From pv magazine ISSUE 02/23

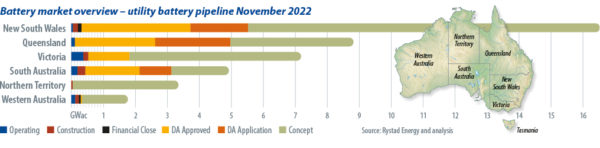

Australia boasts more operational big batteries per capita than either China or the United States. The Smart Energy Council (SEC) recorded 33 sites at the end of 2022, providing around 1.1 GWh of electricity. Another 8.1 GWh of capacity is due this year and the SEC expects 78 big batteries by 2025, with 14.5 GWh of capacity.

Appetite for big storage is not a problem. Finance, costs, and risk, however, can snag such time-sensitive projects. Even in Australia, storage is not coming online as quickly as coal is exiting, says David Dixon, an analyst at Norwegian firm Rystad Energy.

Given that South Australia met all of its demand from solar and wind for more than 10 consecutive days in December 2022 – likely a first for a gigawatt-sized grid – the need for storage is immediate.

The government has introduced two measures to meet demand, building on models that proved transformative for big solar in the last decade by massively reducing costs. Geopolitics and commodity shortages cloud the path for battery storage, but the federal policies will nonetheless move the market, potentially opening up new economies.

Tripling capacity

The Australian Renewable Energy Agency (ARENA) in December 2022 granted AUD 121 million to eight of the largest lithium-ion batteries in the country, all at least 200 MW/400 MWh in scale. The projects, set to be operational by 2025, will triple the national grid’s battery storage capacity and raise grid-forming ability tenfold.

The funding came through Australia’s first large scale battery storage round and Carl Christiansen, ARENA’s manager of business development and transactions, tells pv magazine the agency’s focus was on overcoming commercial and regulatory barriers to demonstrate large scale advanced-inverter functionality.

While cost reduction wasn’t an explicit objective, Christiansen says ARENA expects the round will bear down on costs after increasing competition by introducing new equipment suppliers and construction contractors and increase deployment experience. The round is also hoped to reduce investment risk, he adds, and therefore the cost of advanced inverters that make up 5% of project expense.

Just how much this could add up to the agency is unsure. Rystad’s Dixon believes it could be meagre. “We’re already installing batteries at 100 [MW], 200 MW each,” he says. “Once you get beyond 100 MW, those economies of scale on the installation side typically have been realised.”

Warwick Johnston, founder and MD of solar consultancy Sunwiz, agrees, saying that there is not the same novelty in battery farms as there was with solar when ARENA kick-started that sector. “That said, there is novelty to grid-forming inverters,” he adds.

All-renewables grid

Heralded as the key to unlock a grid operating with 100% instantaneous renewable generation, grid forming inverter technology has additional hurdles to clear beyond those inherent to big batteries. “While it is clear that the private sector is enthusiastic to invest in battery storage projects, there is currently no incentive for a developer to deliver a project with advanced inverters,” ARENA’s Christiansen says. “Their newness carries with it risk, and without any market yet in place to value the system strength grid-forming inverter technologies provide, there is little uptake.” Neoen’s famous South Australian big battery, the Hornsdale Power Reserve, provides inertia to the grid through advanced inverters but this only became the case last year, following two years of testing.

That speaks to the regulatory hurdles of realising projects, with Christiansen noting that Australia’s grid connection standards for inverter-based renewable generators were “not designed with advanced inverter functionality in mind.” This has led to conflicts about whether system strength or accelerated operations should be prioritised by developers.

By funding advanced inverters on the eight projects, ARENA hopes to iron out kinks and share knowledge. “Through the funding round, advanced inverters may become lower risk than standard grid-following inverters, due to their ability to operate in weak grids and contribute to system strength,” Christiansen says.

Archie Chen, CEO of Risen Energy Australia, which is constructing 200 MW/400 MWh battery in Bungama, South Australia, after receiving grant funding, says the support was vital in “bridging the gap” between grid-following and grid-forming inverters. “To develop a project using grid forming technology, there are costs attributed to equipment, engineering, project management, logistics, construction, commissioning, and lastly, BESS [battery energy storage system] integration,” Chen tells pv magazine, noting that integration is demanding.

The sheer scale of Australia’s big battery pipeline is “uncharted territory,” says SEC Policy, Research, and Legal Adviser Connor Woulfe. While fewer projects need to get across the line to provide capacity, he says, “at that scale there is a whole range of different infrastructure required.”

Revenue uncertainty

As “groundbreaking” as it will be to have grid system strength provided by inverter-based technology, Rystad’s Dixon describes ARENA’s funding round as little more than a “sugar hit.”

“It doesn’t actually solve the certainty of revenue problem, all it does is alter the cost,” Dixon says, noting that returns are based on energy arbitrage and power services such as frequency control.

Neoen, Australia’s biggest big battery owner, saw storage revenue almost triple in the first nine months of 2022, dwarfing growth in solar and wind income – largely crediting the change to its Victorian Big Battery coming online. With revenue uncertain for developers, however, lenders will remain wary. “If you have all these projects being built in the next couple of years, there’s actually an education, knowledge building, role for the financial world as well, which will enable them to assess other projects with more certainty,” says the SEC’s Woulfe.

The Labor federal government announced plans in December 2022 – along with state energy bodies – to underwrite large-scale zero-emission storage. The Capacity Investment Scheme will see the federal government pay revenue shortfalls based on a pre-agreed floor value, guaranteeing projects baseline income. If revenues exceed an agreed price ceiling, the government will take a share of profits.

SEC acting chief executive Wayne Smith helped develop the program and says it will function as a de facto storage target as authorities determine how much is needed, state by state, to inform auctions set to start this year. The policy will complement official targets, such as those of New South Wales and Victoria, and build on that ARENA “sugar hit.” Woulfe says that “the Capacity Investment Scheme effectively delivers that renewables-shifting, from daytime to the evening peak period, and then ARENA is really good for delivering batteries that give a particular grid benefit.”

‘Friendshored’ energy

The price tag of lithium and other raw materials is a concern, though, according to Rystad’s Dixon. “Project capex [capital expenditure] has gone up 30% in the past year in utility batteries so, from a cost perspective, we’re, net, worse off than we were last year, even post-subsidy.”

Asked how to reduce cost, Sunwiz’ Johnston says, “That’s more a matter of how fast you can build a lithium mine.” In fact, he has observed an effort to build local refining, processing, and manufacturing capacity.

Western Australia in particular saw lithium refining and processing plants come online last year and the Inflation Reduction Act in the US has prompted American companies – including US-Australian battery cell maker Recharge Industries and iron-flow battery maker ESS Inc – to announce Australian manufacturing plans. As hydrogen plans in the US and Europe threaten to leave Australia lagging, focus is switching to the latter’s critical minerals and the desire of allies to use “friendshored” supply chains.

Australia doesn’t lack battery projects, “It’s just getting the incentive structure and infrastructure there to get them moving,” adds Dixon. Alongside electricity transmission upgrades, he describes that as the “last piece of the puzzle” to realising a decarboniesd Australian grid.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.