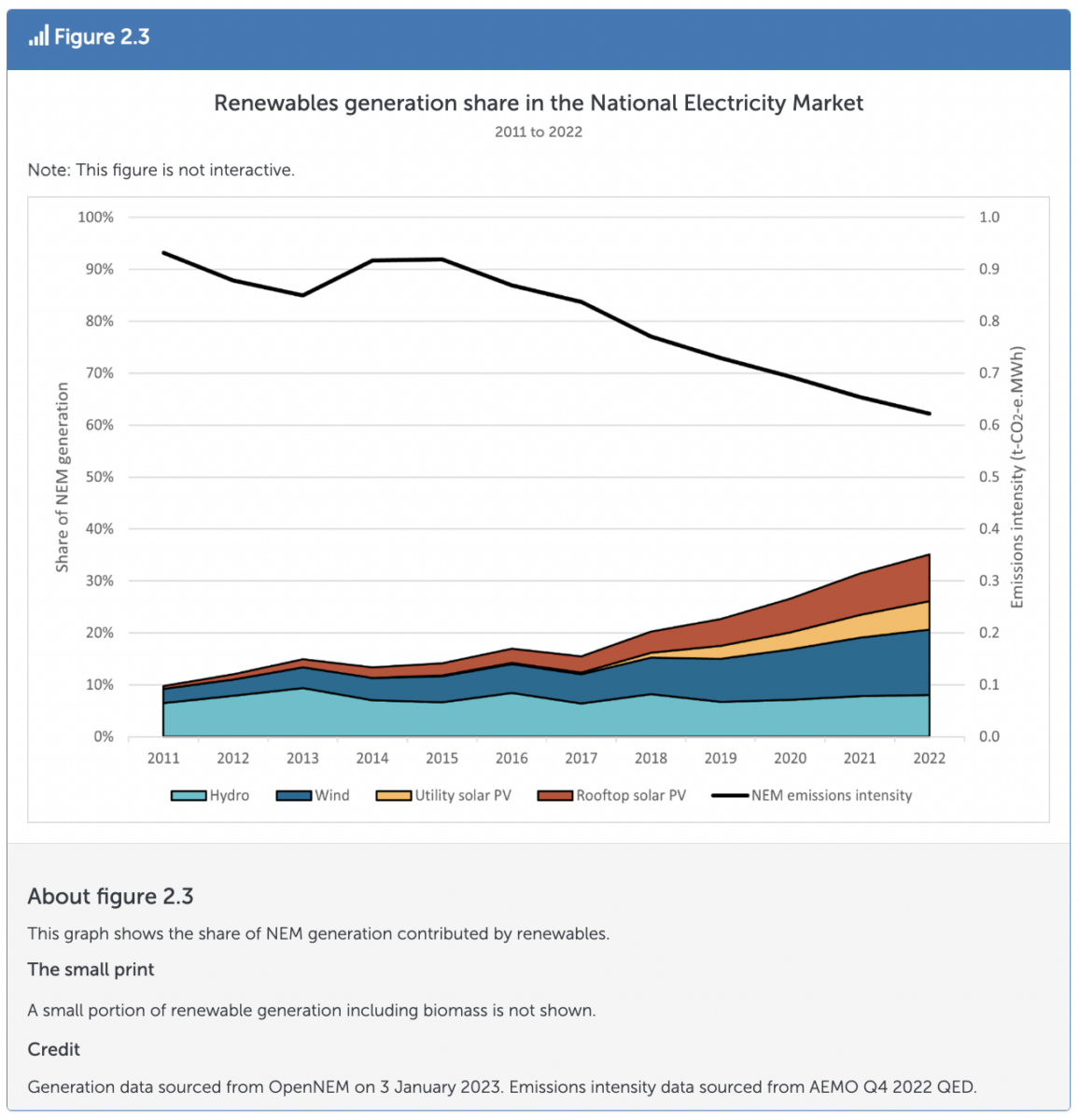

Australia’s Clean Energy Regulator says the level of renewable investment last year is a “good start” to achieving the national target of 82% renewable penetration by 2030. Renewables met an average of 35% of demand in Australia’s National Electricity Market (NEM) in 2022, though that figure lifted to an average of 42% in November and December. That boost came on the back of solar performing at a record level in December, reaching 23% of total generation, the Regulator’s report noted.

