From pv magazine ISSUE 02/23

Cost remains a key driver in the energy storage space. In 2022, battery cell chemistry evolution continued at breakneck speed. There was a shift towards cheaper lithium ferro phosphate (LFP) batteries, which have been eating into the market share of lithium nickel-manganese-cobalt oxide (NMC) devices since 2020. LFP cells were, on average, 20% cheaper than NMC products in 2022.

“LFP had formerly occupied a relatively small share of the global EV [electric vehicle] market, due to its limited energy density,” says Gareth Hartley, business intelligence manager at UK battery research body the Faraday Institution. “However, recent advances in cell-to-pack engineering have enabled the lower cell energy density of LFP to be somewhat offset and increased by around 19-27% with respect to a conventional Tesla pack architecture (126 Wh/kg with LFP), decreasing costs without a significant loss of range.”

BYD’s LFP blade battery was reported to have energy density of 150 Wh/kg, and CATL claimed its Qilin LFP pack would offer 160 Wh/kg. The quest for next-generation, high energy density lithium-ion batteries saw anodes feature more silicon in 2022. That was due to the abundant, non-toxic material’s theoretical capacity of 3,600 mAh/g, compared to graphite’s maximum of 372 mAh/g. Efforts were also made towards cathode optimisation, such as increasing nickel and reducing cobalt content in NMC cathodes.

In system architecture, the trend was towards modular, scalable devices. “Segmented” batteries can change with consumer needs and are easier to install, maintain, and operate.

“The key advantages of modular and easily scalable BESS [battery energy storage systems] for project owners and operators are flexibility and future proofing,” says Kevin Shang, senior research analyst at Wood Mackenzie. “Battery energy storage systems can be scaled in a building-block manner and project owners and operators can cut the expenses in future, possible expansion projects.” Shang says modular solutions can reduce installation costs up to 10% to 20% per unit.

The trend towards modular devices is expected to grow as competition intensifies and the battery supply chain evolves. “There is a clear trend of battery manufacturers seeking vertical integration aggressively and pushing their product portfolios downstream, with companies like CATL, Samsung SDI, and LG Energy Solution expanding their modular ESS [energy storage system] products suites,” adds Shang.

Chemistry lessons

Supply chain volatility fueled the search for new battery chemistries. Companies explored alternative lithium-ion solutions including lithium manganese iron phosphate (LMFP) and lithium sulfur batteries, which contain no cobalt or nickel; as well as lithium-free sodium-ion batteries. Industry insiders, however, expect few to reach commercialisation.

“Some of the over-excitement in the investment space for alternative technologies that we saw in 2020 and 2021 has cooled,” says George Hilton, senior analyst at S&P Global. “This has left a number of companies with very healthy balance sheets that now need to focus on using this cash in a smart and effective way so that they can scale and deliver commercial projects. The key for the future of alternative technologies lies in how well they are able to deliver on their ambitious promises.” S&P Global notes two criteria successful battery technologies must fulfill: easy scalability – likely through standing on the shoulders of other industries; and decoupled power and energy – to be competitive for long duration applications, the area in which ubiquitous lithium-ion is least competitive.

Solid-state batteries have been an R&D priority for electric carmakers but the technology’s market share has remained negligible, whereas sodium-ion batteries have made progress towards commercialisation and the world’s first gigawatt-hour production line – operated by domestic concern HiNa Battery Technology – opened in China. “Sodium-ion technology is particularly exciting as it could scale rapidly, comparable to lithium-ion, with similar hardware enabling companies across the value chain to quickly and easily swap to sodium-ion if it becomes more widely available, or lower cost,” Hilton says.

Raw materials

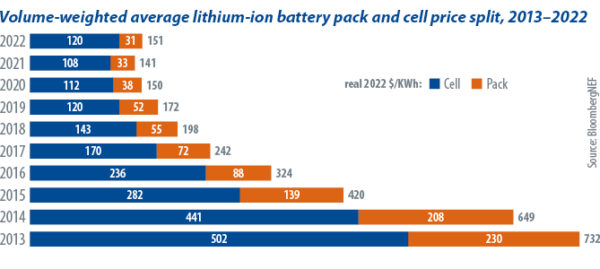

What had been the regular practice of tracking battery cost declines came to a sudden end in 2022 as prices rose for the first time since analyst BloombergNEF began collating these figures a decade ago. The volume-weighted average price for lithium-ion battery packs across all sectors increased to USD 151/kWh ($224/kWh) in 2022, a 7% rise from 2021, in real terms. Rising raw material and battery component prices, and soaring inflation, were the main culprits behind the development and were it not for the higher adoption of the lower-cost LFP chemistry, and continued reduction of costly cobalt in nickel-based cathodes, prices could have risen even further.

