Following a market sounding in late 2022, Amp Energy has emerged with the rights to develop the Cape Hardy Green Hydrogen Project and is now in a nine-month exclusivity period as part of its commercial arrangement with site owner, Iron Road.

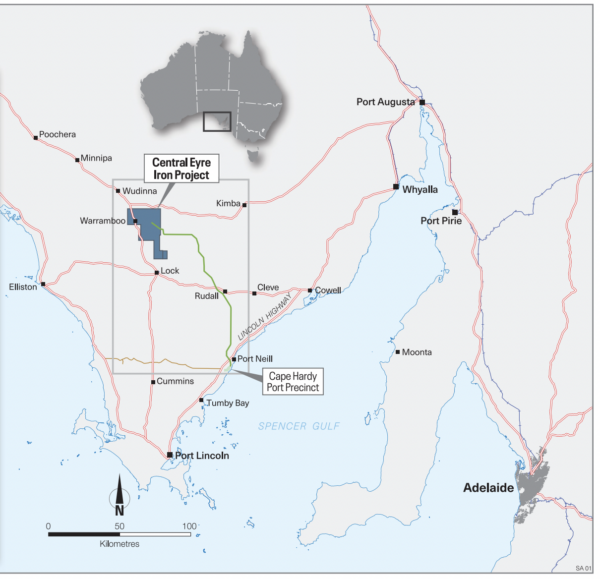

The project will sit on about one third of the 1,200 hectare plot on South Australia’s Eyre Peninsula controlled by ASX-listed company Iron Road, which is concurrently developing an iron export and port development project on the site.

Amp Energy said it intends to develop and build up to 5 GW of electrolyser capacity over the next decade in the Cape Hardy precinct. It plans to deliver over five million tonnes of green ammonia per annum from the project.

Image: Iron Road

Amp, which is backed by private equity giant Carlyle Group, said the Cape Hardy project is part of its bigger green hydrogen play in Australia. The company said it plans to develop around 20 GW of electrolyser capacity across three precincts here, producing the equivalent of 19 million tonnes of green ammonia per annum.

It is not entirely clear if these other precincts are part of projects Amp has already proposed – namely the $2 billion (USD 1.3 billion) Renewable Energy Hub of South Australia (REHSA). This hub, which was made public in 2021, is in fact a portfolio of integrated solar and battery assets located at three sites in South Australia. These include 636 MW at Robertstown, 336 MW at Bungama and the 388 MW Yoorndoo Ilga project, just north of Whyalla.

In 2021, Amp said it had already secured land and development approvals and expected the Robertstown and Bungama projects to begin staged energisation in 2023, however the trail seems to have gone cold since then. In total, this proposed portfolio would have 1.36 GW of combined capacity, and at the time Amp did flag its future plans to introduce hydrogen production.

While the Cape Hardy announcement made no explicit reference to the Renewable Energy Hub of South Australia (REHSA) portfolio, Amp did point to its “integrated model” in Australia, saying the company envisions being among one of Australia’s largest hydrogen developers and will do so by “owning and optimising feedstock generation assets, transmission, processing, and export.”

