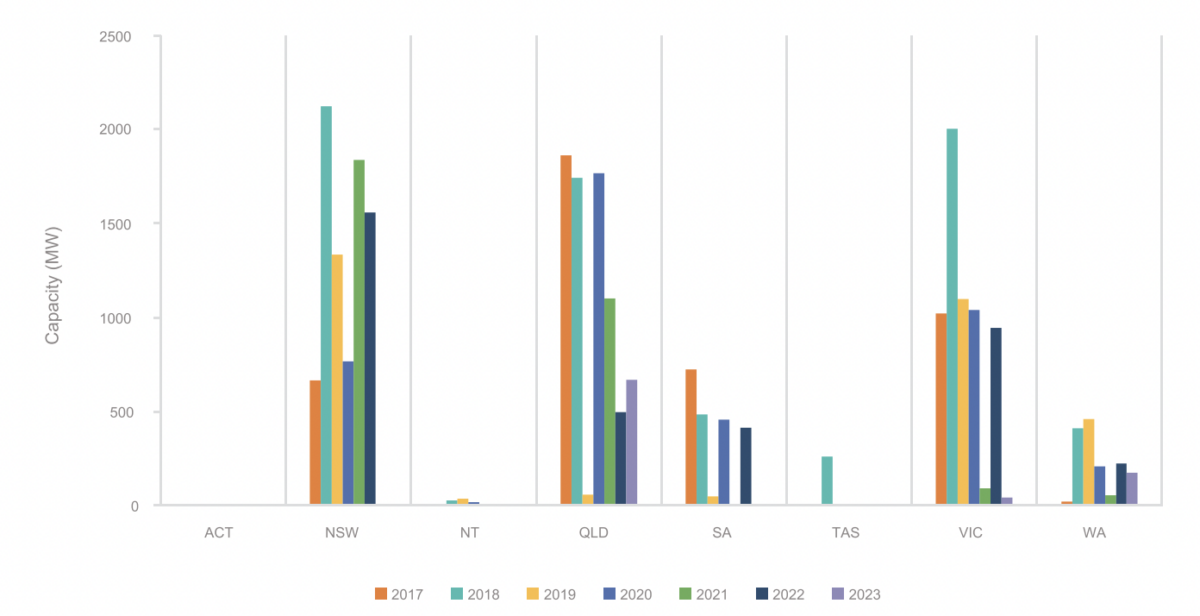

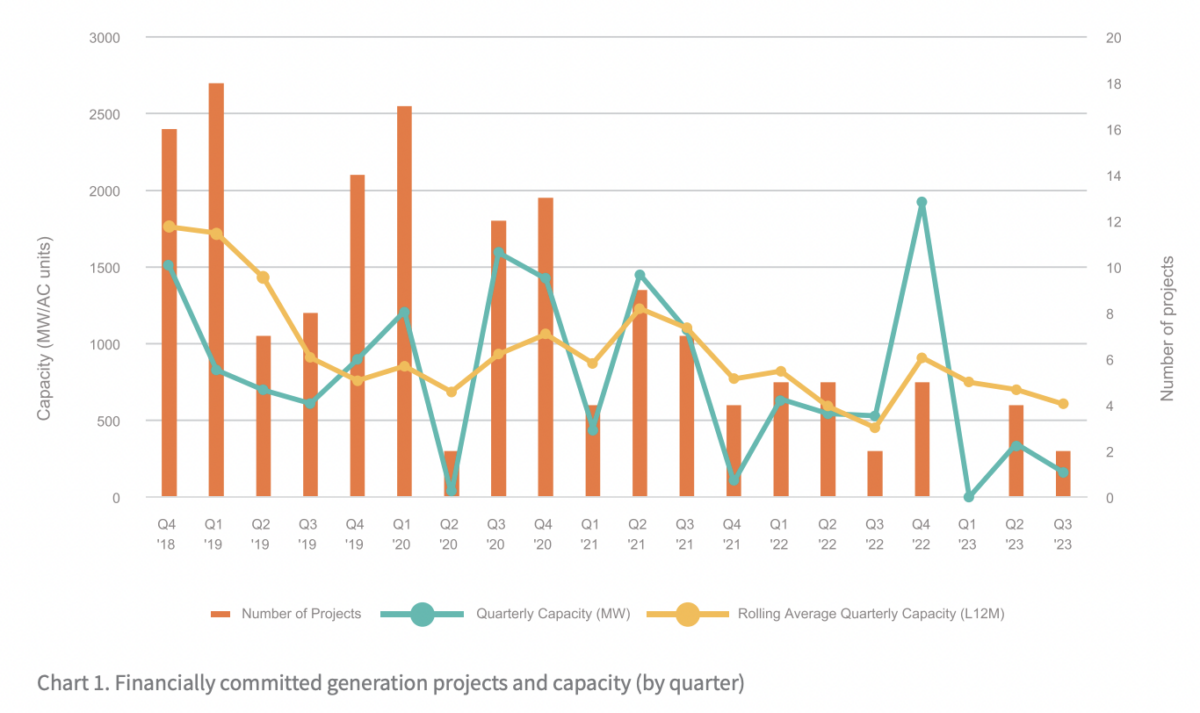

Utility-scale renewables in Australia are in dire straits, with a new Clean Energy Council report saying 2023 is shaping up as “the worst [year] for large-scale renewable energy investment” since it began tracking data in 2017.

It would seem Australia’s large-scale segment is falling into a similar pattern to hydrogen of yesteryear – awash with grand announcements, but with very little getting off the ground. In its Q3 Renewable Projects Quarterly Report released today, industry peak body, the Clean Energy Council (CEC), said just six large-scale projects, totalling 509 MW, have been financially committed so far this year. Between 5 GW and 7 GW would need to be financially committed annually to reach Australia’s target of 82% renewable penetration by 2030, it added.

Image: Clean Energy Council

Large-scale renewables in Australia have been facing compounding issues in the years since 2020, when the nation’s Large-scale Renewable Energy Target (RET) scheme was achieved. The problems culminating this year include difficulties securing equipment due to high global demand, soaring insurance premiums and associated project costs, project planning and grid congestion, dropping margins as a result of ever-lowering midday wholesale energy prices, and staffing difficulties. On this backdrop, project owners are struggling to secure offtake agreements that can properly reflect their costs.

While Q3 has been particularly dismal, CEC said that all three quarters of 2023 so far rank in the bottom five for lowest new capacity commitments since 2017.

Image: Clean Energy Council

