Independent energy research company Rystad Energy has released analysis of the federal government’s Solar Sharer scheme, which will give households three free hours of electricity during the middle of the day from July 2026.

But, it says increased demand from utility and household batteries, and a forecast slowdown of rooftop solar could boost utility renewables and coal via that demand, while impacting gas and utility batteries.

Rystad Energy Renewables and Power Research Senior Vice President David Dixon said while the need to shift demand into periods of renewables generation i.e. daylight hours, is recognised, there are several consequences that need to be considered.

“These include but are not limited to retailers needing to charge more during non-daylight hours to compensate for losses made during the “free” times of day, the equity of the scheme as those that need to be at work during the day / renters miss out on the benefits but pay the cost,” Dixon said.

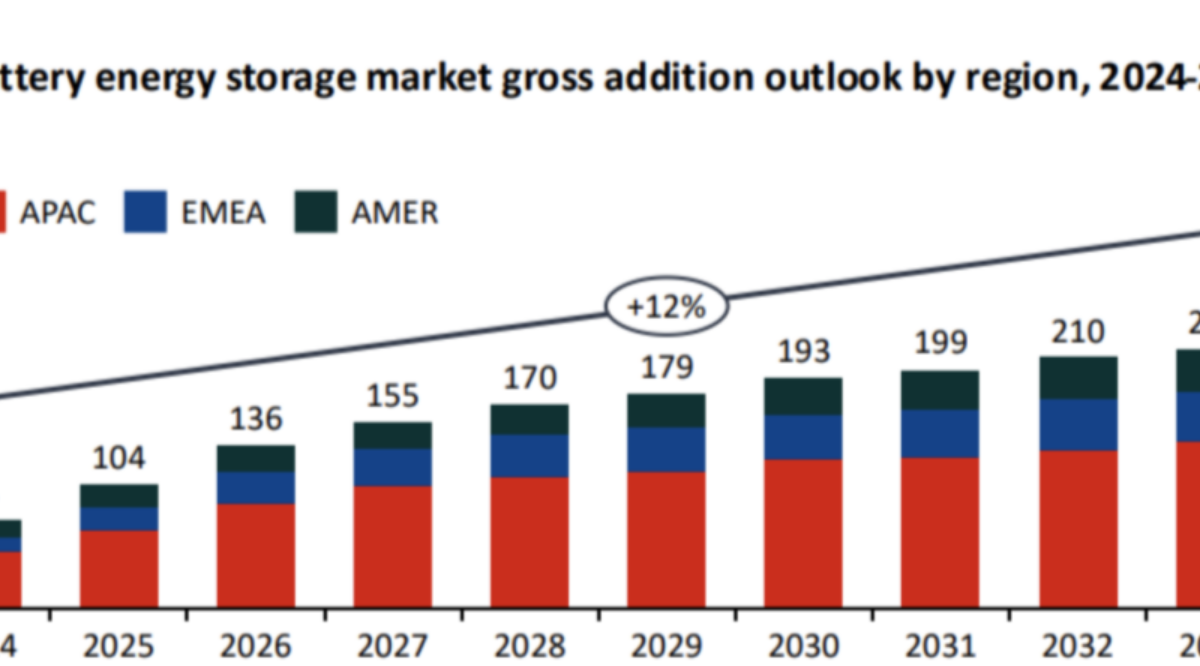

“Also the impact on investment signals is not to be underestimated. Australia is now the third largest utility battery market globally, but billions of investment was predicated on cheap solar generation being available during the middle of the day, so if this is being absorbed by the residential market and thus daytime prices rise significantly, this will undermine the investment case for new utility storage.”

Implications

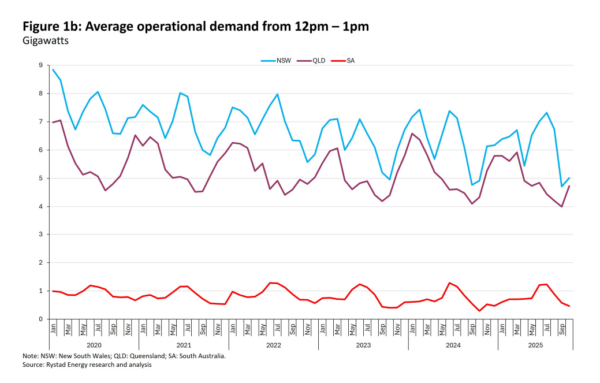

The implications for power generation projects will depend on the success of the scheme in shifting meaningful (hundreds of MW) amounts of demand into the middle of the day, the research says.

“Should this materialise, we would expect utility solar, wind and coal will all benefit from this scheme as it will add additional demand during hours of their highest curtailment. Therefore, these technologies will capture higher daytime volumes at higher prices,” Rystad’s findings say.

“The peaking technologies, such as gas, hydro and utility batteries, will all suffer as there will be reduced demand in the evening, i.e., lower volumes and lower prices. Furthermore, utility batteries will see a reduced spread due to both lower evening prices and higher daytime prices.”

In addition, Rystad’s research says the economics remain positive for behind-the-meter solar and batteries with the key restrictions for both being labour and market saturation.