“It’s lithium, nickel, and cobalt that play the biggest role in battery cell material prices,” says Yayoi Sekine, head of energy storage at BloombergNEF. Specifically, lithium prices remained high due to persistent supply chain constraints and the slow ramp of production capacity. “As of the end of November, lithium carbonate and hydroxide spot prices were 615% and 779% higher, respectively, compared to January 2021. Nickel spot prices were 42% higher, and cobalt spot prices were 25% higher,” Sekine says.

However, as per Bloomberg’s survey, cell prices increased just 11%, which indicates that commodity price volatility is not directly passed onto batteries as metals only make up part of the battery cost. “Procurement strategies used by cell makers, including off-take contracts using indexes that trade at a discount or premium to spot prices, play a role in shielding some of the price increases,” Sekine says. The halting of price declines is, however, unlikely to cool demand. Of the more-than 180 participants surveyed in BloombergNEF’s latest energy storage system cost study, exactly zero responded that they would cancel their project if prices remain high. Two-thirds would proceed, a quarter would evaluate, and only 10% would postpone.

Geopolitical concerns

With multiple regions looking to accelerate domestic manufacturing amid geopolitical tensions and supply chain vulnerability, energy storage received a shot in the arm. In the US, the Inflation Reduction Act (IRA) – with billions of dollars in clean energy incentives – is expected to boost energy storage buildout by almost a quarter compared to previous estimates.

The biggest impact of the IRA is that it includes a dedicated 30% tax credit that applies to standalone energy storage projects. For instance, residential energy storage systems were previously only eligible for tax credits if charged 100% by solar power, whilst front-of-meter and commercial and industrial systems were only eligible if charged 75% by solar energy. That meant the business case for energy storage was limited, and arbitrage – buying and selling electricity at optimal price points – was less viable.

Industry observers unanimously agree the IRA will fundamentally alter battery market trajectory, improving project economics, as batteries offer a greater variety of auxiliary services and energy sharing projects, and provide much-needed relief to storage developers that have been slammed by inflation, logistics issues, and supply chain challenges.

Meanwhile, in Europe, the conflict in Ukraine has catapulted energy into the spotlight, prompting unprecedented interventions in energy markets in a bid to keep prices down. While high power prices have driven the deployment of residential BESS to new highs – reaching 9.3 GWh installed in more than 1 million European households, according to trade body SolarPower Europe’s data – big batteries experienced a bump in ancillary services revenues.

“This is partly because wholesale spreads have increased, meaning batteries are earning greater revenues from arbitrage, and also because the prices of frequency and balancing services have increased as they are often a function of the wholesale market price,” says Ryan Alexander, research lead for European power markets at Aurora Energy Research.

The energy revenues associated with trading on the day-ahead or intraday markets were particularly high and the good news for storage owners was that they were excluded from the revenue cap that renewables owners are facing under the emergency energy measures agreed by the European Commission and European Council in September. While new storage projects will feel the pinch of higher upfront costs, due to increased battery pack prices, the business case for operating batteries is expected to remain strong.

“Until the global gas market rebalances – which we don’t expect until the late 2020s – gas prices and, in turn, power prices will remain eye-wateringly high,” says Aurora’s Alexander. “This means existing battery assets likely have a couple of very good years ahead of them.”

Hydrogen hype

The hydrogen project pipeline kept growing but deployments lagged. The “2022 Hydrogen Insights” report from Brussels-based trade body the Hydrogen Council and analyst McKinsey & Company, noted 680 large scale project proposals, worth USD 240 billion ($35 billion), last year but only USD 22 billion ($32 billion) worth reached a final investment decision. While Europe led investment, with around 30%, China was slightly ahead on electrolyser deployment, with 200 MW.

It is anticipated that around USD 700 billion ($1.03 trillion) of hydrogen investment will be needed through 2030 to hit net zero in 2050. Only 3% of this capital is committed today. “The green hydrogen pipeline in 2022 almost doubled, compared to 2021, reaching close to 500 GW in global electrolyser capacity,” says Minh Khoi Le, head of hydrogen research at analyst Rystad Energy. “We also saw a significant step up in capacity in projects that entered construction, going from a 20 MW range last year to 100 MW to 200 MW.”

The IRA, which includes the world’s largest hydrogen subsidies, changed the skeptical narrative around last year’s hydrogen hype. The IRA’s USD 3/kg tax credit could reduce the cost of green hydrogen production by almost half, to nearly USD 3/kg for a project starting this year, making it far cheaper than gray hydrogen.

The Ukraine war turbocharged the hydrogen segment. Days after Russia’s invasion, the cost of fossil fuel-linked grey and blue hydrogen increased from around USD 8/kg to USD 12/kg, making the economics of green hydrogen more attractive. “With policies such as the production tax credit in the US, or contracts for difference in Europe looking to advance and be in full effect this year – coupled with gas prices expected to remain high throughout [this year] – we expect the transition from grey to green hydrogen to further accelerate in 2023,” Khoi Le says.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.