Called the Queensland’s Energy Transformation: From Coal Colossus to Renewable Energy Superpower report, its key findings show renewables are the fast-growing energy source in the state’s grid, on track for its coal fleet to retire by 2035. State government policy, the report concludes, is attracting billions in private sector investment into renewable energy infrastructure.

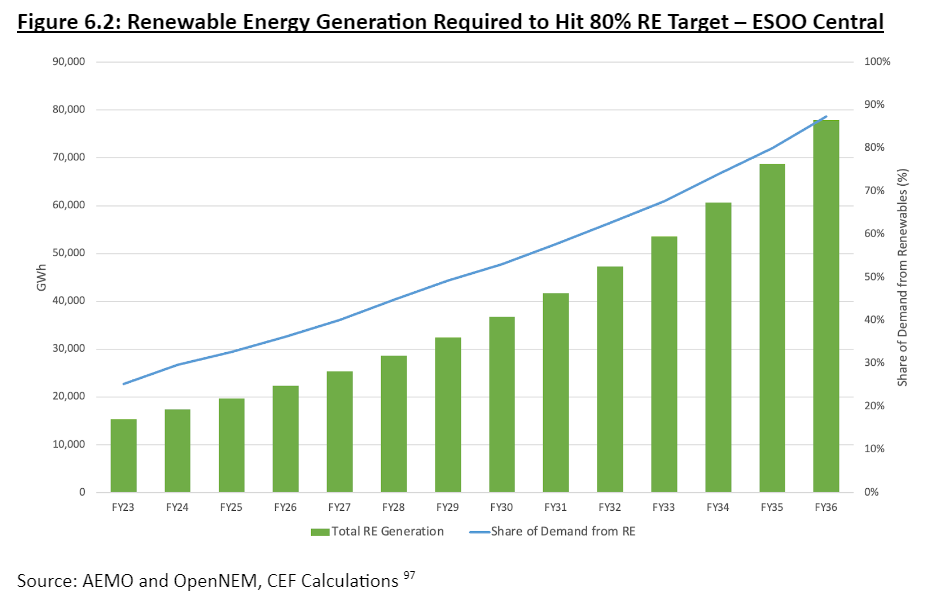

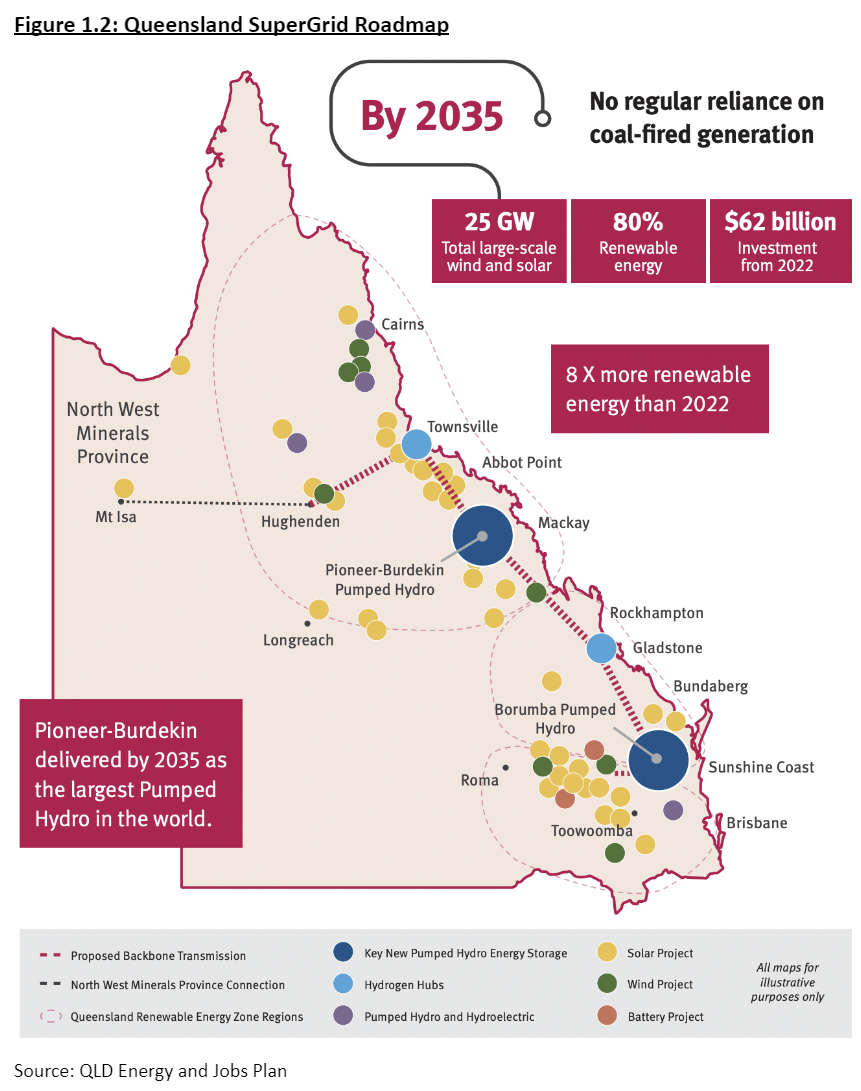

This month the Queensland government legislated a 75% emissions reduction by 2035, and net zero by 2050, complementing its ambition of 70% renewables by 2032 and 80% by 2035, earmarking 25 GW of zero-emissions generation and 40% of the total current National Electricity Market (NEM).

The 25 GW target capacity would result in over $45 billion of investment into large-scale clean energy generation, of which $21 billion will be from private capital, ensuring majority public market share, the report said.

The Australian Energy Market Operator (AEMO) has also identified 41 GW of utility scale wind and solar in the investment pipeline for Queensland, representing $73 billion of investment proposals from private developers, with state government investment in transmission projects to be $10.4 billion.

The state government is also investing $5 billion into CopperString, a 1,000 km high-voltage transmission highway connecting far north and west regional Queensland, to facilitate isolated communities to invest in grid-connected rooftop solar and batteries.

Rooftop solar, batteries, EV and heat pump regulatory and capital barriers need to be overcome, the report said, to incentivise uptake, but the state leads the way globally with the world’s highest penetration of rooftop solar at one in three households.

The price for rooftop solar in Queensland has halved in the past decade. Alongside this progress, lithium-ion batteries have seen cost declines of 90%.

The wider impact of the renewable energy adopting is having a positive impact on power prices. CEF finds that reduced exposure to fossil fuel prices and increased renewables penetration has seen wholesale electricity prices drop 38% to $79/megawatt hour in the fourth quarter 2023.

Tim Buckley, Director CEF, and report co-author said Queensland’s leverage of multibillion-dollar revenue from progressive coal royalties to reinvest in public infrastructure enabling the state’s decarbonisation is good policy.

“We are headed at last in the right direction, and it’s time to accelerate. Economies the world over are rapidly decarbonising. Global leader, China, is greening its economy at a staggering pace and the US government is investing US$1 trillion in the Inflation Reduction Act … now driving massive deployment of renewables, jobs, and GDP growth.”

The CEF is urging the government to commit another $100 billion to the energy transition in the May Federal Budget.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.