All of this exemplifies how badly needed the federal government’s Capacity Investment Scheme (CIS) is. While the scheme has been floating around for the last year, it initially looked to back just 6 GW of “dispatchable” renewable energy, largely storage. Last week, the scheme was massively broadened to encompass 9 GW of storage capacity and 23 GW of variable renewable generation, for a total of 32 GW nationally.

While the need for storage is acutely being felt in Australia as solar duck curves become so pronounced that balancing the grid is a precarious juggle, the stark downturn in investment of renewable energy generation projects are clearly also a problem for the nation’s transition. This probably factored into the federal governments decision to not just use the scheme to support storage but also large-scale generation projects.

The importance of the scheme cannot be overstated, with Professor Bruce Mountain, director of the Victoria Energy Policy Centre, describing it as “the biggest news in Australia’s electricity policy for as long as we can remember.”

Sluggish year

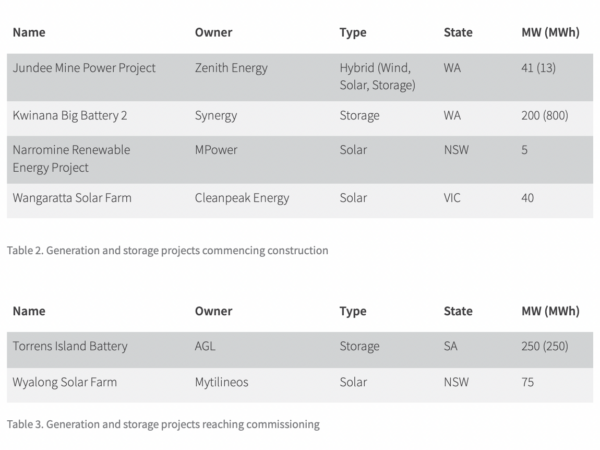

Coming back to CEC’s quarterly report, the council noted it was not just slow going in terms of financial commitments, but the number of projects reaching construction and commissioning were also underwhelming.

Image: Clean Energy Council

CEC said just three generation projects commenced construction during Q3, comprising 86 MW of additional capacity, while one project reached the commissioning stage, contributing a total of 75 MW. Back on finance, renewable energy generation and storage projects attracted a total of $150 million (USD 99 million), during Q3 2023 – a figure which, again, is among the lowest seen since 2017.

