A number of media outlets have today led with headlines of a $3.2 billion (USD 2.09 billion) cost blowout and up to three year delay to the Central West Orana Renewable Energy Zone in New South Wales (NSW), but the foundation of these claims appear misguided.

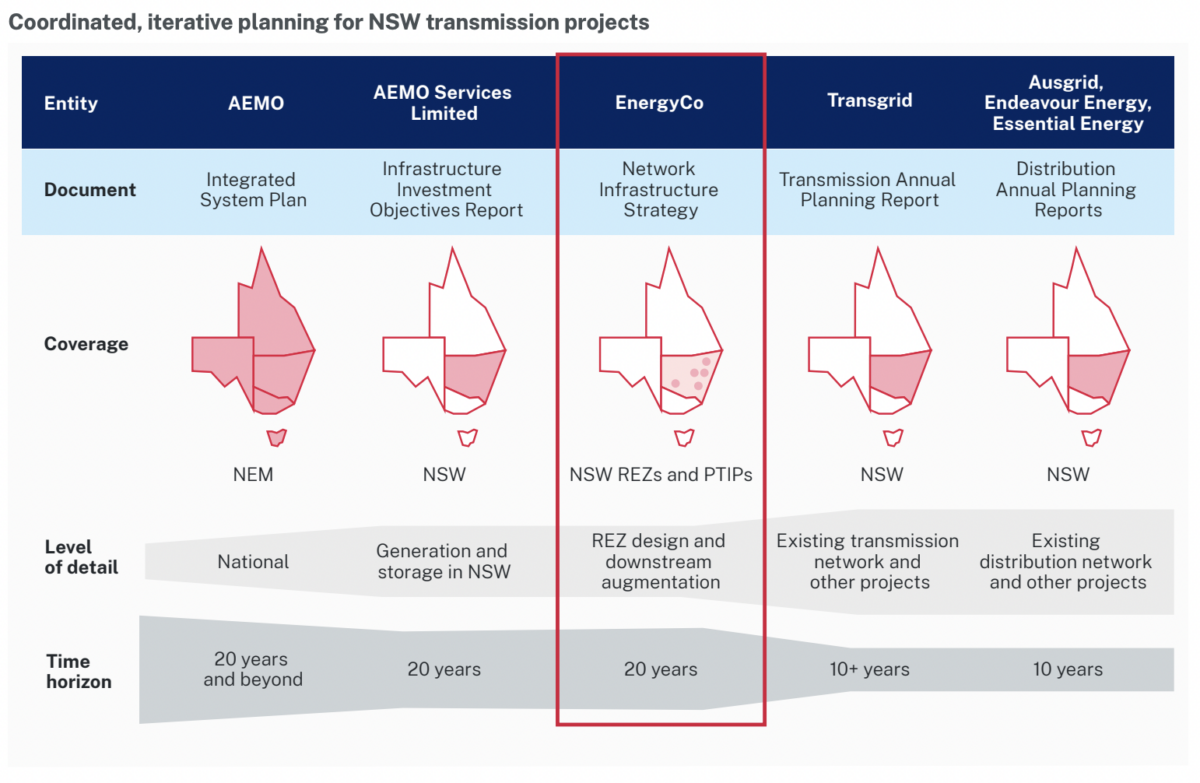

The news was sparked by the release of the NSW Network Infrastructure Strategy, a 20-year plan for the state’s transmission infrastructure and Renewable Energy Zones (REZ), prepared by its infrastructure planner, EnergyCo.

