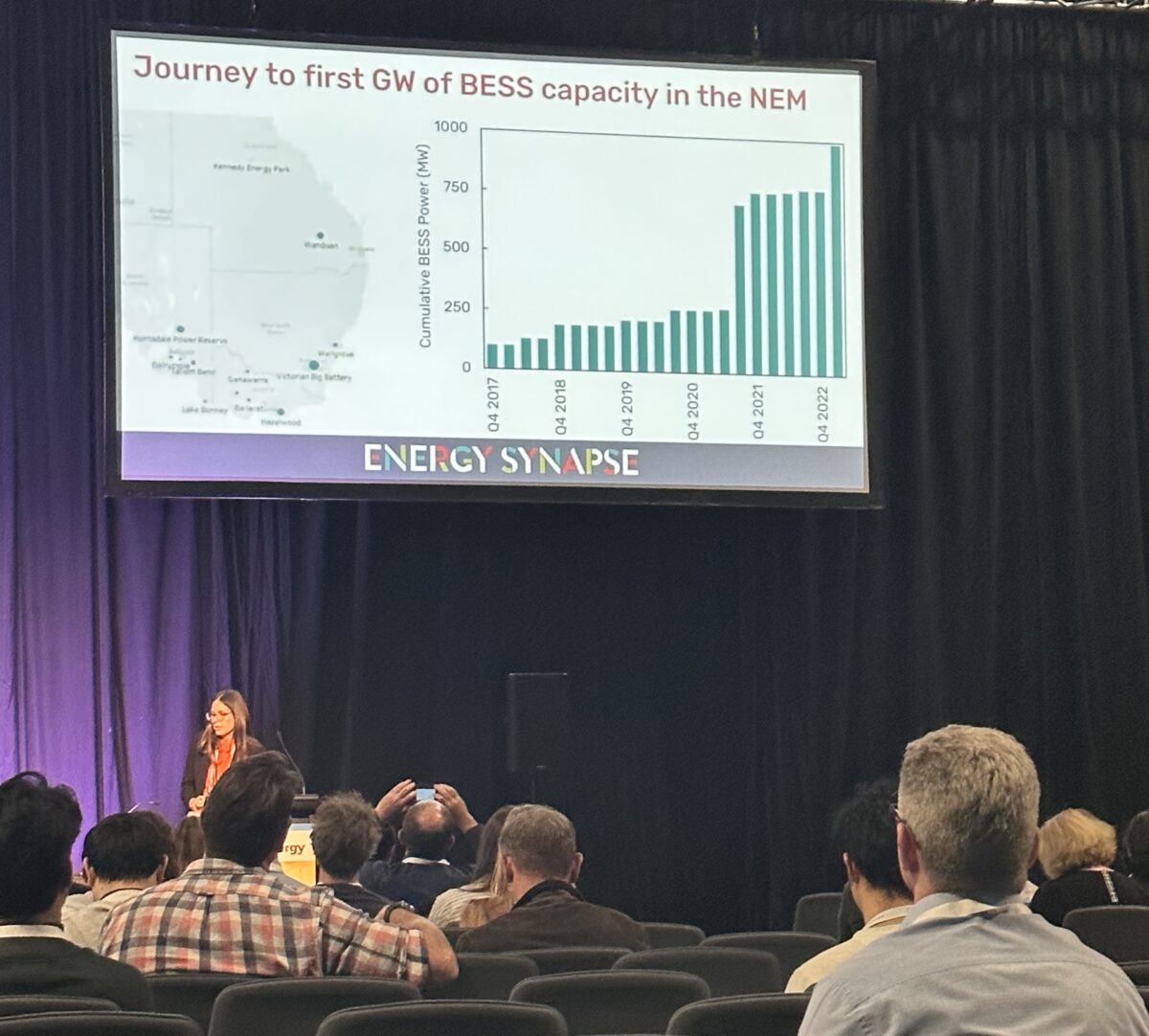

From total non-existence before 2017, Australia’s big battery market has now hit 1 GW. During the Smart Energy Conference held in Sydney’s Convention Centre on May 3 – 4, Energy Synapse founder Marija Petkovic highlighted some key takeaways since the connection of the Torrens Island and Hazelwood batteries rounded out the country’s first gigawatt.

Perhaps the most interesting is the fact that what experts presumed to be very shallow markets, namely the Frequency Control Ancillary Services or FCAS, have in fact proven much deeper than expected. The last seven years have seen numerous predictions about new large-scale batteries collapsing these markets but Petkovic said “we’re just not seeing that play out in the numbers.”

