Relectrify, which has developed technology that replaces the conventional battery management system (BMS) and bi-directional inverter with a single electronic system, announced that it has closed a $17 million (USD 11.3 million) funding round led by United States-headquartered climate tech venture capital firm At One Ventures.

Having previously proven its CellSwitch technology in its own ReVolve battery energy storage product, Relectrify said the new funding will allow it to scale and apply its technology to the next generation of battery energy storage systems for international markets.

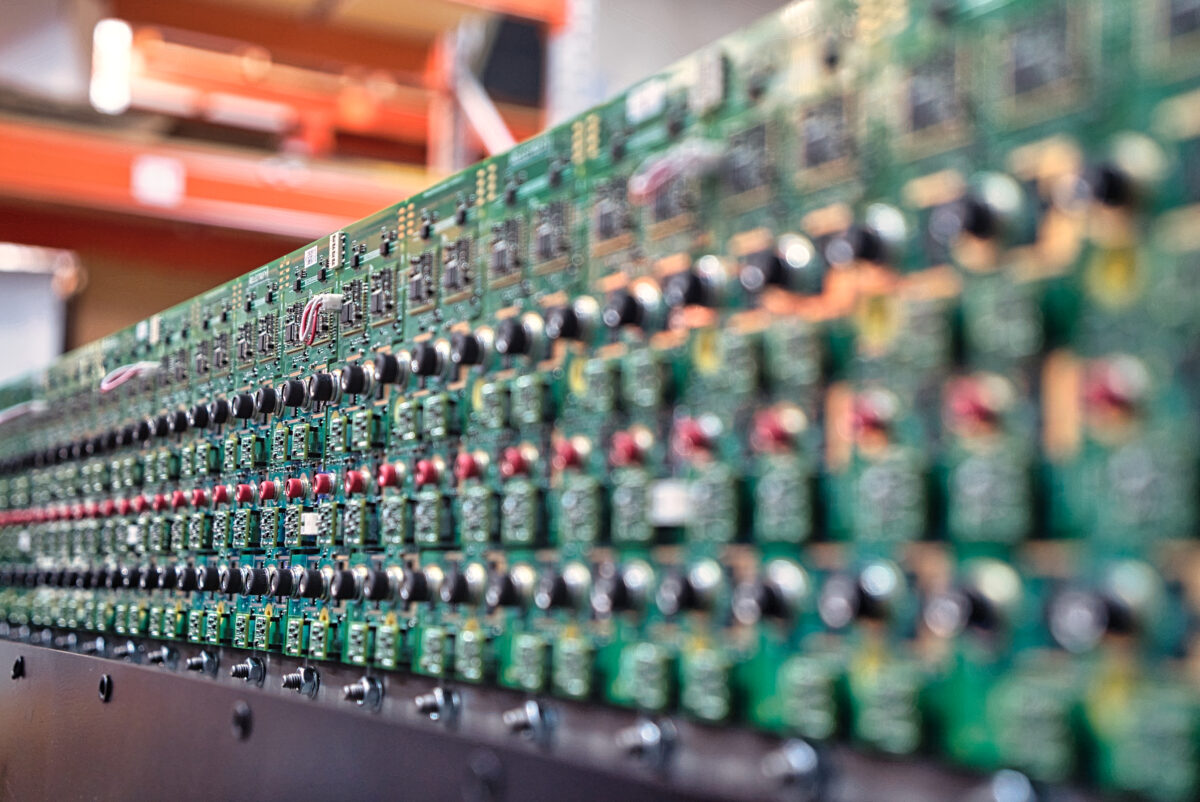

Relectrify’s CellSwitch technology eliminates the inverter, the BMS and DC-DC converters in conventional systems, replacing them with electronics and software. The cell-level system delivers grid-compliant alternating current (AC) directly from the battery pack by controlling every cell individually.

Melbourne-based Relectrify said the technology achieves “game-changing performance improvements for energy storage assets while reducing the cost of systems by eliminating the need for conventional inverters.”

“The technology controls each cell in a battery enabling the extraction of more energy from the system, extending the operational life of a battery storage asset by as much as 30%,” the company said.

At One Ventures founding partner Laurie Menoud, who has now joined the Relectrify board, said she was highly impressed with the company’s technical solution and market traction.

“Relectrify’s cell-level control system not only increases the lifespan of energy storage systems by up to 30% but also dramatically cuts CAPEX by removing the need for inverters while significantly reducing the risk of failures that lead to safety issues like fires,” she said.

“In essence, Relectrify drives down the cost of battery storage, accelerating the shift towards renewable energy and the move away from fossil fuels.”

In addition to At One Ventures, the latest funding round also attracted support from existing investors including the Clean Energy Finance Corporation through Virescent Ventures, Japanese car giant Toyota’s venture capital firm, California-based Energy Innovation Capital and Creative Ventures, South Korean industrial company GS, and Sydney investment firm NOAB Ventures.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.