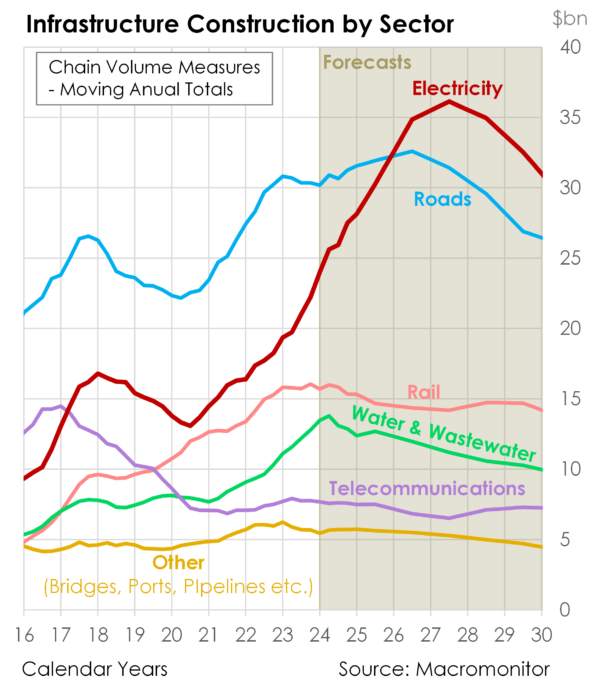

A new report by Sydney-based construction sector forecast service Macromonitor has predicted electricity will be Australia’s largest infrastructure investment sector from 2026, driven by a boom in renewable energy construction.

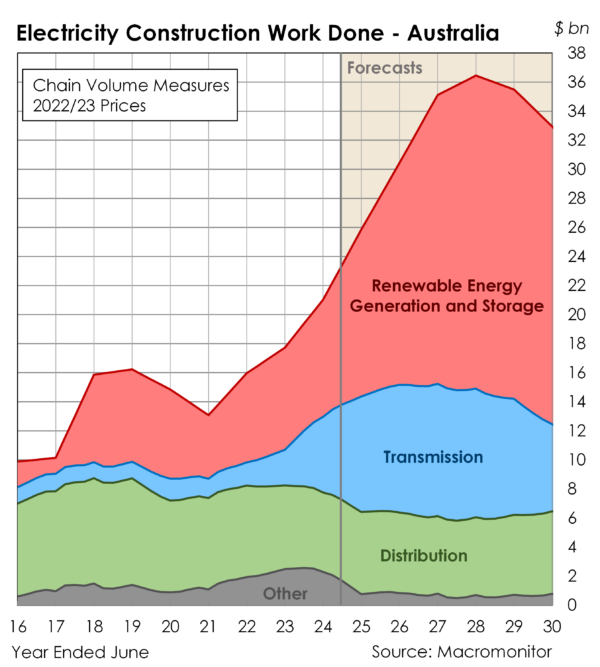

The Renewable Energy Construction Outlook – Australia report forecasts spending is on track to peak at over $36 billion (USD 23 billion) in 2027/28 for clean energy construction across all technologies, including solar and batteries, having already surged 74% in the past four years from $13.8 billion in 2020 to $24 billion in 2024,

Solar is forecast to well surpass the construction declines of 5% in 2022/23 and 28% in 2023/24, to culminate in a record high of $5.7 billion in 2027/28, the report says.

“While a decline is projected after this peak, construction activity in the solar sector is expected to remain historically elevated, averaging around $3.5 billion annually over the five years to 2033/34,” it says.

The last peak driving solar construction nationwide was in 2017/18 when the total value of work done reached $3.4 billion, of which Queensland solar investments contributed $2.2 billion.

Despite declines in the following three years to June 2021, the average total value of work done in the solar sector nationally remained around $2.1 billion annually.

Macromonitor Economist and Lead Report Author Dr Abdul Hannan said the construction boom is being driven almost entirely by renewable energy and related projects.

“Construction will rise even more rapidly over the next few years and be at peak levels in 2028, 2029 and 2030, while renewable generation capacity will still be rising strongly through the early 2030s,” Hannan said.

The report says renewable generation construction doubled from $4 billion in 2020/21 to $8 billion in 2023/24, and is forecast to reach $21.5 billion by 2027/28, while transmission investment has also more than doubled in 2023/24 and projected to accelerate further in the coming years.

“Along with a large increase in renewable generation investment, a large proportion of growth will now come from transmission and storage,” Hannan said.

Challenges

Challenges however will likely involve high costs, grid connection delays, and community resistance, particularly for wind and transmission projects in regional areas.

After 2030, when Australia hopes 82% of it’s electricity generation will be done by renewables, Macromonitor forecasts a moderate decline in renewable energy construction, as the initial boom stabilises, and capacity will continue to expand at a slower rate.

“The next few years are critical; the pipeline of projects is strong but delivering them on time and within budget will be a real challenge given regulatory complexity, competing infrastructure demands and ongoing cost pressure,” Hannan said.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.