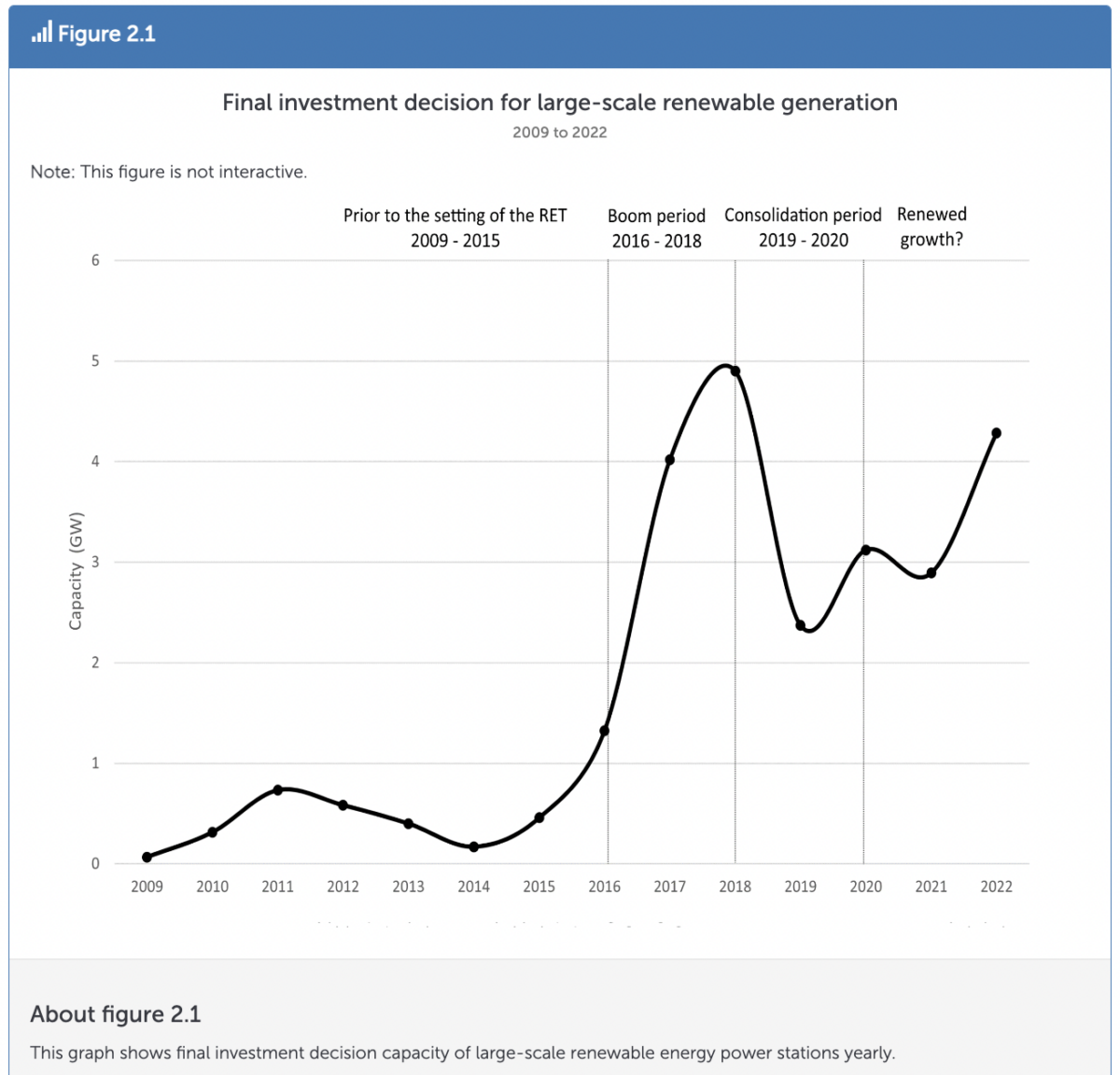

In terms of the investment spread, last year saw 4.3 GW of large-scale solar and wind projects reach final investment decision (FID) – a 50% jump from the previous year – and 2.8 GW of rooftop investment. The Regulator also noted for large-scale projects, 2.1 GW of the 4.3 GW investment was committed in the fourth quarter alone. For comparison, an average of just 2.8 GW of utility-scale projects reached FID annually over the 2019 to 2021 period.

While these 2022 results tip the scales between small and large-scale projects, small-scale still leads for actual installation, with 2.5 GW of utility-scale projects coming online compared to 2.8 GW of rooftop. The boom in utility-scale investment nonetheless suggests the change in federal government last May, and subsequent change in national rhetoric around renewables, is indeed encouraging far greater confidence in the sector.

