Andrew Forrest’s Fortescue has become a “lead investor” in Electric Hydrogen (EH2), putting an undisclosed amount into the startup’s USD 380 million ($603 million) Series C funding round.

The company has also signed a seperate supply agreement, which will see EH2 supply 1 GW of its electrolysers to Fortescue so it can deliver the green hydrogen projects it is developing worldwide.

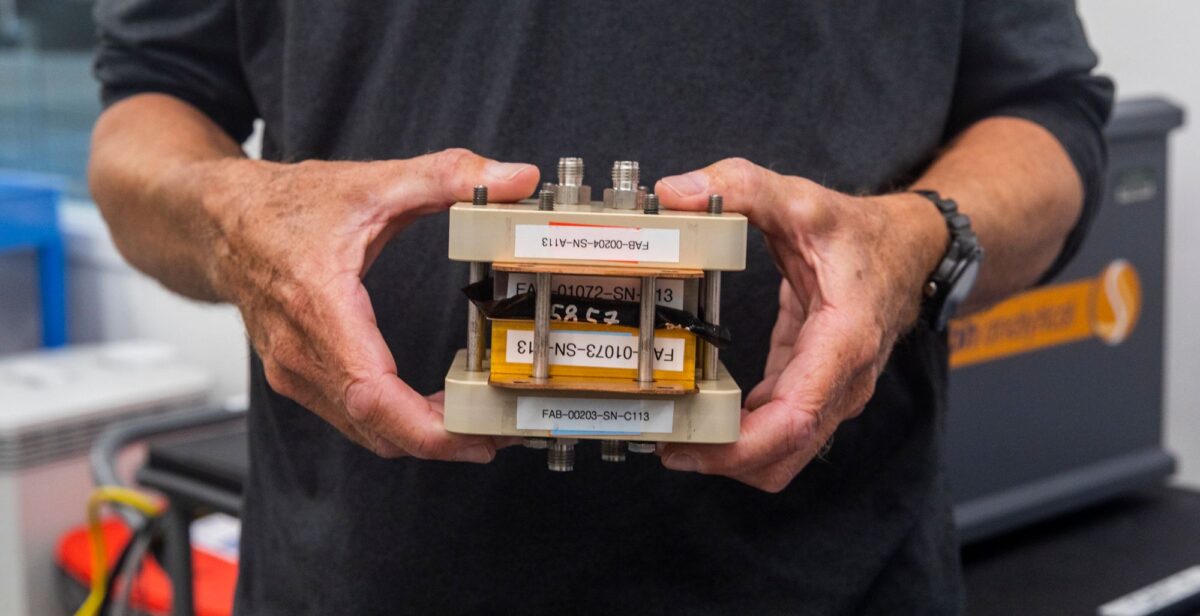

Image: FFI

“Right now there are not enough electrolysers in the world to support the amount of green hydrogen we are set to produce,” Fortescue Energy CEO, Mark Hutchinson, said. “That is why we are partnering with other world leaders in this space to secure our green energy supply chain.”

EH2, founded in 2020, boasts electrolysis systems able to make nearly 50 tonnes of green hydrogen per day “at transformational low cost,” Fortescue says. Indeed, the startup seems to be a roaring success story, with Reuters reporting this latest funding round valued EH2 at USD 1 billion ($1.59 billion).

Its capital raise was well oversubscribed, with Fifth Wall, Energy Impact Partners, and many more joining Fortescue to invest. Amazon, Honeywell, Equinor, Rio Tinto, and Mitsubishi have also invested in EH2.

Electrolyser manufacturers are facing massive global backlogs due to high demand and low manufacturing capacity in operation today, resulting in lead times of multiple years. This fact is likely what has driven Fortescue to set up its own manufacturing facility in Gladstone, Queensland. While Fortescue’s factory is hoping to start producing by the end of the year, the scale evidently will not be enough to cater to Fortescue’s proposed projects.

Image: Fortescue Future Industries/Twitter

Moreover, relatively little is known about the PEM electrolyser technology Fortescue has developed “in house” and is hoping to manufacture after the company’s deal with another US manufacturer, Plug Power, fell apart earlier this year.

EH2, on the other hand, has developed a full 100 MW “electyrolyser system.” In May, it announced its first factory in Devens, Massachusetts. “The Devens factory will have an annual manufacturing capacity of 1.2 GW with production of EH2’s 100 MW green hydrogen electrolysers commencing in Q1 2024,” it said at the time.

It would seem, then, that Fortescue will be taking the bulk of EH2’s electrolyser production, but given the lack of timeline detail in Fortescue’s announcement, it is hard to say.

While Fortescue has not disclosed the value of its supply deal with EH2, the Australian Financial Review claimed it to be worth almost $100 million.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.