The latest forecasts from Cornwall Insights Australia show the recently launched Very Fast Frequency Control Ancillary Services (FCAS) markets could deliver big profits for batteries as the market operator seeks to balance supply and demand.

Cornwall’s price forecasts show participants in the Very Fast markets could make an average of 10 times as much as those operating in other FCAS markets.

FCAS have traditionally been provided by generators such as coal and gas plants but with the level of variable renewables in the power grid continuing to increase, and ageing coal-fired generation rapidly exiting the system, the Australian Energy Market Commission (AEMC) in 2023 introduced the Very Fast services to help maintain frequency and ensure the stability and reliability of the grid.

The Very Fast FCAS market requires operators to respond in about a second to a fall or rise in frequency outside the power system’s normal operating range.

The Very Fast FCAS markets commenced on October 9 2023 and are still in a transition phase with a low maximum volume requirement of 175 MW for the raise service and 100 MW in the lower. That limit is set to increase over time as the market operator increases the amount of very fast services procured and more participants, including existing battery energy storage systems, enter the market.

Cornwall has forecast that more than 1 GW of response will be available by 2026 with high projected revenues making participation in the Very Fast FCAS market highly attractive.

“Our forecasts show the future of Very Fast FCAS markets looks bright for batteries,” Cornwall Modelling Manager Ben Tudman said.

“The potential for substantial profits, combined with the vital role batteries play in ensuring grid stability, means they are poised to be a driving force in this revolutionary energy landscape.”

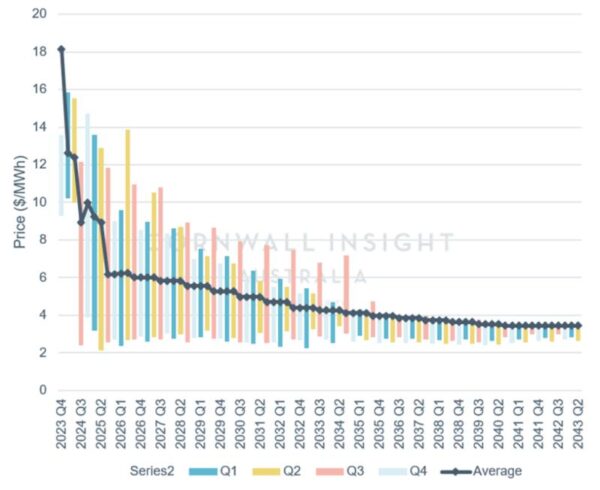

Image: Cornwall Insight Australia

Cornwall’s price forecasts show participants in the raise market are predicted to make an average of $9.64 (USD 6.46) per MWh out to 2026 and $10.95 / MWh in the lower market. This compares very favourably to other markets currently forecast to make less than a $1 / MWh.

Even as prices stabilise in the long run, batteries are expected to see sustained gains, averaging around $5.50 / MWh over the 20-year forecasts.

“We are optimistic that the higher prices available will see appetite grow for involvement in the markets, enticing both new players and existing battery assets to actively participate and contribute to these evolving energy markets,” Tudman said.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Substantial profits in the FCAS markets are also open to business with high electricity usage.

Large, energy-intensive assets, especially those with backup generation or blackout protection, hold untapped potential too.