From: Cornwall Insight Australia

Using Cornwall Insight Australia’s battery simulation model, we simulated a stand-alone 200 MW/400 MWh battery energy storage system (BESS) with standard conditions, estimating battery operating profit for batteries participating in the Frequency Control Ancillary Services (FCAS) and wholesale energy markets for each of the mainland National Electricity Market (NEM) states.

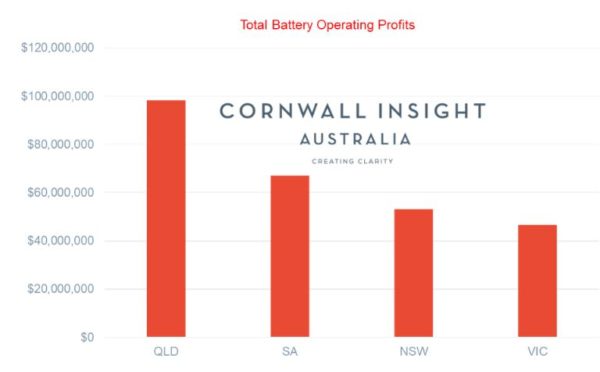

The first figure looks at the profitability of batteries in the NEM over the past financial year and shows that Queensland provided the greatest opportunities for battery profits in FY22, followed by South Australia, New South Wales, and then Victoria.

The main drivers behind the high battery revenues in Queensland and South Australia are high energy price events allowing the battery to earn significant revenues over short-term price spike events.

Image: Cornwall Insight Australia, AEMO Nemweb

One thing to note is that these results assume perfect price foresight. That is, the optimisation algorithm knows with certainty what future prices will be. Therefore, actual revenues are likely to be lower for an operational BESS (our analysis indicates that this reduction for perfect foresight is usually in the order of 10-20%).

Our BESS results show high energy arbitrage opportunities in Queensland (accounting for around 70%) due to price volatility in Queensland, with Victoria making the lowest revenue in the energy markets during the same time scale.

Image: Cornwall Insight Australia

The second figure illustrates the contribution of daily operating profit to the annual total. If battery revenues were consistent throughout the year, we would expect the cumulative revenue line (blue) to be linear throughout the year.

However, we see that Queensland’s revenues for FY22 have been driven by a few price spike events, with 50% of revenues earned over 8% of the year. In our simulation, almost 10% of the year’s battery profit was earned on 1 February and 8 March, where the average wholesale price hit $14,500 (USD 9,289) on Feb. 1, between 6pm-7pm, and $11,600 between 5:30pm-7:30pm on March 8.

Looking at these charts, Queensland was best placed to earn significant operating profits in FY22.

Author: Samudra Joshi, graduate analyst, Cornwall Insight Australia

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.