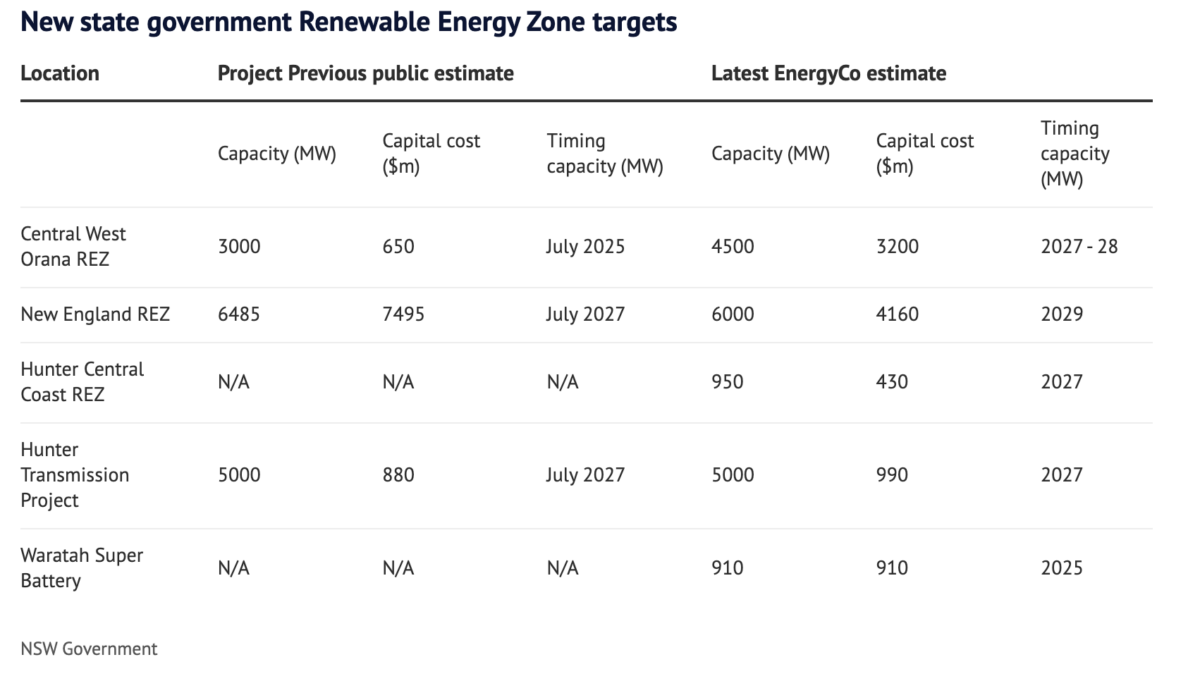

In light of this new document, a number of media outlets have published and republished the below table outlining huge disparities in the costings of the Central West Orana REZ and the New England REZ, with the former apparently costing an additional $3 billion while the latter appears $3 billion cheaper.

Image: Screenshot from SMH

Where these ‘previous public estimates’ originated from is unstated here, but some outlets point to Australia’s national energy planning document, known as the Integrated System Plan or ISP, as the source.

What the 2022 ISP actually forecast was the cost of the Central West Orana transmission link, which it estimated at between $450 million and $850 million, and modelled at $650 million. Pv magazine Australia cannot find any forecasts in the ISP around the capital costs of the entire Central West Orana REZ, but given the zone initially proposed adding 3 GW of renewables to the grid, $650 million beggars belief.

Media outlets have also reported the Central West Orana REZ has been delayed from July 2025 to 2027/28. Again, in the ISP the 2025 timeline relates to the transmission link, not the entire zone.

The NSW Network Infrastructure Strategy, published today, is the first detailed government assessment of both the timeframes and capital costs of the state’s renewable energy zones and related transmission infrastructure. That fact alone casts questions over how cost “blowouts” and delays could become the centrepiece of reporting.

The Strategy essentially seeks to clarify the order and magnitude of the state’s energy transition projects to realise the Electricity Infrastructure Investment Act 2020, a policy introduced by NSW’s former Coalition government under Energy Minister Matt Kean. This is, the document outlines how NSW will deliver 12 GW of renewable generation and 2 GW of storage as soon as practicable before most of the state’s coal plants close in 2033.

According to the Guardian, NSW’s new energy minister, Penny Sharpe, briefed journalists about the strategy document on Wednesday, ahead of its release. It reports: “Sharpe said the price of transmission infrastructure and preliminary works to connect the [Central West Orana] zone to the broader network had originally been costed at about $400 million to $800 million but it was now expected to cost about $3.2 billion.”

This distinction between the initial costs relating to a particular piece of supporting transmission rather than whole Orana REZ appears to have been lost in the reporting of most outlets. This may be because the key message of Sharpe’s briefing hinged on delays and cost blowouts.

“This strategy is the first time that the likely costs have been identified and published on the specific projects. I am concerned that costs and timeframes have grown since they were first proposed in 2020,” Sharpe said.

