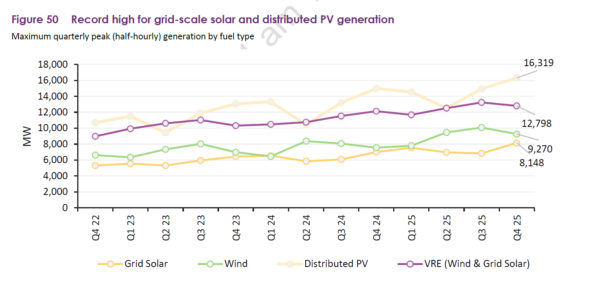

Rooftop solar generation hit an all-time high in Q4 2025, up 8.7% with an output of 4,407 MW, while also reducing daytime operational demand, contributing to battery charging, and a new renewable energy generation record for the National Electricity Market (NEM) of over 51%.

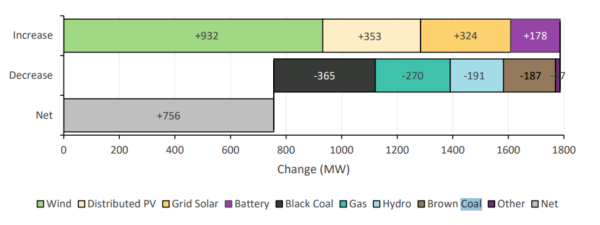

Jumping 353 MW compared to Q4 2024, distributed solar output in the quarter was ahead almost 30 MW output compared to grid solar output, which achieved 324 MW over its Q4 2024 results, but also set a new quarterly record, rising by 149 MW (+6.3%) from grid solar’s Q1 2025 record to average 2,535 MW.

Exceptional peaks were recorded, where distributed solar reached a record 16,319 MW in the half-hour ending 12.30 pm on Wednesday, 3 December 2025, an 8.9% increase on the previous record of 14,980 MW recorded in Q4 2024.

Image: Australian Energy Market Operator

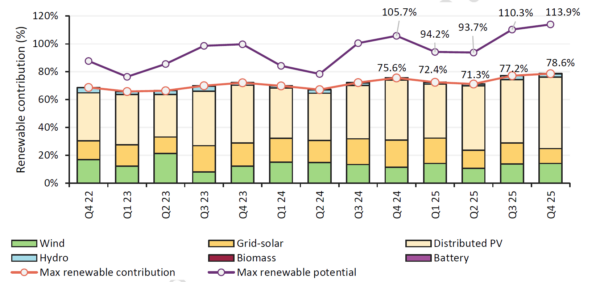

Outlined in the January 2026 Australian Energy Market Operator (AEMO) Quarterly Energy Dynamic report, the peak renewable contribution in the quarter in the NEM reached a new record of 78.6% during the half-hour ending 11.30 am on Saturday 11 October 2025, exceeding the previous record of 77.2% set on 22 September 2025.

The earlier record was surpassed in three consecutive 30-minute intervals before the new high was established. The latest outcome also represents a 3.1% increase on Q4 2024’s peak of 75.6%, the report says.

At the time of the record, distributed solar accounted for 51.3% of total generation, while wind and grid-scale solar contributed 14.2% and 10.6%, respectively.

Image: Australian Energy Market Operator

Grid-scale solar reached a new record half-hourly output in Q4 2025 as well, of 8,148 MW in the interval ending 1,000 hours on Monday, 24 November 2025, exceeding the previous peak of 7,536 MW set in Q1 2025 by 8.1%.

Overall, in October 2025, renewable potential exceeded 100% in 55 half-hour intervals, compared with 13 intervals in October 2024.

AEMO Executive General Manager Policy and Corporate Affairs Violette Mouchaileh said the landmark quarter reflects years of sustained investment.

“It demonstrates that more wind, solar and battery capacity in the system reduces reliance on higher cost coal and gas generation, placing sustained downward pressure on wholesale electricity prices,” Mouchaileh said.

Wholesale electricity prices averaged $50 (USD 35) per MWh across the NEM, a $39 / MWh (-44%) reduction from Q4 2024 and a $37 / MWh (-43%) decline from Q3 2025.

Whole Electricity Market

Western Australia’s (WAs) Wholesale Electricity Market (WEM) demonstrated similar records from renewable and storage generation.

Total WEM solar installations increased from 0.4 million at the end of 2020 to 0.6 million at the end of 2025. In the same period, CER solar capacity increased from 1.6 GW to 3.0 GW. Consistent with this growth trend, in Q4 2025 distributed solar generation increased by 46 MW (+7.8%) when compared to Q4 2024.

“Western Australia is experiencing the same momentum. Renewable and storage generation supplied a record 52.4% of energy needs this quarter,” Mouchaileh said.

“Renewable output peaked at 91.1% late in the quarter, the highest on record, driven by strong rooftop solar and wind,” she said.

Coal and gas

In WA, coal-fired generation decreased to an all-time quarterly low in Q4 2025, by 33 MW (-5.8%), driven by battery discharge replacing coal-fired generation during the evening peak as well as a slight reduction in coal availability as Muja C Unit 6, approximately 200 kilometres south of Perth, near Collie, was decommissioned in Q2 2025, the report says.

Image: Australian Energy Market Operator

Gas-fired generation dropped 27% to its lowest level since Q4 2000, with average gas-fired generation decreasing 126 MW (-16.4%).

Reduced gas consumption is attributed partly to gas-fired generation being replaced by renewable generation at all times of day, particularly by battery discharge during the evening peak, and partly to the decommitment of synchronous facilities due to changes to the FCESS Uplift payment framework, the report says.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.