From pv magazine print edition 4/24

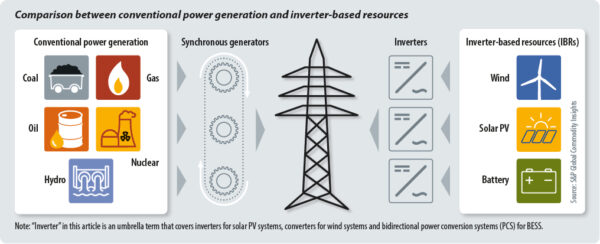

Global power systems have historically been dominated by synchronous generators. Conventional energy resources, such as coal, nuclear, hydropower and gas plants drive hundreds or thousands of such generators, which are physically coupled to the grid and synchronised to rotate at the same speed to generate a stable alternating-current (AC) waveform.

Solar, wind, and battery sites use inverters, rather than synchronous generators, to supply AC electricity to the grid and these “inverter-based resources” (IBRs) can affect network stability. Grid-forming inverters have emerged as a viable solution to the problem.

System instability

Conventional synchronous power systems are designed to maintain grid stability by providing system strength with the ability to generate, maintain, and control voltage waveform. The addition of IBRs to grids undermines power system strength because most inverters now in use cannot independently generate voltage waveform. Instead, they need a smooth and stable voltage waveform to follow in order to operate properly, meaning they are “grid-following.” In other words, when they connect to the grid, conventional inverters dilute the system strength provided by synchronous generators.

In addition, unlike synchronous generators that inherently store inertia by spinning, IBRs controlled by conventional power electronics cannot provide inertia in case of frequency disturbances, which leaves less time for a system to detect and react to contingencies.

The rapid response of power electronics means conventional IBRs can provide frequency response faster than synchronous generators. This “fast frequency response” (FFR) ability, however, cannot fully replace inherent and instantaneous inertial response.

Greener grid

For almost 20 years, rising installation of renewables has required grid-supporting functions from grid-following inverters, such as fault ride-through, automatic generation control, and voltage control, for frequency and voltage adjustment. The addition of renewable energy generation sites is expected to see even greater acceleration in the coming decades, with solar and wind production expected to reach 51% of global power generation in 2050, compared to 14% in 2023. Clean energy penetration rates in the world’s top 15 renewables-friendly countries are expected to reach 30% to 70% in 2025, and to increase to 50% to 85% in 2030. As a result, inverter technology must move beyond grid-following and be able to “form” a grid in certain situations.

Compared to the current mainstream grid-following solutions, grid-forming inverters are better able to stabilize and strengthen electricity networks by operating as voltage sources that have no reliance on external grid voltage. In other words, grid-forming systems can provide the same capabilities as synchronous generators while benefiting from the fast, flexible control offered by power electronics.

The application of grid-forming technology started with microgrids in rural villages, at mine sites, and at military bases, for example. Those demonstration projects were built to showcase the capabilities of grid-forming solutions. As grid-forming technology matured, new inverters started being deployed in island grids that incorporated a larger number of generating sources and loads.

With the addition of grid-following solar and wind projects located far from synchronous generators leading to low system strength, grid-forming technology has been deployed to provide system strength and support further installations of IBRs. The continuous penetration of IBRs into bulk power systems means grid-forming inverters are expected to be used at large scale to provide system strength and other grid-stability services, just like conventional synchronous generators.

New regulations

Grid-forming inverter technology has been mainly driven by financial and regulatory initiatives in regions with concerns about weak grids. The United Kingdom and Australia are the leading adopters of the technology.

The National Grid Electricity System Operator (NGESO) of the United Kingdom implemented Grid Code modification GC0137 in February 2022, to introduce a minimum specification required for the provision of grid-forming capabilities. The change facilitates the participation of grid-forming IBRs in the provision of grid services.

The Australian Renewable Energy Agency (ARENA) has funded eight grid-scale battery projects that will operate in grid-forming mode between 2024 and 2026.

Regions including mainland China, the United States, the European Union, and Chile have also released roadmaps, official documents, draft specifications, tenders, or funding programs to promote the large scale application of grid-forming inverters.

Barriers to deployment

The rollout of grid-forming technology is still at an early stage and has many barriers to overcome, including a lack of specification, limited enabling market mechanisms, technology immaturity, technical challenges, and cost premiums.

The most urgent barriers to tackle are the lack of specifications globally to define grid-forming capabilities, and the introduction of technical and compliance requirements for grid-forming projects. Without the clear definition of required capabilities, inverter suppliers cannot design and develop products based on uniform technical standards to meet grid requirements, and developers have limited guidance on evaluating how well such projects would be able to meet grid needs. That means it’s hard to forecast project returns.

Overcoming all the barriers to deployment requires collaboration between grid operators, project developers, system integrators, and inverter suppliers, so grid needs are clearly defined, products are well developed, and projects are funded, constructed, and operated properly to ensure grid stability.

About the author: Siqi He is a Shanghai-based senior analyst on the clean energy technology team at S&P Global Commodity Insights and researches solar, inverter, and energy storage supply chains. Before joining S&P Global, she worked for Wood Mackenzie Power and Renewables, in New York, and spent four years as a financial analyst with PetroChina, in Beijing. She holds a degree in finance from Renmin University of China and a master’s degree in public administration from Columbia University, in the United States.

About the author: Siqi He is a Shanghai-based senior analyst on the clean energy technology team at S&P Global Commodity Insights and researches solar, inverter, and energy storage supply chains. Before joining S&P Global, she worked for Wood Mackenzie Power and Renewables, in New York, and spent four years as a financial analyst with PetroChina, in Beijing. She holds a degree in finance from Renmin University of China and a master’s degree in public administration from Columbia University, in the United States.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.