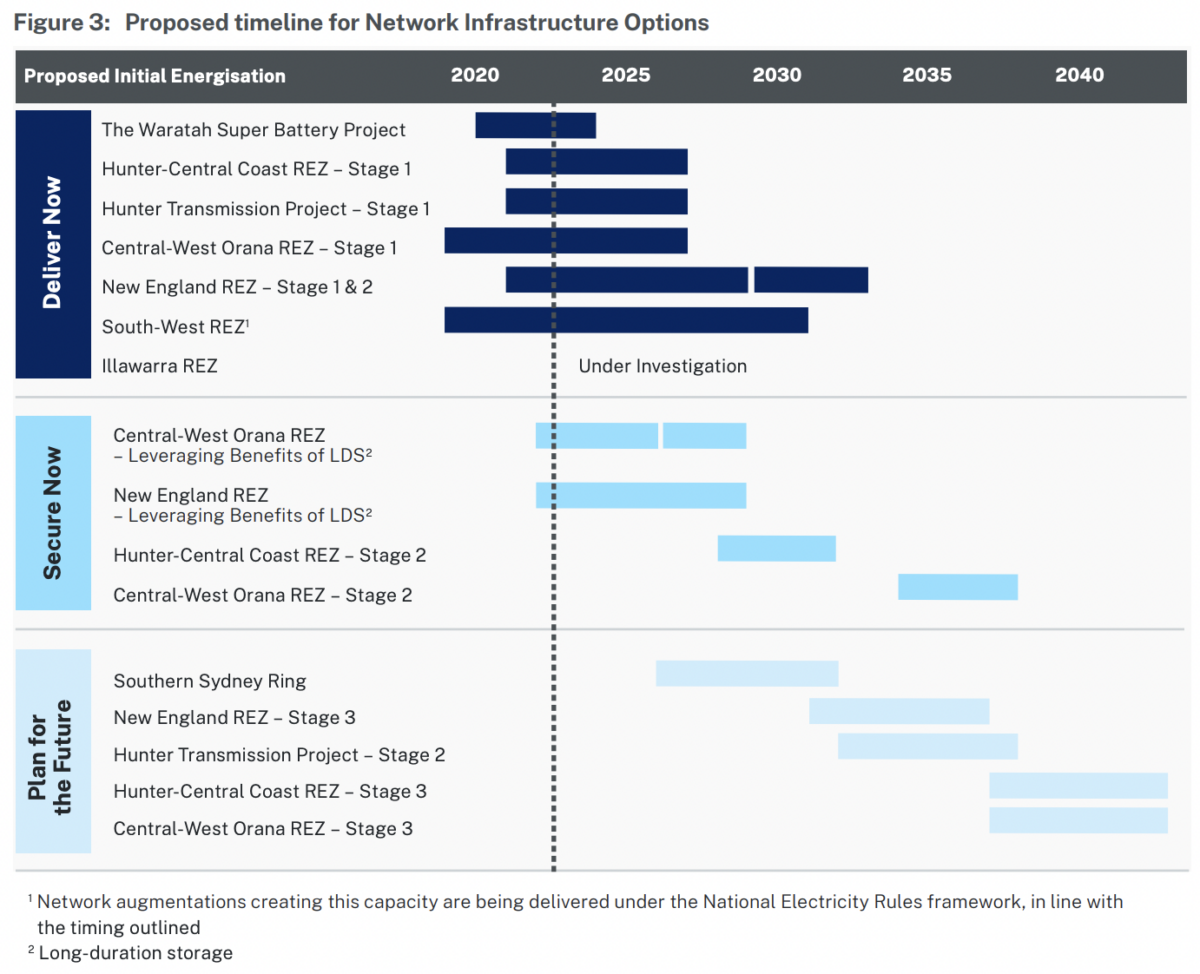

Image: EnergyCo

Alongside Central West Orana REZ, delays to the state’s largest zone, the New England REZ, have been reported. Renew Economy said the New England REZ’s completion date has been delayed from 2027 to 2029, while The Guardian reported those dates refer to the start of construction on the zone.

It is not clear to pv magazine Australia where the 2027 date originated from, but given the zone is planned to host 6 GW of renewable capacity it seems all but impossible such a feat could be completed by 2027, especially since the zones are made up of numerous individual projects constructed by private companies.

The overall cost of NSW’s transformation has also been confusingly reported, with the Australian Financial Review quoting $10.6 billion, saying this figure relates to poles and wires only. Meanwhile, the Sydney Morning Herald came to a conclusion of $9.3 billion by 2030.

