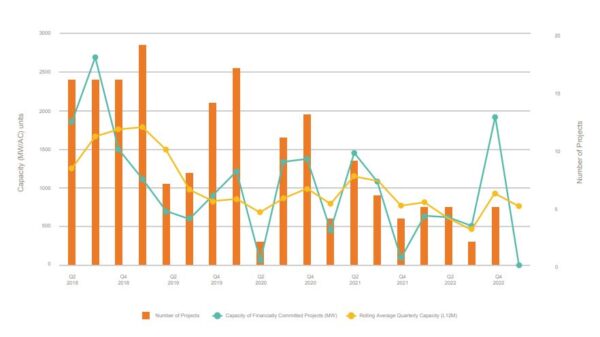

New data from the Clean Energy Council (CEC) shows that in the first three months of 2023 construction commenced on eight solar and battery energy storage projects worth a cumulative $1.3 billion (USD 85 million), nearly double what was under construction in the preceding quarter.

The CEC said the construction activity has been overshadowed by a significant fall in new financial commitments in large-scale renewable projects with quarterly investment in financially committed generation and storage projects slumping to $400 million. This is the second lowest quarterly result since data collection began in 2017 and a dramatic fall from the $4.3 billion seen in the previous quarter.

While the CEC data indicated no generation projects reached the critical stage of financial commitment in the quarter, Pacific Partnerships achieved financial close on the 102 MW Glenrowan Solar Farm in northeast Victoria.

The only storage project to reach financial commitment was the 200 MW/400 MWh Rangebank Battery Energy Storage System being developed in Victoria by Shell Energy Australia in partnership with Green Investment Group.

CEC Chief Executive Officer Kane Thornton said the shortage of projects reaching financial close is “cause for concern”, saying Australia needs to increase the pace of its renewable energy rollout if it is to meet legislated targets.

“A slowdown in the rate of new projects reaching financial close is at odds with our need to accelerate deployment,” he said.

“Australia needs to double the rate of renewable energy deployment to ensure we have enough new supply to drive down power prices, replace exiting coal generation and ensure we achieve the target of 82% renewable energy by 2030 and put Australia on a path to achieve net-zero by 2050.”

Image: CEC

Thornton said energy investors are enthusiastic about investing in clean energy in Australia but that confidence is being undermined by a “variety of headwinds.”

This includes the global competition for clean energy as many countries follow the United States’ Inflation Reduction Act (IRA) and dramatically increase the scale and incentives for clean energy projects.

Thornton also pointed to challenges with connecting to the grid, supply chain and workforce constraints and delays in planning and approvals.

“These risks and challenges need urgent and coordinated attention to ensure Australia gets back on track to delivering new clean energy supply critical in managing the energy transition,” he said.

The CEC said the federal government has made significant progress in managing the energy transition, including allocating $2 billion in the budget to support green hydrogen production, but urged the government to abandon plans to phase out Australia’s Renewable Energy Target (RET).

Thornton urged the government to consider an extended RET to provide certainty for investors and support more large-scale investment.

“No policy has delivered as much abatement, given as much certainty and unlocked as much investment as the RET,” he said. “Extending it beyond 2030 would be simple and fast, and the costs associated with this extension will be far outweighed by lower energy prices that we know will follow.”

Image: CEC

Among the seven generation projects that began construction in the Q1 2023 was the 290 MW Wollar Solar Farm being developed near Mudgee in central west New South Wales by the Australian arm of China-headquartered clean energy company Beijing Jingneng Clean Energy (BJEI).

The 300 MW/800 MWh Blyth Battery, being developed by France-headquartered renewable energy developer Neoen in South Australia’s mid-north, was the only storage project to commence construction over the same period.

The total capacity for the eight generation and storage projects combined was 1,014 MW. Quarterly investment in financially committed generation and storage projects reached $400 million, the second lowest quarterly result since data collection began in Q1 2017.

Two projects were commissioned in the first three months of 2023 including the 400 MW first stage of the New England Solar Farm in northern NSW, and Fortescue’s Pilbara Generation Project battery energy storage system in Western Australia.

In terms of new installed capacity added, this was 2,023 MW less compared to the previous quarter, and 1,379 MW less than the same quarter 12 months ago.

The CEC said there are currently 108 generation and storage projects with a combined total of 16.7 GW of generation capacity and 13.9 GWh of storage, that have either reached financial commitment or begun construction.

Since 2017, 193 large-scale generation and storage projects have been commissioned in Australia, contributing 15.5 GW of installed capacity, 1.7 GWh of storage, and more than $27 billion worth of investment.

Edit: Updated to include details about Pacific Partnerships achieving financial close on Glenrowan Solar Farm.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.