The Clean Energy Finance Corporation has been allocated $2 billion (USD 1.2 billion) in the 2025-26 Federal Budget to invest in renewable power and storage, energy efficiency, and other low emissions technology.

The $2 billion will support private sector investment in solar, wind, green hydrogen and electrification initiatives by unlocking a further $8 billion of added investment and is in addition to $36.9 million to enhance the use of existing grid infrastructure, and a $10 million accelerated connections fund (ACF) to reduce grid bottlenecks.

Green metals

The previously announced $2 billion green aluminium production credit (GAPC) will support Australian smelters to transition to renewable energy, and the confirmation of the $1 billion green iron investment fund (GIVF) will help to accelerate the development of that industry.

Climate Energy Finance Director Tim Buckley said the CEF welcomes the green metals support but a lot more is needed to transform Australia’s value add onshore manufacturing.

“Particularly as the government works with our key trade partners to build the case for an Asian CBAM* – carbon pricing in international trade is the ultimate price signal our industry and mining critically needs,” Buckley said.

“Until then, we will need to keep tapping taxpayers to fund the transition.”

Climate Council economist Nicki Hutley said the confirmed funding commitments for initiatives, like green metals, are welcome.

“From here, there are abundant opportunities for the Federal Government to grow Australia’s clean economy for generations to come through win-win solutions for our economy and climate,” Hutley said.

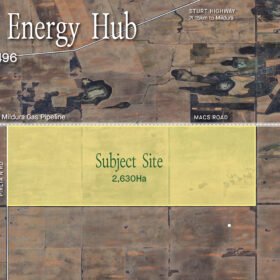

Up to $219.3 million will be made available to the Whyalla steelworks to provide immediate support for the steelworks through its ongoing administration, local business creditors and longer-term transformation of the plant, plus $500 million through the GIVF in support of green iron production.

Australian Workers’ Union National Secretary Paul Farrow said the budget unlocks critical investments in the nation’s manufacturers under the Future Made in Australia (FMA), shoring up the country’s manufacturing capabilities well into the future.

“Now that we’re securing the future of our industry with these investments, it’s time for strong policies that put domestic manufacturers first,” Farrow said.

“To ensure that our steelworks and aluminium smelters continue to survive and thrive in growing economic uncertainty, we need stronger local procurement requirements. Mandating Australian steel and aluminium in public infrastructure projects makes perfect sense. It ensures local industries benefit directly from taxpayer-funded initiatives, helping secure thousands of Australian jobs.”

Farrow added that keeping industry strong and viable today is the only way to ensure Australia evolves into the clean energy manufacturing powerhouse it can be.

Hydrogen and critical minerals

The government has legislated $13.7 billion in hydrogen and critical minerals production tax incentives and the budget allocates $1.5 billion in support for priority areas through the FMA innovation fund.

This includes $750 million for green metals, $500 million for clean energy technology manufacturing capabilities and $250 million for low carbon liquid fuels.

*Carbon border adjustment mechanism

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.