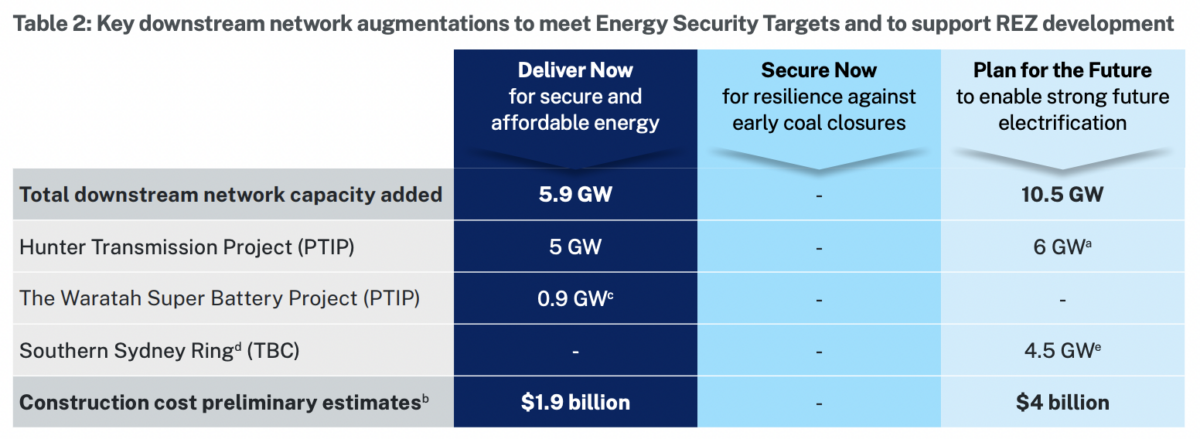

The correct estimated figure is $9.7 billion within the next decade (2033). The figure is made up of a $1.9 billion preliminary estimate to realise two transmission and a storage project, namely the Hunter Transmission Project, the Southern Sydney Ring and the Waratah Super Battery.

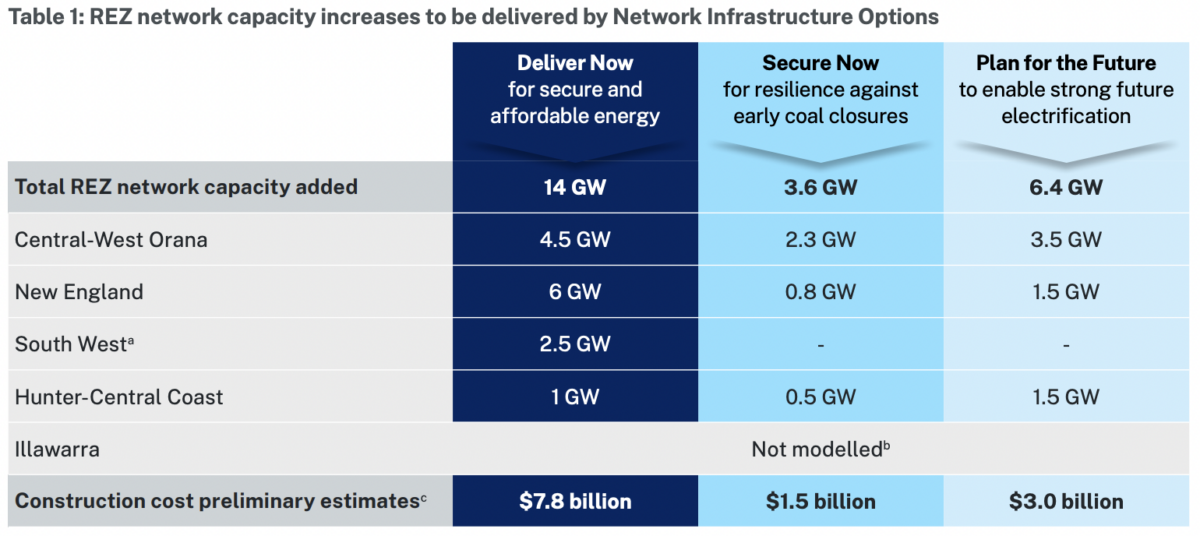

The bulk of the spend comes from renewable energy zones, with the preliminary estimate sitting at $7.8 billion. It is worth noting EnergyCo has not modelled the costs of the fifth Illawarra REZ.

These preliminary estimates include clauses stating the projections could be up to 50% more or less.

