The Clean Energy Finance Corporation (CEFC) has been allocated an additional $20.5 billion to accelerate progress towards Australia’s transition to net-zero emissions by 2050 with the bulk of the funds set aside to deliver the federal government’s Rewiring the Nation program.

The Australian Parliament has passed amendments to its Treasury laws, paving the way for the CEFC to receive the first increase in its capital allocation since it was established in 2012 with $10 billion in capital.

The federal government said amendments have been approved providing for the CEFC to receive the first $11.5 billion of the new funding and allowing for a further $9 billion to be added by other new appropriations.

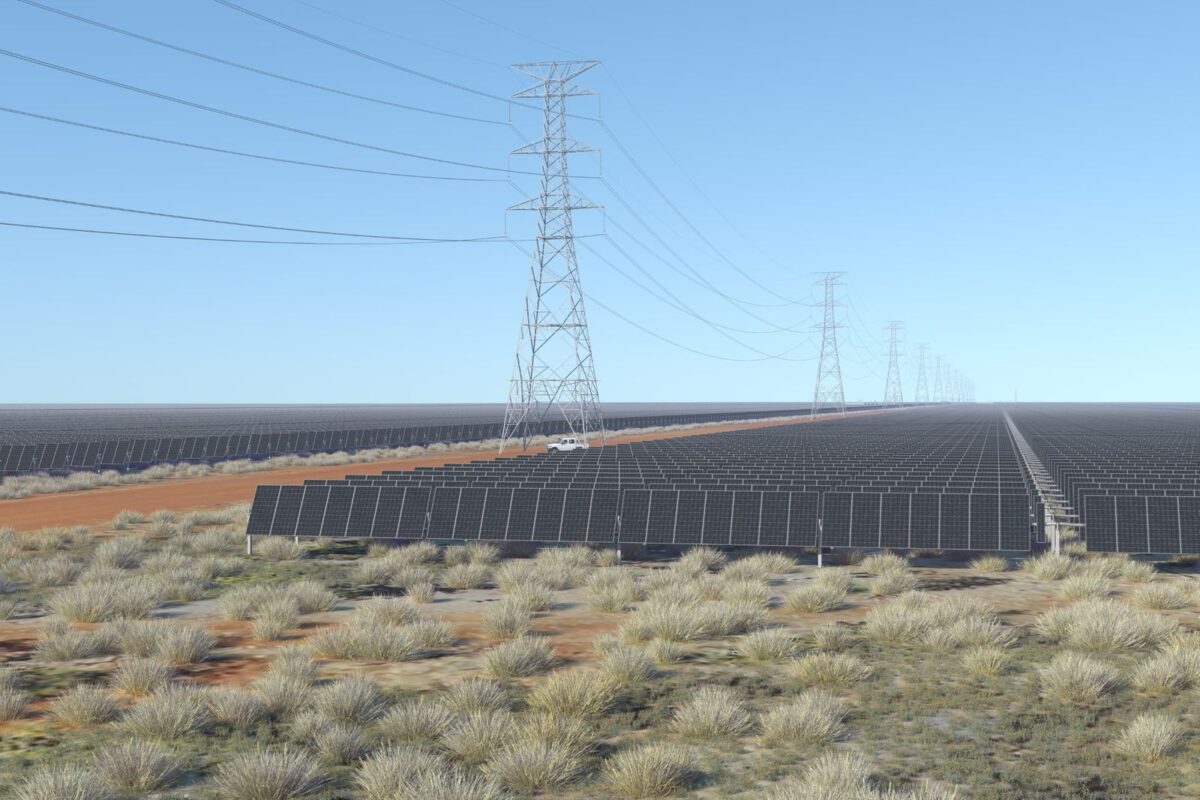

The additional funding includes $19 billion to help deliver the Rewiring the Nation program, which is the backbone of the federal government’s plan to cut emissions by 43% by 2030, while also reaching 82% renewable energy grid penetration.

The CEFC said the new funding will be utilised to help finance new high-voltage transmission links between states and regions, long-duration grid storage and electricity distribution network infrastructure as the nation transitions from thermal generation to renewable energy.

The increase in capital funding also includes $1 billion to create the Household Energy Upgrades Fund which will provide discounted consumer finance to increase sustainability across the housing sector and $500 million for a new Powering Australia Technology Fund which will facilitate the development, commercialisation and take up of clean energy technologies.

CEFC Chief Executive Officer Ian Learmonth said he expects the first investments funded by the new capital will be announced in the coming months in a bid to fast-track the decarbonisation of Australia’s electricity sector and secure a strong and stable clean energy supply.

“We do not underestimate the scale of the challenge or the pace at which this transformation must occur, especially in light of the economic and supply chain headwinds impacting many sectors of our economy, including energy,” he said.

“Subject to commercial considerations, we expect to make substantial grid-related investment decisions within the next 12 months.”

“While these transactions are often large and complex, we must move quickly to invest in the expansion and augmentation of our grid and related infrastructure to deliver on Australia’s net-zero objectives.”

Learmonth said public investment has an important role to play in the development of the transmission and infrastructure projects needed to build a grid that’s fit for a clean energy future.

“At the intersection of this revolution in low-emissions energy generation and distribution is government and private sector capital, delivered via new and tailored investment models that leverage the considerable market momentum toward sustainable green investment opportunities,” he said.

Learmonth said the “very substantial increase” in additional capital allocation will be invested alongside ongoing CEFC investment activities across the economy, including in renewable energy and energy efficiency, emerging cleantech and hydrogen opportunities.

CEFC Chair Steven Skala said the additional capital funding recognises the success of the CEFC model in investing to lead the market and proving up investment opportunities.

“The Rewiring the Nation program, Household Energy Upgrades Fund and Powering Australia Technology Fund substantially expand the role of the CEFC, alongside its ongoing core businesses,” he said.

“New large-scale investments in priority grid infrastructure projects complement our existing work in transforming our energy system and bringing the benefits of decarbonisation to key sectors of our economy.”

At 31 December 2022, the CEFC had made lifetime investment commitments of $11.7 billion. After repayments and returns on its investments, the CEFC had $4.6 billion available for ongoing investment activities from its original $10 billion funding allocation from the Australian government.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.