During a call with investors on Tuesday, Albemarle CEO Kent Masters said the company hopes to close the buyout by the middle of next year but following the company’s successful offer, rumours of a potential bidding war have broken out.

Since the Albemarle bid was endorsed earlier this week, Liontown has seen some unusual trading activity with share prices jumping 9% and trading volumes spiking to 85 million on Thursday, up from 15 million the day before.

Media outlets have speculated the buyer is Australia’s richest person, Gina Rinehart, though this has not been confirmed. Rinehart is understood to already have held a 4.9% stake in Liontown, and it is speculated she is looking to up her stake to gain controls associated with being a substantial shareholder.

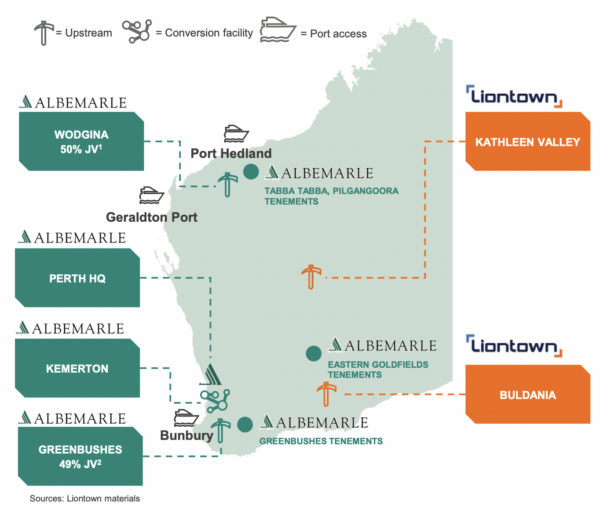

Image: Albemarle

Albemarle has already made significant inroads into mining and processing lithium in Australia. The American company already has spodumene resources and lithium conversion facilities at Greenbushes and Wodgina and Kemerton. The buyout of Liontown would further cement the US company’s dominance.

Albemarle made a new cash offer for Liontown at $3 a share, which the lithium developer’s board backed on Monday this week. This offer was the latest of several from the US lithium producer. The new offer is 20% higher than the $2.50 a share that Albemarle offered in late March this year and which Liontown turned down as being too low.

During the call with investors on Tuesday, Masters explained Albemarle sees Liontown and its Kathleen Valley lithium deposit as a means to “increase our opportunity to meet rapid and growing lithium demand.” Australia produces more lithium than any other country – generating a third more than the next largest producer, Chile.

So far, the deal is non-binding and must still be formalised and approved by shareholders. Liontown, whose assets are located in Western Australia, has agreed to let Albemarle review its lithium supply agreements with Ford, Tesla and South Korean battery giant LG Energy Solution, among others, which go through to 2030.

Liontown’s two Western Australian lithium deposits should start producing from the middle of next year, starting with the flagship Kathleen Valley project, which is one of the largest and highest-grade hard rock lithium deposits in the world.

According to Reuters, Albermarle executives say that if the Liontown deal closes, the US lithium producer will have to build processing facilities for the Kathleen Valley mine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.