What is actually going on in the NSW Network Infrastructure Strategy

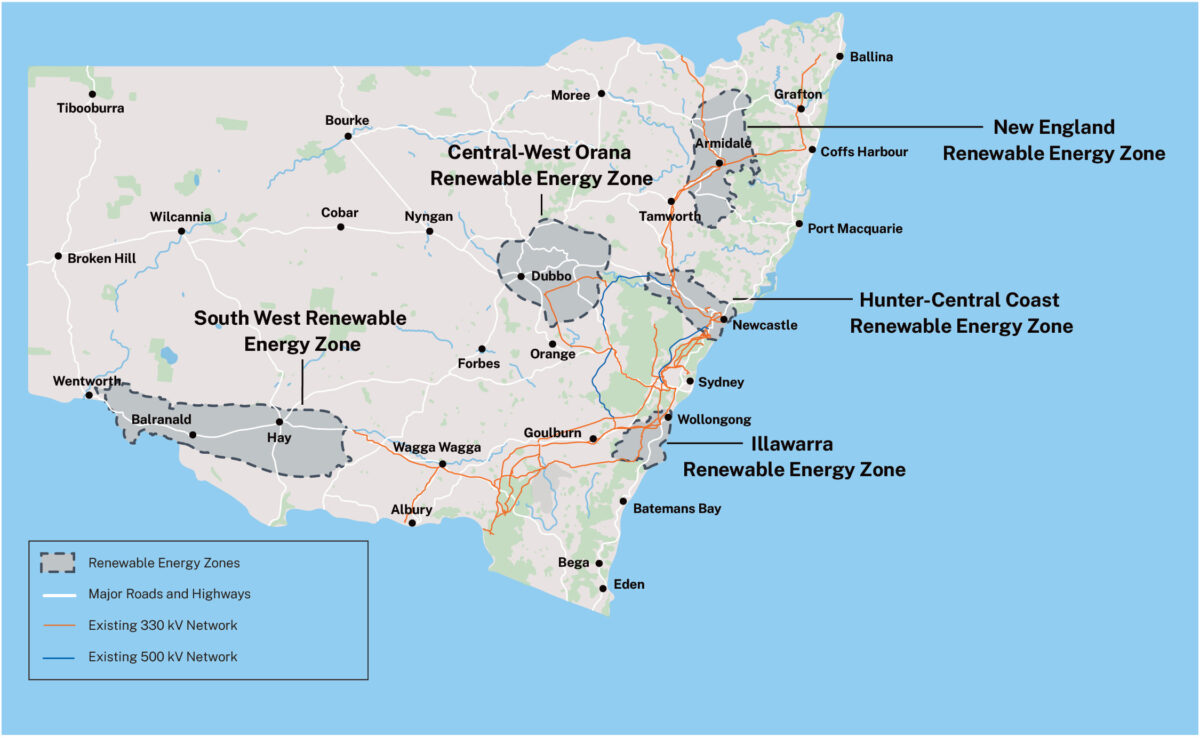

As mentioned, today’s document includes the first real cost and timeline estimates for the state’s energy transformation, which largely rests on the five renewable energy zones being delivered by EnergyCo.

The Strategy was drawn up in collaboration with with AEMO Services, which acts as the ‘Consumer Trustee’ in NSW.

Andrew Kingsmill, Executive Director Technical at EnergyCo, said the NSW Electricity Roadmap is a third of the way to delivering the state’s promised 14 GW by 2030.

The Network Infrastructure Strategy is a part of realising this roadmap and is designed to inform the Infrastructure Investment Objectives Report, which underpins the tender plan for NSW’s generation, firming and storage auctions. That is, EnergyCo assesses project options, including doing community consultations, and then makes recommendations to AEMO Services for its Objectives Report, which then go to market.

