Australia will need to ramp up the pace of its renewable energy transition to meet its clean energy targets with a new report from research organisation BloombergNEF (BNEF) highlighting a slowdown in investment as the industry faces “strong headwinds.”

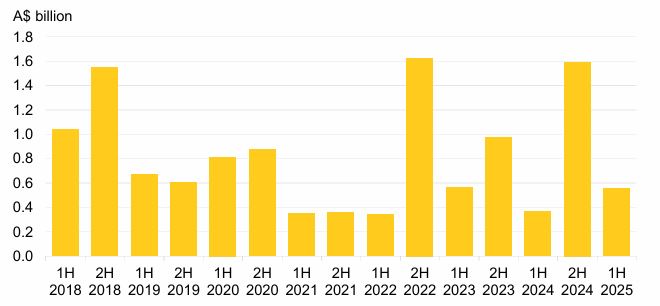

BNEF has released its Australia Market Outlook for the first six months of 2025, revealing that investment in solar and wind declined 64% compared to the final six months of 2024.

The report shows that in the first half of 2025, Australia saw $556 million (USD 363 million) of investment in utility scale solar, down from $1.6 billion in the previous six months. No new wind projects reached financial close in the first six months of the year – a result last observed in 2021.

BNEF said the slower activity over the first half reflects the ongoing challenges facing project implementation today.

“Investment fell as protracted permitting processes, slow grid expansion and social licensing issues continued to pose significant headwinds in the sector,” it said in the report.

“Key transmission projects like the VNI West and Marinus Link are delayed and are experiencing cost overruns. The permitting and grid-connection process remains tedious and social licensing issues are causing significant delays and cost overruns for big projects.”

While investment slowed, BNEF said at least eight large-scale solar projects with a combined capacity of 5.86 MW were financed in the first half of 2025, including Canadian developer Amp Energy’s 339 MW Bungamba PV and battery project in South Australia which secured $404 million in investment.

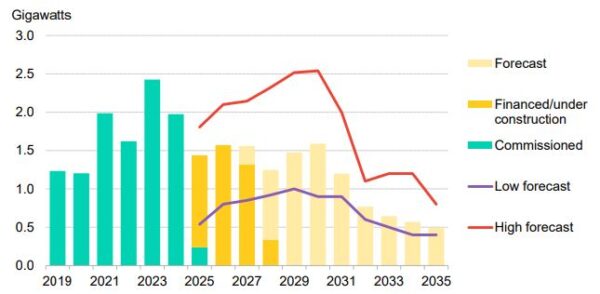

BNEF said 9 GW of utility scale solar and wind projects are currently under construction and 239 MW of utility scale solar was commissioned in the first six months of 2025, down from the nearly 2 GW of capacity commissioned in 2024.

This brings total large-scale solar capacity in Australia to 13.4 GW with BNEF forecasting an additional 9 GW to be commissioned over the next five years, a significant decrease from projections in the last half.

The rollout of small-scale solar industry also slowed in the first half of the year with BNEF saying the economics of the technology are beginning to weaken as daytime grid power supply becomes cheaper and upfront rebates wind down.

Image: BNEF

BNEF said 1.4 GW of rooftop PV was installed across Australia in the first six months of 2025, a 20% decline from the second half of last year. Just 3 GW of commercial and industrial solar was installed.

Small-scale solar installations are forecast to fall by 12% in 2025 compared to 2024, with BNEF projecting 2.8 GW of capacity to be added across Australia this year.

Total rooftop solar capacity has now climbed to 27.6 GW with BNEF forecasting 46 GW of rooftop PV capacity to be operational in 2035.

Small-scale battery energy storage installations surged in the first six months of 2025, with BNEF estimating that more than 700 MWh of small-scale storage capacity was installed during that period.

Behind-the-meter battery installations are expected to more than double in 2025 compared to the previous year on the back of the federal government’s Cheaper Home Batteries program with BNEF’s base case tipping small-scale storage capacity to reach 16.5 GW by 2030 and 30.2 GWh by 2035.

Utility scale battery energy storage capacity also continues to grow with nearly 3.3 GW of capacity operational as of July 2025

BNEF’s base case forecast’s an additional 11 GW of installed capacity by 2030 and 16.8 GW by 2035, driven by “concrete policy mechanisms to mitigate revenue uncertainty, coal planting closures, and elevated power market volatility.”

BNEF said the share of wind and solar in Australia’s National Electricity Market (NEM) power mix reached 34.4% in the first half of 2025.

Australia is pursuing a target of 82% national renewable electricity generation in the NEM by 2030. This increased NEM renewable penetration would help Australia reach its legislated target of reducing emissions by 43% below 2005 levels by 2030.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Hi David,

Your text is inconsistent with the Graph:

“BNEF has released its Australia Market Outlook for the first six months of 2025, revealing that investment in solar and wind declined 64% compared to the same period last year.

The report shows that in the first half of 2025, Australia saw $556 million (USD 363 million) of investment in utility scale solar, down from $1.6 billion in the same period in 2024. No new wind projects reached financial close in the first six months of the year – a result last observed in 2021.”

THE GRAPH SHOWS INVESTMENT FOR FIRST HALF OF 2024 IS APPROX $400 MILLION (NOT $1.6 BILLION AS STATED IN THE TEXT).

THE GRAPH SHOWS THAT FOR MOST YEARS INCLUDING 2022, 2023 & 2024, THERE IS A MUCH GREATER INVESTMENT IN H2 THAN H1. WHETHER THIS WILL HAPPEN IN 2025 REMAINS TO BE SEEN.

Cheers and Best Regards.

Hi John, thanks for pointing out – $556 billion is down on the $1.6 billion in the second half od 2024, not the first. Article now updated. And yes, the graph does show the second half of previous years have delivered improved results – hopefully the same occurs this year. Regards

Hi David,

Thanks for the update. I look forward to reading more articles in PV Magazine by your good self and others.

Cheers,

Dr John Kevin Lee PhD