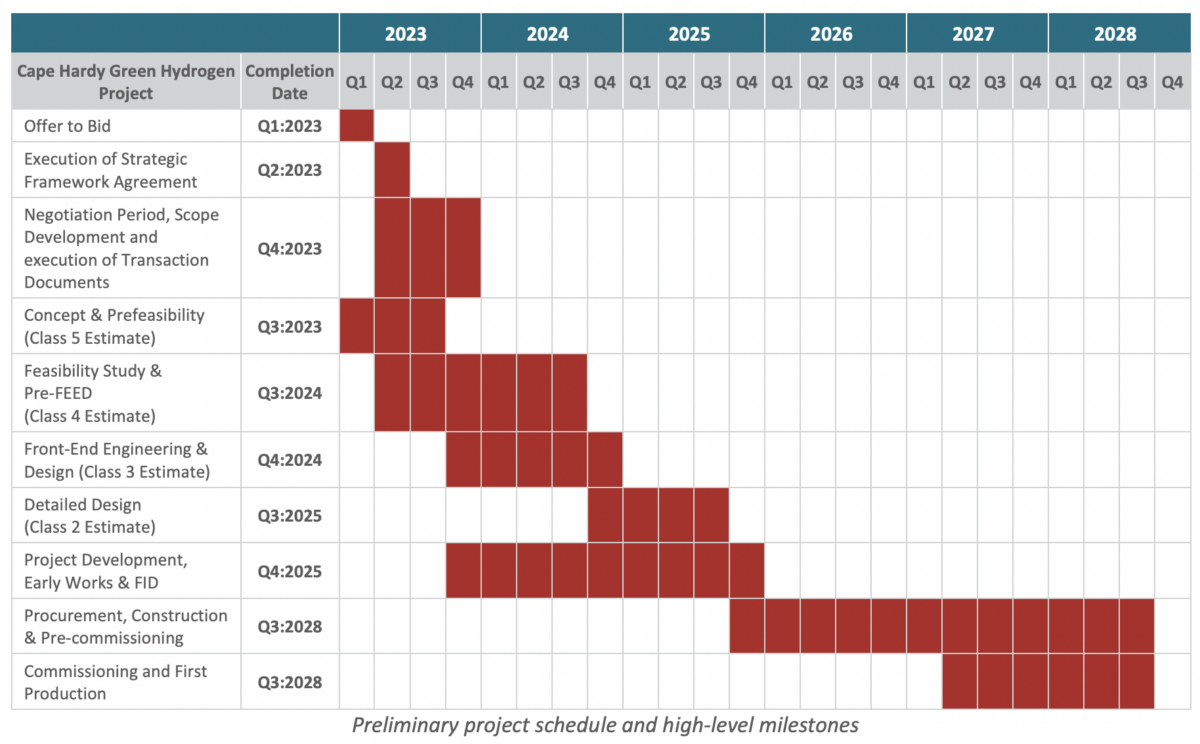

Image: Iron Road

Amp said it was drawn to the Cape Hardy project “due to its strategic geographic location and strong support from the South Australia government.” The Cape Hardy site boasts direct access to existing high voltage transmission infrastructure and a deep-water port. The South Australian government has previously pointed to Cape Hardy as a viable location for a green hydrogen hub, and the Australian federal government has previously pledged $25 million to help develop the site’s port infrastructure.

Noting the green hydrogen buzz, the owner of 1,200 hectare greenfield site at Cape Hardy, Iron Road, hired consultancy WSP in 2022 to undertake a market sounding exercise to gauge global interest in developing a green hydrogen project there. By September, the company launched a formal Expression of Interest bid process “following on from the considerable interest expressed,” it said.

Having emerged as the winner, Amp Energy’s cofounder and chief information officer, Paul Ezekiel, described the Cape Hardy project as “critical to our continued global growth and long-term strategy.”

South Australian Premier Peter Malinauskas welcomed Amp Energy’s progression. “This project complements my government’s commitment to hydrogen, through the Hydrogen Jobs Plan,” Malinauskas said.

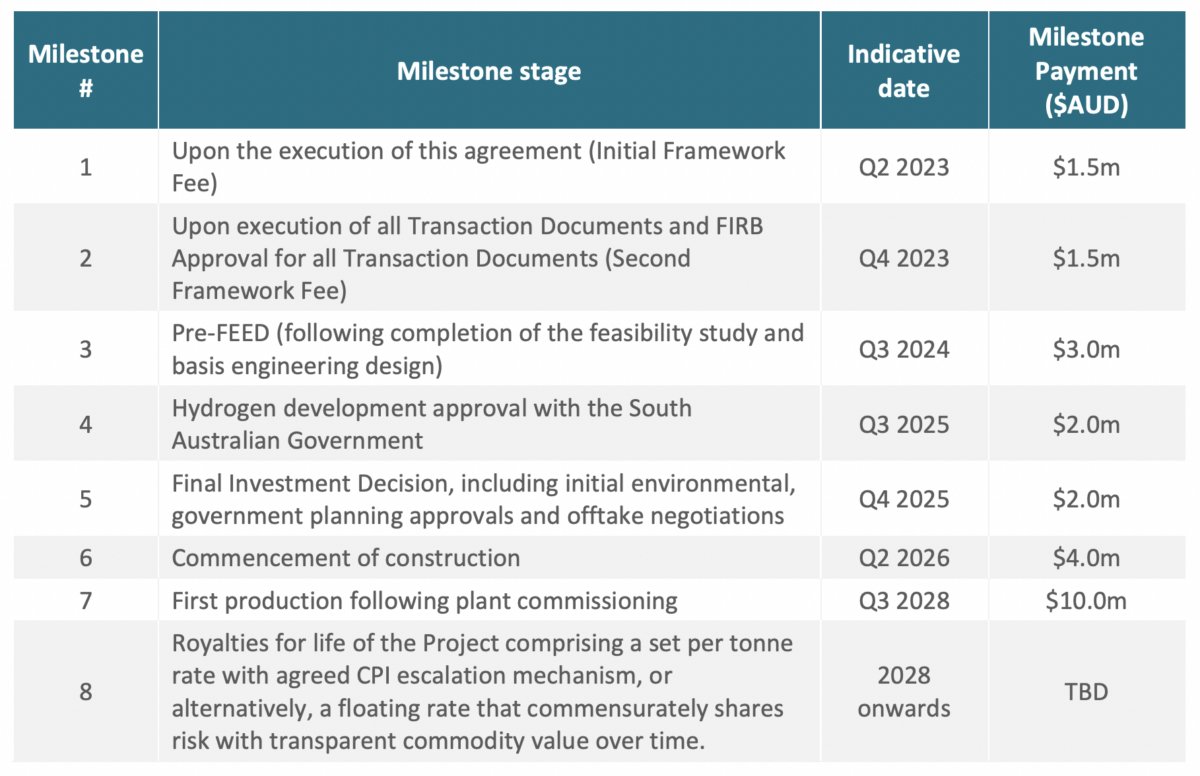

Image: Iron Road

The Cape Hardy project will include and leverage Amp Energy’s automated grid flexibility platform, Amp X, the company said.

Since being founded in 2009, Amp says it has developed and built close to 3 GW of renewable assets globally, and has another 4 GW either in late-stage development or construction. The company entered Australia in 2017 and alongside its proposed South Australian portfolio, it owns two operating solar farms in New South Wales, the 119 MW Hillston solar farm and the 39 MW Molong solar farm.

In 2022, Amp’s Indian arm announced a partnership with manufacturer Websol Energy System to produce up to 1.2 GW of monocrystalline PERC solar cells and modules. The company’s cited its Australian ambitions in the announcement, saying its entry into PV manufacturing was a “natural progression” and will help it to better control the supply chain.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.