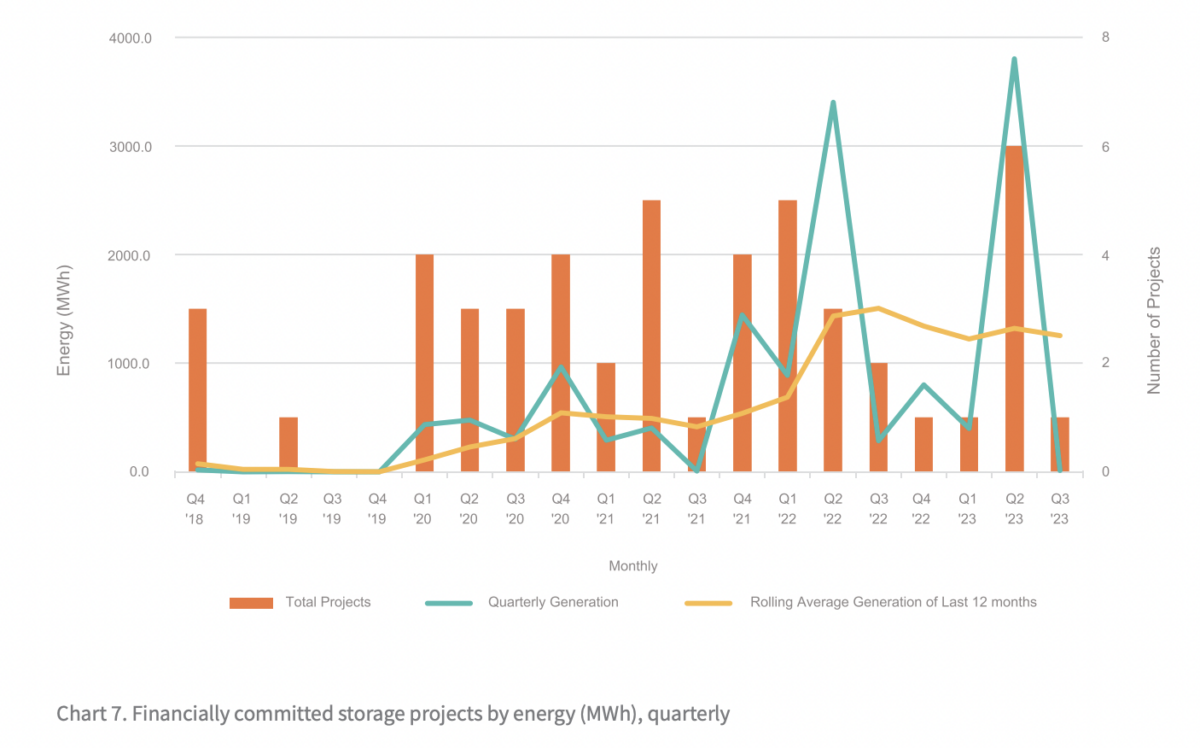

Energy storage has been a bright spot amid the large-scale struggles of the past years, but CEC noted even this segment is stumbling now, failing to continue the strong results of previous quarters. “Large-scale energy storage projects did not replicate the lofty heights seen in the second quarter of 2023, with only 12 MW (installed capacity) / 13 MWh (energy) financially committed for the quarter,” the report said. “This 13 MWh of energy marks the lowest return since the third quarter of 2021.”

Image: Clean Energy Council

Separately, developers have recently been flagging problems investing in Australia’s large-scale segment. Earlier this month, managing director of Canadian infrastructure fund Omers, Kevork Sahagian, said the company was “well short” of its renewable investment goals here, despite having grand ambitions in the country.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Hello Bella

Thanks for a great read re: ‘Worst’ year for investment in Australia’s large-scale segment’

I’m not surprised at the lack of start-ups given how difficult funding is, CEFC jumps at public opportunities to boast clean energy funding but the mechanism its funded through is just the same as any other lending criteria, lenders require funding serviceability without the solar project, for small investors like myself who has a shovel ready 400kW solar farm they don’t see the investment I’ve already made and can’t acknowledge the instant revenue generation on completion.

Keep up the good work.

Chris Jallian

In Australia we are finally acknowledging energy reality. The complete fiasco of “renewables” is being brought to an inevitable end by Minister Chris Bowen.

We will have a mix of HELE, Modular nuclear, gas and remnant “renewables”😁👌