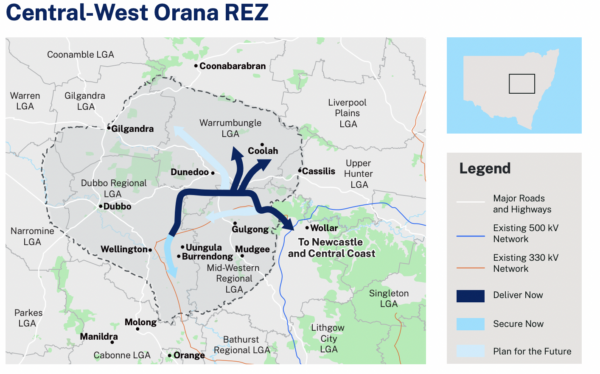

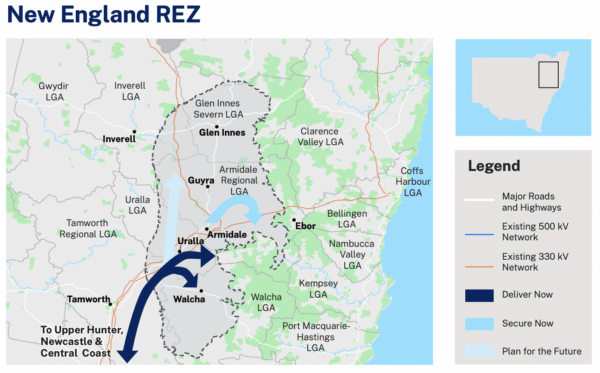

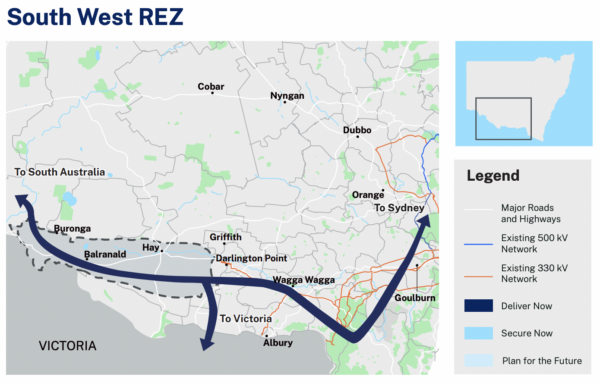

While the main focus is on the next decade, the strategy proposes options which add between 14 GW and 24 GW of capacity over the next 20 years, depending on the modelled scenario. They are grouped into: ‘deliver now,’ meaning projects needed ASAP, ‘secure now,’ meaning projects that follow on from the first batch, and ‘plan for the future,’ which are on the 20 year horizon.

These projects would represent about 5% of wholesale electricity costs over the next 20 years, EnergyCo says, but could unlock up to four times the value in generation, storage and firming infrastructure.

EnergyCo’s ‘deliver now’ projects, it says, consist of only ‘no regret’ options, meaning they benefit electricity consumers under all modelled scenarios. EnergyCo lists those projects as such:

- Central-West Orana REZ: add 4.5 GW of network capacity, with new lines to connect five new substations to the existing network.

- New England REZ: add 6 GW of network capacity, with new lines to connect four new substation hubs to the existing network between Bayswater and the Tamworth–Armidale line. This is proposed over two stages of 2.4 GW and 3.6 GW.

- Hunter-Central Coast REZ: add 1 GW of network capacity, with two new and one upgraded lines to connect new substation hubs to the existing network in the Upper Hunter.

- South West REZ: add 2.5 GW of network capacity, through the ISP projects EnergyConnect, HumeLink and the Wagga Wagga to Dinawan section of VNI West.

- Hunter Transmission Project Stage 1: add 5 GW of network capacity with a 500 kV double circuit line between Bayswater and Eraring power stations, providing capacity for the CWO, New England and HCC REZs. This project is essential to alleviate downstream network constraints when the total power transmitted from CWO, New England and HCC REZs exceeds 3 GW.

- The Waratah Super Battery Project: add 0.9 GW of network capacity from a 700MW SIPS scheme provided by a standby battery at the site of the former Munmorah coal-fired power station, and minor upgrades to Transgrid’s existing network.

The planned Waratah Super Battery will be built on the site of a former coal power station. Image: Powin

While the state’s renewable energy zones will obviously require significant amounts of new network infrastructure, EnergyCo also notes it is “exploring options” for small-scale distribution network upgrades and storage projects in the shorter term while these bigger projects are being built.

Transmission, and specifically community opposition to transmission, is heating up in Australia. In March, the NSW government published a review detailing the renewable energy sector’s conflicts with agriculture, which has driven much opposition, especially around renewable energy zones. “The friction that is emerging may be the most significant risk to policy success,” the government report states.

One of the things opposing communities often call for is the undergrounding of transmission lines. EnergyCo draws a pretty firm line around this in the document, pointing to a number of reasons why underground high voltage direct current (HVDC) are rarely appropriate. Not only is it more expensive, EnergyCo says the environmental benefits are overblown and underground lines are significantly harder to repair. “The costs and benefits of undergrounding were independently assessed for the HumeLink project in NSW,” it states. “The assessment found that an underground transmission for that project scope would cost more than three times that of the overhead options, with a two- to three-year delay in project delivery.”

Editions of the Network Infrastructure Strategy are set to come every two years, with EnergyCo noting that future updates will include more details on emerging technologies and markets like offshore wind, green hydrogen, and long-duration storage.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.