Australia (2031-32).

While that all sounds rather spooky, AEMO’s CEO Daniel Westerman noted: “Despite the challenging reliability outlook against ‘committed’ projects, should the 3.4 GW of anticipated generation and storage projects, alongside ISP actionable transmission projects, be delivered to their current schedules, then reliability standards would be met in all regions of the NEM until later in the decade when more large thermal generators exit,” Mr Westerman said.

Adding to the delicacy of the situation, the oncoming wave of coal plant retirements – which is happening even sooner than planned in AEMO’s 2021 report – will coincide with a jump in electricity demand as houses and businesses electrify their appliances and electric vehicle uptake grows.

Considering the proposed pipeline is bulging at 165 GW, it seems like getting enough replacement generation in the system is doable, if it can be done quickly – but adding enough transmission to enable the green electricity to flow remains an issue.

“The five transmission projects identified in the 2022 Integrated System Plan – HumeLink, VNI West, Marinus Link, Sydney Ring and New England REZ Transmission Link – should progress as urgently as possible to enable electricity consumers to make shared use of existing and future generation and storage,” Westerman said.

AEMO’s report mentions delays frequently, though there isn’t much discussion about what it sees as the major cause of these delays. Opposition to both transmission and large-scale projects does appear to be getting more organised in Australia and is certainly something with the potential to blow out expected timelines.

On the other side of things, big projects tend to run into their own hurdles with AEMO flagging that since last year’s report, Project EnergyConnect – a transmission project linking South Australia, New South Wales and Victoria – has pushed back its timeline, starting early stage developments a year later than expected, aiming for 2024-25, rather than 2023-24.

The major Snowy 2.0 pumped hydro project also appears to be a sore spot, though AEMO repeatedly notes “despite media reports suggesting a delay to the project, Snowy Hydro has not confirmed any adjustment to its previously provided commissioning schedule.”

Be that as it may, the report modelled a two year delay but found it would have a pretty minimal impact on reliability forecasts.

The recent change in government and the last few months of energy minister meetings, which have seen state and federal leaders come together to enshrine emissions reduction as an objective for the national electricity system, as well as revisions to project financing and energy transition planning, was noted by AEMO as greatly “improving the investment environment” and enabling the NEM’s transformation.

“Governments also have a range of measures to bring in new generation, storage and transmission, which will greatly aid the short- to medium-term outlook. As these become committed, they will be incorporated into future reliability assessments, and will reduce the reliability risks presently forecast,” Westerman said.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

7 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.