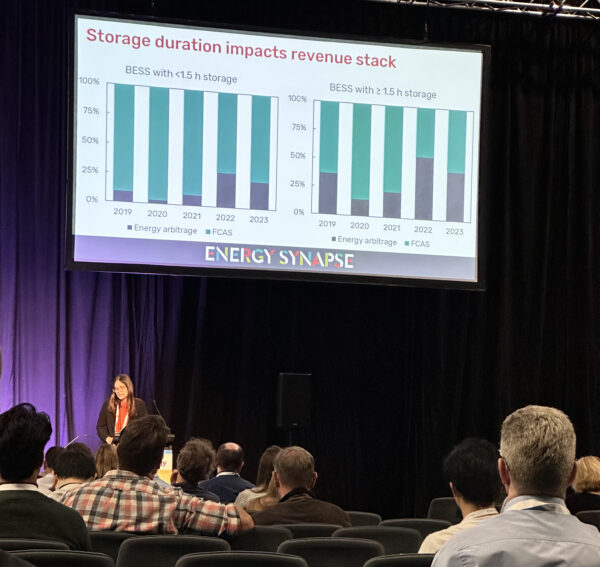

Of course, the markets’ depth varies across years, but FCAS has consistently provided the lion’s share of battery revenue and is yet to fall in a heap. Interestingly, how much of a battery project’s revenue stack came from the FCAS markets varies massively depending on the battery’s duration.

For batteries with less than 1.5 hours of duration, it usually accounted for well over 80% of the revenue stream. But for batteries with over 1.5 hours duration, FCAS sometimes provided less than half of their average revenue.

It is also worth noting that with every passing day, both new contracts and new markets are being developed to reward battery project’s value. Perhaps the most significant of those will be the federal government’s Capacity Investment Scheme, which has taken notes from the NSW government’s Long-Term Energy Service Agreements or LTESA scheme. Key big battery players like Neoen are also negotiating increasingly novel private contracts for their storage projects.

Today, energy arbitrage is unsurprisingly battery project’s second biggest revenue stream. Petkovic pointed out that it is not actually average wholesale energy prices that are important, but rather the price spread of these spot markets.

During the energy crisis in 2022, these spreads increased massively – sending a strong market signal for storage, which has always been something of an issue for Australia. Victoria and South Australia both have low average wholesale prices, but big pricing spreads – making them attractive locations for big batteries.

On average, Australia’s big batteries do 0.8 cycles per day – though Petkovic points out this figure is highly dependant on whether the projects are chasing FCAS markets (in which case they cycle less) or energy arbitrage.

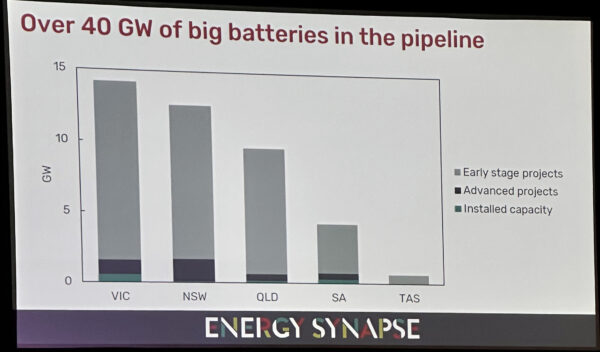

Australia may 40-fold its big battery installations over the coming decades with over 40 GW in the pipeline. This, however, includes all battery plans from the earliest stages – some of which inevitably won’t reach realisation. The growth projects are far from out of line though, with the Smart Energy Council expecting Australia to be home to 78 big batteries by 2025, with 14.5 GWh of capacity.

In terms of battery chemistries, Petkovic described herself as “very interested” in flow batteries, which are probably the most developed alternative to lithium chemistries today.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I came across your article discussing the milestone achievement of big batteries in Australia reaching 1 GW of capacity, and I wanted to express my excitement and appreciation for sharing this significant news. The rapid growth of large-scale battery storage in Australia is a testament to the country’s commitment to renewable energy and its potential to revolutionize the energy sector.

Reaching 1 GW of big battery capacity is a remarkable milestone that highlights Australia’s progress in adopting energy storage solutions at a large scale. Big batteries play a crucial role in enhancing grid stability, enabling better integration of intermittent renewable energy sources, and facilitating the transition to a more sustainable and reliable energy system.

The key takeaways from this achievement are worth noting. Firstly, it demonstrates the success and effectiveness of government policies and incentives that have encouraged investment in energy storage infrastructure. These policies have not only attracted private investments but have also fostered innovation and competition within the energy storage sector.

Secondly, the growth of big battery installations in Australia underscores the country’s commitment to renewable energy and decarbonization. As the capacity of renewable energy sources, such as solar and wind, continues to increase, the need for reliable and flexible energy storage solutions becomes even more critical. Big batteries provide the necessary backup power and grid support to ensure a smooth and efficient energy transition.

Moreover, the scalability and versatility of big battery installations make them suitable for various applications, including grid-scale energy storage, demand response management, and ancillary services. They offer multiple benefits, such as reducing peak demand, optimizing renewable energy utilization, and providing fast-response capabilities during grid emergencies.

The achievement of 1 GW of big battery capacity in Australia not only sets a positive example for other countries but also reinforces the notion that energy storage is a vital component of a sustainable energy future. It serves as a catalyst for further investments in renewable energy and storage infrastructure, driving innovation and creating new opportunities within the energy sector.