From pv magazine Global

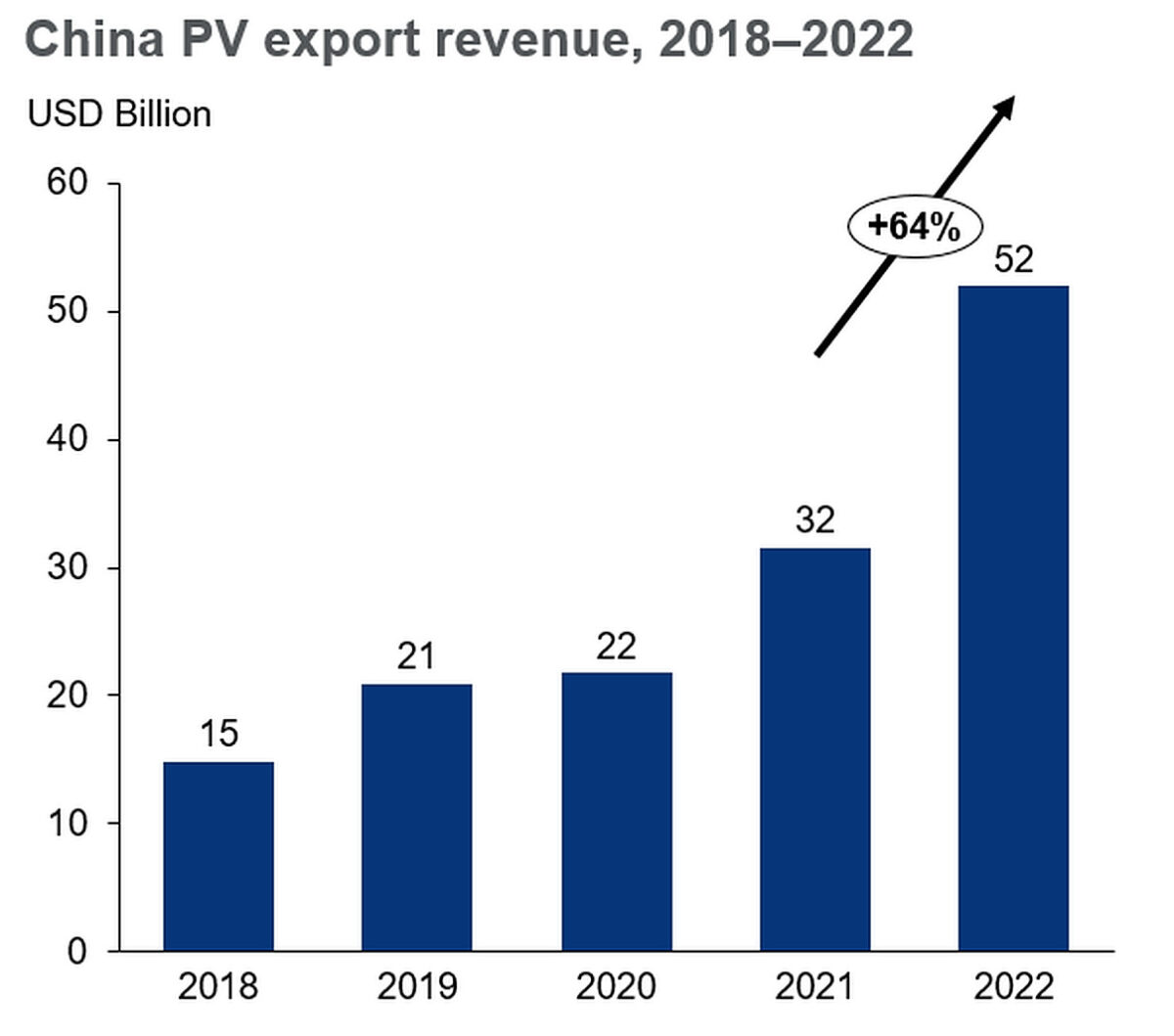

China’s PV module, cell, and wafer exports surged by 64% to USD 52 billion ($79 billon) in 2022, according to market research firm Wood Mackenzie.

Last year, China exported 154 GW of modules, with Europe remaining the top market, accounting for a 56% share. Chinese modules were also 57% cheaper than those produced in the United States and the European Union, according to Wood Mackenzie.

The upward trend continues, with Europe importing approximately 29.5 GW of Chinese modules in the first quarter of this year, based on information obtained by pv magazine. Wafer shipments rose 44% to 41 GW, while solar cell exports exceeded 24 GW. Southeast Asia secured 31% of the cells manufactured in China.

“US tariffs on Chinese-made modules have driven module production to Southeast Asia, where many manufacturing facilities import cells from China,” said Wood Mackenzie.

The report’s authors noted that the cost advantage of Chinese companies challenges offshoring policies in the United States, the European Union, and India. China’s wafer and cell export capacity is expected to surpass 230 GW by 2026, exceeding global demand outside of China. By 2026, China’s available module export capacity is projected to gradually increase to 149 GW.

“The US is counting on the [Inflation Reduction Act], which will allocate at least USD 41 billion ($62 billion) to stimulate domestic manufacturing. But costs still favour imported modules, and even as more local module production comes online in coming years, there will be persistent dependence on imports of components from Asia,” said Alex Whitworth, research director for Wood Mackenzie. “In Europe, the EU is advocating trade restrictions to secure local PV manufacturing but lacks specific policies to propel capacity build‑outs and displace imports. India also has great ambitions to expand its PV manufacturing, but financial support is insufficient to reach aggressive targets.”

Source: Wood Mackenzie

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.