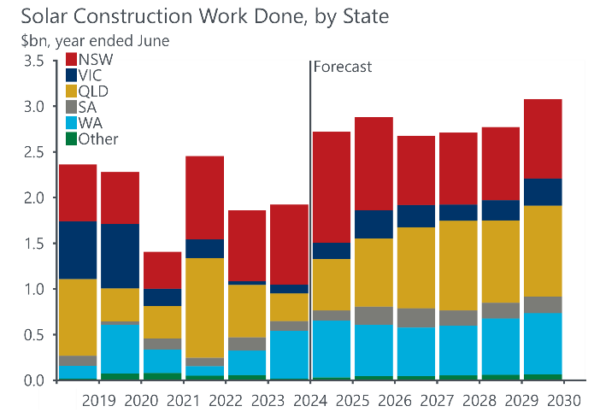

A Sydney-headquartered economic forecasting company Oxford Economics Australia report measured electricity construction activity at a record high of $19.2 billion (USD 12.5 billion) over FY24, and with an expected investment of $5 billion a year to FY30, the way forward for solar projects is clear, in particular, for Queensland.

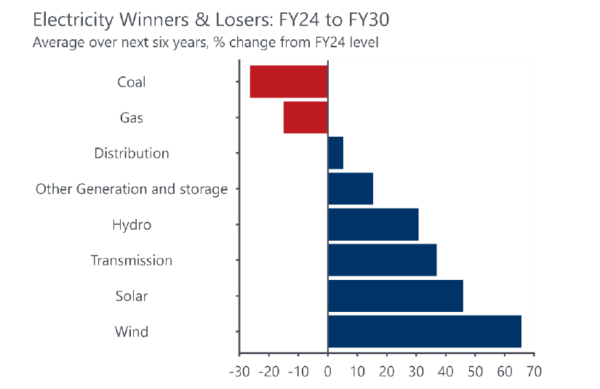

An annual $5 billion investment to decarbonise grid infrastructure is almost 80% higher than the $2.8 billion per annum over the six years up to FY24.

Oxford’s Greening the Grid: the next wave of electricity construction report says investment into the electricity construction sector is driven by the federal government’s target of generating 82% of electricity from renewable sources by 2030.

While the cost of decarbonising the electricity grid is high, Oxford notes the political will is strong and the sector has grown at a compounded rate of 16.8% year on year, and growth will be at a compounded rate of 5% from FY25 to FY30.

Construction of utility-scale solar infrastructure has been constrained by the proliferation of rooftop solar causing a mismatch of supply and demand and negative electricity prices that have reduced the revenue of solar farms, and the appeal of solar farm investment against other sources, the report finds.

Australian Bureau of Statistics, Oxford Economics Australia

“But this is changing – battery storage, both as a component of new solar projects and standalone projects, has allowed new and existing solar farms to sell electricity at prices closer to peak demand periods, increasing their viability,” it says.

“Ongoing transmission work on the Queensland-NSW Interconnector (QNI) upgrades and Central- Hunter Transmission Project will unlock even more solar and wind investment in these zones to service demand in NSW and South-East Queensland.”

Battery project investment will grow from $2.6 billion in FY24 to $4.6 billion in FY25, five times its FY23 level of $912 million.

The report suggests development of renewable energy zones in Queensland will see that state outpace New South Wales (NSW) and become the main hub of solar investment.

“Growth will then slow, as an increased number of batteries in the grid reduces the profit margin available by ‘time-of-use’ arbitrage. These lower returns on investment is expected to see growth in battery construction work slow over the coming years,” the Greening the Grid report says.

Australian Bureau of Statistics, Oxford Economics Australia

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.