Solar Sharer

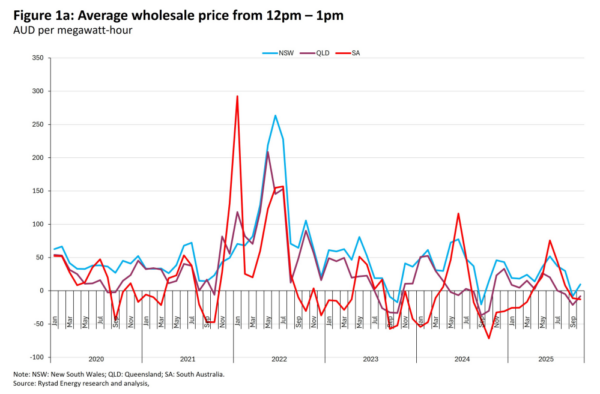

On 4 November, federal Energy Minister Chris Bowen announced the introduction of the new retail energy offer called Solar Sharer, with the underlying purpose of the scheme to shift more demand into the daytime period, where prices and operational demand are generally lowest and renewable generation is highest (due to high solar output).

“It is worth noting that while prices are low during daytime hours, they are not consistently below zero, with the exception of South Australia,” the analysis says.

Scheme arriving as battery demand skyrockets and rooftop solar slows

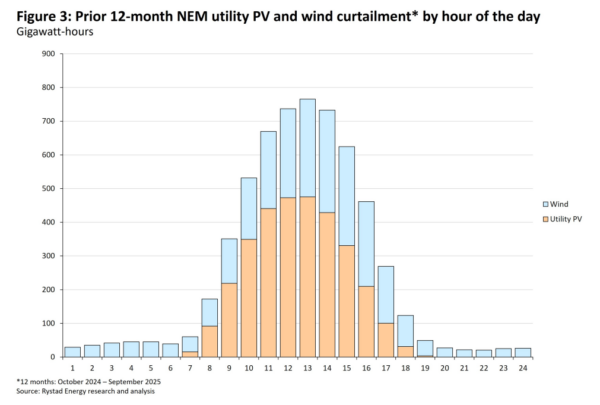

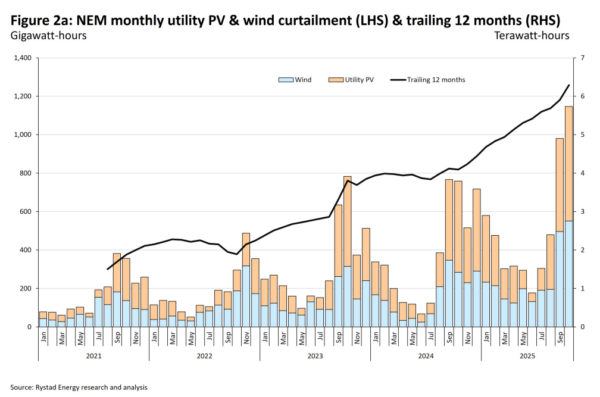

Rystad’s analysis says utility solar and wind facilities in Australia’s National Electricity Market (NEM) curtailed 6.3 TWh of generation over the prior 12 months, equivalent to almost 3% of total NEM annual generation and while the trend appears to be an upward trajectory, several key reasons this could be about to reverse include:

- Operational utility battery capacity is expected to triple to 9.7 GW by the end of 2026, from just 3.4 GW at the start of 2025. At one cycle per day, this would add over 9 TWh per year of additional demand. Greater than all the curtailed utility solar and wind.

- The cheaper home batteries program, which began in July 2025, effectively subsidises home batteries by around 30%. The scheme has boosted demand for household batteries, with early figures suggesting 350-450 MWh of installations per month. On an annual basis, this is equivalent to 4.8 gigawatt-hours per year; cycling once per day would add 1.75 TWh per year of additional demand. This level of additional demand would be sufficient to absorb most of the growth in annual rooftop solar installations.

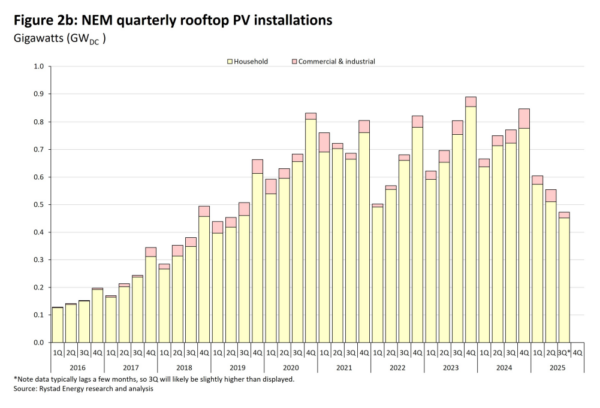

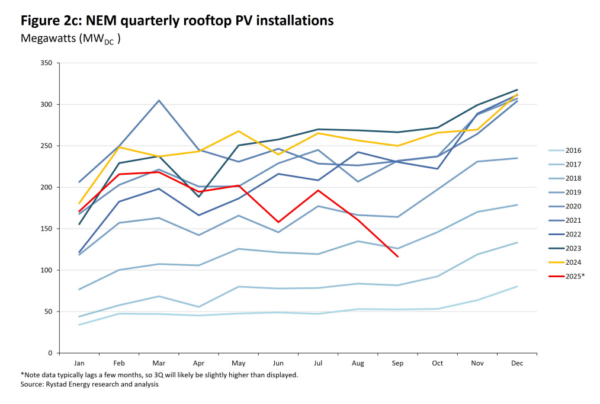

- Rooftop solar generation is one of the primary causes of curtailment during daylight hours, due to the inability to turn down most installed systems. However, 2025 may mark a pivotal year for rooftop solar as it could be the first year of meaningful decline in almost a decade. Rooftop PV installation data typically lags by several months; thus, data for 3Q 2025 will likely be revised upward. However, the data for 1H 2025 shows that monthly rooftop PV installations were lower for every month compared to 2024, as well as for most comparable periods from 2021 to 2023. It is currently unclear whether this represents market saturation in high-penetration markets (such as South Australia / Queensland) or if there are labour constraints due to the boom in household battery installations.

Updated 27/11 with new hyperlink.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.