NEM 2.0 – COAG sets out for two-sided market

The COAG Energy Council’s plan to unlock Australia’s potential to reindustrialise its energy system has taken another step forward with the publishing of an Energy Security Board consultation paper. The paper discusses what the two-sided market required to free up the potential of household energy technology will look like.

South Australia forecast to add nearly 1 GW of big PV over the next four years

With more than half of its electricity already supplied by wind and solar, South Australia is setting the bar high for how to efficiently decarbonize the grid. As it moves toward its 2030 target of “net” 100% renewables, the speed of the state’s energy transition will depend on a host of factors.

Australian solar owners are saving more while staying at home because of Covid-19

Analyzing its fleet of solar sites, Solar Analytics has found that energy consumption in households due to Covid-19 confinement is up only slightly, if at all. While this is good news, the great news is that the onsite consumption of free solar power in these households is up significantly.

Falling power prices could benefit mega-sized solar and wind projects

The Covid-19 pandemic will create a “perfect storm” for the wholesale electricity market as lower demand comes together with lower gas prices and large-scale solar and wind being commissioned to depress power prices, finds a report by Melbourne-based consultancy RepuTex.

Covid-19 to pause gigawatts of wind and solar project in Australia

The pandemic will postpone or cancel the financial close of some 3 GW of solar and wind in Australia, according to Norwegian consultancy Rystad Energy, as the falling Australian dollar renders projects uneconomical. The biggest loser among the states will be New South Wales.

Sustainable Australia Fund announces special terms to support the solar industry

The Sustainable Australia Fund is launching special financing terms for the solar industry to mediate the impact of Covid-19. The terms seek to put immediate cash savings in the hands of businesses.

NEM 5-minute settlement delayed until 2022

Australia’s energy regulators say their COVID-19 power plan released last week is designed to ease regulatory pressure on the industry and strike a balance on reforms and changes: some must continue at pace while others will be slowed or deferred.

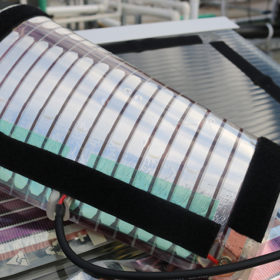

Ecolog partners with University of Newcastle for commercial rollout of printed organic solar cells

The Dubai-headquartered Ecolog has inked a memorandum of understanding with the Centre for Organic Electronics at the University of Newcastle to commercialize its low-cost, lightweight and portable solar energy technology.

Survey: Covid-19 to cause 50% decline in rooftop solar segment

Australia’s previously booming rooftop PV market segment is likely to see a steep decline in the face of Covid-19 related shutdowns and uncertainty. An industry survey has revealed that around 50% or survey respondents have seen customer enquiries decline by between 25-50%, with a further 20% reporting that new leads have dried up completely.

Another remarkable year: 2019 saw renewables records tumble

With 4.4 GW of new renewable energy capacity installed and almost a quarter of Australia’s electricity supply now coming from renewable energy sources, 2019 was another year of extraordinary growth, according to the latest edition of the Clean Energy Australia report. As rooftop solar continued its record-breaking streak, big PV made up more than two-thirds of Australia’s large-scale renewable energy capacity installed last year. Meanwhile, the battery storage sector started to gain momentum.