On Sunday, US company Albemarle Corp., the world’s largest lithium producer, dropped its $6.6 billion (USD 4.2 billion) takeover offer for West Australian lithium hopeful Liontown Resources, saying “growing complexities associated with the proposed transaction” meant that the takeover was “not in Albemarle’s best interests.”

After Liontown Resources’ board backed Albermarle’s refreshed bid in September, Australia’s richest person, mining magnate Gina Rinehart, set about upping her stake in the publicly listed Liontown, growing it from an original 4.9% stake to a 19.9% as of Friday, October 13. According to the Australian Financial Review, her company Hancock Prospecting spent around $1.3 billion doing so.

It isn’t completely clear what Rinehart’s play was, with many positing she had hoped to block the takeover, though Hancock Prospecting recently indicated its willingness to partner with Albemarle in owning and operating Kathleen Valley and its onshore lithium processing ventures.

Billionaire Gina Rinehart has stifled Albemarle’s $4.2 bln bid for Liontown. Now the minerals producer has to raise cash just as prices for lithium are falling. She needs to show why her spoiling tactics were worth it, says @AntonyMCurrie https://t.co/jBK8WTp3NB pic.twitter.com/Ya3XzYpAEn

— Reuters Breakingviews (@Breakingviews) October 16, 2023

Either way, Albermarle decided it would not move forward under these new conditions. Liontown Resources has now entered a trading halt as it seeks to raise funds for its flagship Kathleen Valley lithium mine project.

Liontown had hoped the Kathleen Valley lithium mine, which is one of the largest and highest-grade hard rock lithium deposits in the world, would start producing from the middle of next year. It remains it be seen whether this timeline will be impacted by the corporate turmoil, but it is worth noting Hancock Prospecting repeatedly cast doubts on Liontown’s ability to deliver the Kathleen Valley project.

Hancock Prospecting bought much of its stake in Liontown in the last week at $3 a share, matching the Albermarle offer. Analysts now expect Liontown’s share price to drop, with a number of trading houses downgrading the stock’s rating.

Image: Albemarle

In terms of Albermarle’s reaction, its CEO Kent Masters said: “our engagement with the Liontown team has been meaningful and productive. We appreciate the level of cooperation we have received, and we thank the entire team for their efforts. That said, moving forward with the acquisition, at this time, is not in Albemarle’s best interests.”

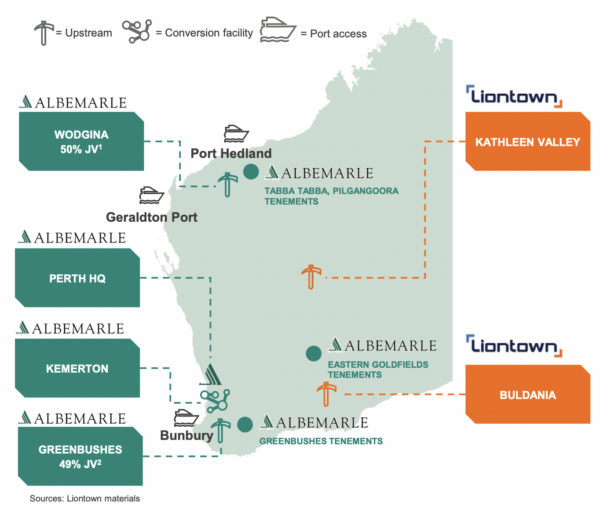

Albemarle has already made significant inroads into mining and processing lithium in Australia. The American company already has spodumene resources and lithium conversion facilities at Greenbushes and Wodgina and Kemerton.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.