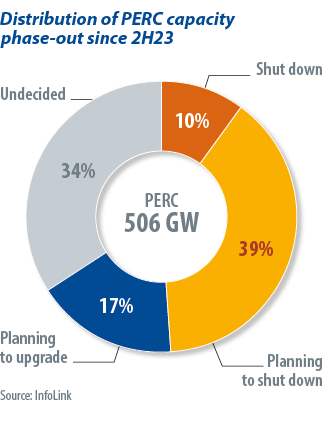

As 2024 opens, the solar industry faces serious surplus after manufacturers accelerated production capacity commissioning across the supply chain in 2023. Driven by technological shifts, the cell segment saw the most excess supply, with total annual manufacturing capacities reaching beyond 1.1 TW in 2023. There was 506 GW of existing passivated emitter rear cell (PERC) solar capacity and 670 GW of tunnel oxide passivated contact (TOPCon), negatively doped, “n-type” production lines. That was twice the level of end-user demand.

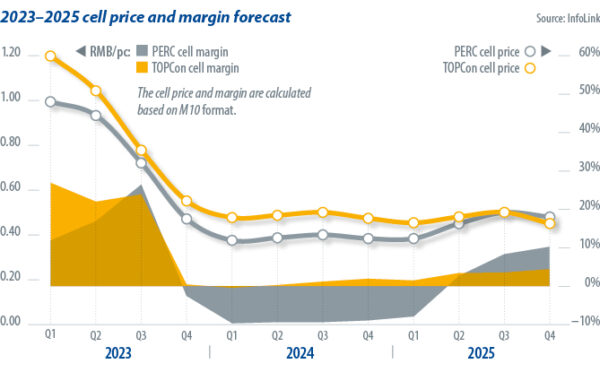

Prices collapsed. With end-user demand still sluggish while module prices continue to decline, manufacturers producing M10-wafer-based PERC cells in 2023 experienced price falls led by polysilicon during the first half, and then a 20-week period of consecutive price declines from the third quarter on. InfoLink’s survey showed that most makers producing PERC cells have been facing an income deficit since November 2023. At first, manufacturers could safeguard their production operations and cashflow by using unbranded original equipment manufacturer (OEM) and dual distribution channels. As the market quickly switched to n-type products, however, OEM fees for PERC cells dropped as positively doped, “p-type” cell orders continued to decrease. It became difficult for manufacturers to profit from OEM use at the end of 2023 and, overall, they would lose money on production.

PERC phase-out

After undergoing two months without profit, since November 2023, many manufacturers started shutting down their older lines to avoid bigger losses. Some manufacturers even stopped production entirely or withdrew from the market. As of the end of 2023, some 50.6 GW of annual PERC production capacity has been marked for shut-down or a production halt, accounting for around 10% of the total. Most of the companies affected are professional cell makers. The majority of vertically integrated companies, with advantages in downstream channels, maintained operations and are planning for capacity phase-out or modified schedules. In markets outside of China, most PERC cell lines are still operating as the technological shift is taking place more slowly. However non-Chinese PERC cell production capacities will also be gradually eliminated as new capacity comes online and n-type demand continues to rise.

Moreover, many production capacity expansion plans for new technology have slowed or even halted as prices are low and business profitability has shrunk. As of the end of 2023, at least nine companies had halted TOPCon cell projects with 120 GW of production capacity, which is quite significant.

Judging from expected 2024 trends, the scale of hold-ups in production capacity expansion and the rate of older capacity phase-out will continue to widen. Meanwhile, upgrade projects from PERC to TOPCon are also in the pipeline, with most manufacturers watching for the outcome of leading cell makers’ line modifications. Manufacturers are also mulling over whether to acquire halted TOPCon projects in a bid to elevate their competitive edge while avoiding line modification risks.

After manufacturers evaluate the suspension of their production capacity expansion plans, and the scale of any PERC cell line modification, InfoLink projects that the market share of PERC and TOPCon will come in at 23% and 65%, respectively, in 2024. The market share of PERC will then decrease to a single-digit percentage from 2025 onwards and become a customized product.

Cell makers

The historic industry cycle indicates surplus supply usually lasts for a certain period and will facilitate healthy and sustainable development after a reshuffling of production capacity and the retirement of old capacity, as well as technological transformation and profit recovery.

Although the recent p-type price collapse drove prices to a new low, cell prices stopped falling at the beginning of 2024 after manufacturers cut or paused production at a large scale. As n-type cell prices have sustained their premium, compared to p-type products, and costs will continue to reduce as conversion efficiency increases, businesses that produce n-type products will enjoy a certain profitability in the long term after eliminating older lines and filtering new production capacities. Given manufacturers have usually actively engaged in R&D when profits were slim in the past, it is expected that technical breakthroughs and cost reduction will accelerate during this period. Cell makers in particular will continue R&D and mass production of n-type and other new technology while phasing out older lines at a faster pace. For instance, laser-enhanced contact optimization technology emerged in the third quarter of 2023 and can help enhance TOPCon cell efficiency by more than 0.3% and bring module power output up by 5 W to 10 W. Currently, most manufacturers are planning to adopt the technique, which is expected to become standard this year.

Development of the solar industry is closely tied with cost reduction, efficiency improvements, and reliability. The downturn in the industry may help drive an industrial transition and businesses may demonstrate their resilience through technological breakthroughs, paving ways for the industry’s “high-quality development.”

About the author: Alan Tu is an assistant analyst on InfoLink Consulting’s solar research team. He focuses on national policies and demand, especially in China, Europe, the United States and other major markets. He monitors policy trajectories and potential impacts on the solar industry. Tu is conducting research on cell supply, demand, and price trends, reporting price updates and exploring connections between the solar market and international trading.

About the author: Alan Tu is an assistant analyst on InfoLink Consulting’s solar research team. He focuses on national policies and demand, especially in China, Europe, the United States and other major markets. He monitors policy trajectories and potential impacts on the solar industry. Tu is conducting research on cell supply, demand, and price trends, reporting price updates and exploring connections between the solar market and international trading.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.