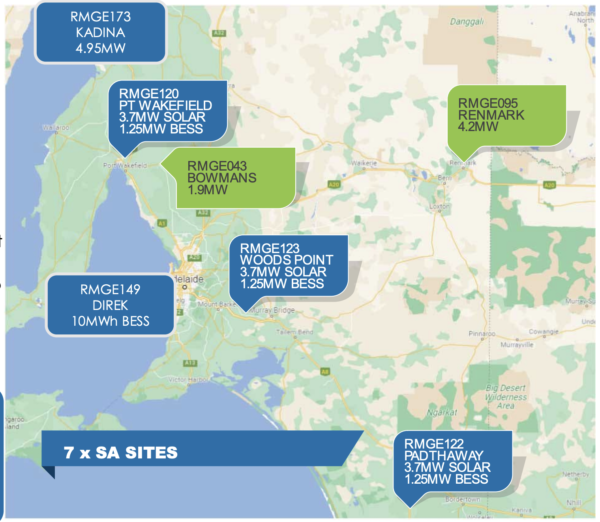

After forming a partnership in 2020, construction company Yates Electrical Services (Yes Group) and Sustainable Energy Infrastructure (SEI), established by global real assets investment manager Patrizia SE on behalf of two Australian institutional superannuation fund investors, have an “approved portfolio” of 55 MW across 11 assets in South Australia and New South Wales.

Five of those are in operation, three under construction, and three in detailed design and procurement, the companies say, with Yes Group adding it has identified a further 70 MW to 100 MW of projects to deliver across SA, NSW and Victoria in the coming three years.

The 5 MW push

The companies are focusing on the mid-scale sector, particularly projects around the 5 MW mark, which dodges some of the major risks the utility-scale segment is prone to. In Australia, renewable projects smaller than 5 MW pass through a different approval process, and can avoid a more protracted and precarious grid connection process.

“These small projects enable us to get assets into the market faster and it provides us with a diversified and scalable platform,” Patrizia’s head of infrastructure for Australia and Asia, Saji Anantakrishnan, said.

Over the last five years, Yes Group says it has developed and constructed over 120 solar farms in the sub-5 MW market, though it would appear it has just contracted on these projects rather than owning and operating the assets as it does with the joint SEI portfolio.

Image: Yes Group/SEI

This sub-5 MW strategy is growing in traction, and has been deployed by companies like Green Gold Energy. Speaking during the 2022 All Energy Conference in Melbourne, the team at Green Gold said it can take just six to 12 months to develop and realise these mid-scale projects, with the company noting the ease of development makes them valuable assets.

The play revolves around owning many small assets which can be developed easily and quickly instead of reaching capacity through big utility-scale projects, a path unfortunately littered with collapsed contractors and developers left with massively blown out projects.

Yes Group, SEI projects

The Woods Point solar-plus-storage project near Murray Bridge was opened by South Australian Premier Peter Malinauskas.

The project comprises 9,000 bi-facial Risen Solar panels on a Nextracker framing system, coupled with a 2.5 MWh battery storage system.

The project is one of three solar-plus-storage projects opening in South Australia in December, with the other two being commissioned in Port Wakefield and Padthaway.

Image: Yes Group/SEI

These three projects will generate 27 GWh of solar and store 3 GWh of energy, the companies say.

In two years of partnership, SEI and Yes Group have invested $90 million (USD 60 million) for 50 MW of projects across SA and NSW. Five of those projects with 20 MW of capacity are now in operation, and another two projects in SA and four projects in NSW are slated for completion in 2023.

The partners plan to invest a further $200 million to develop 70 MW to 100 MW of projects across Australia’s east in the coming years.

SEI was established in 2018 by German-headquartered Patrizia on behalf of institutional investors who purchased a portfolio of established energy assets from AGL.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.