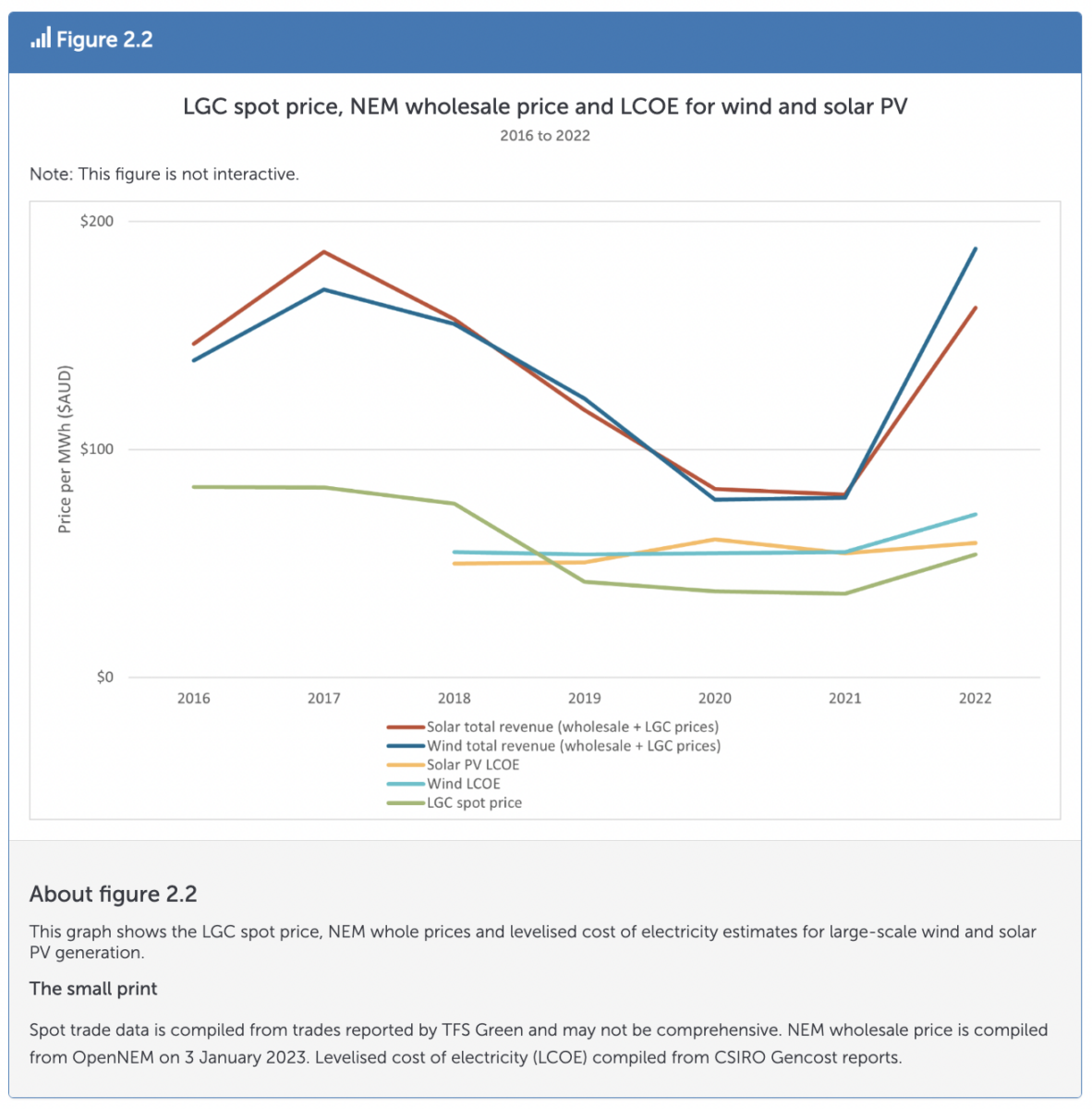

Among the key investment drivers the Regulator pointed to was Australia legislation of its 2030 emissions reduction target, the setting of a 82% renewable target, commercial demand for renewable energy, acceleration of coal closures, high wholesale electricity prices, and government’s acceleration of grid and battery storage projects.

“The increase in FID capacity announcements is expected to continue in 2023,” the Regulator forecast, even going so far as to say Australia may be on the precipice of a new investment boom cycle, similar to that observed in 2016–2018. It did, however, note such a boom would depend on whether clean energy supply chains successfully rebound from the disruptions induced by the pandemic.

The Regulator pointed to predictions from analyst Rystad to support its rosy outlook, noting Rystad had found over 12 GW of large-scale renewable projects currently have development approval with another 15 GW at earlier stages in the approval process.

Australian analyst Sunwiz has a less optimistic forecast for the utility-scale segment this year however, predicting the massive growth in 2022 will be upended. It noted the large-scale segment was buoyed by a small number of particularly large projects in 2022, saying the amount of solar farms actually under construction has dropped markedly. “Meaning 2023 will almost certainly be a year of contraction,” Sunwiz said.

It is worth noting here that Sunwiz is analysing actual installations, while the Regulator is pointing to investment. It is possible both sets of analysis could hold true, since most large projects take years to come online, even after reaching FID.

Path to 82% renewables by 2030

The Regulator expects renewables could reach an average of 40% of total NEM generation during 2023, up from the 35% average in 2022. Coupled with the promising investment numbers, this increase puts the country on a decent trajectory to meet its 2030 renewables target.

“If current electricity demand stayed the same to the end of the decade, renewable generation share must increase by 6 percentage points each year and annual added capacity must increase to at least 7 GW on a sustained basis,” the Regulator said.

Electricity demand is, however, expected to grow this decade as industry and households electrify and begin adding new loads to the grid with technologies like electric vehicles.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.