Juwi to build renewable energy hub in regional Western Australia

The German-headquartered project developer has signed a deal with Pacific Energy’s subsidiary Contract Power to build a hybrid renewable energy project that will power the town of Esperance.

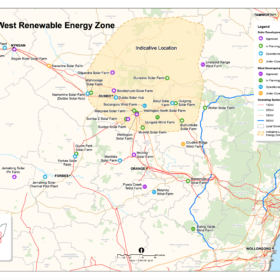

NSW seeks expressions of interest for 3 GW renewable energy zone

Solar, wind and energy storage companies have until June 5 to express interest in building parts of the 3 GW renewable energy zone in New South Wales.

Solar parks may have better biodiversity impact than intensive monoculture farming

A research project in the Netherlands is seeking to assess the impact of large scale PV projects on soil quality and biodiversity. Principal scientist Wim Sinke, of Dutch research center TNO, says well-designed and operated and maintained solar parks could prove to have better outcomes than monoculture farming.

Solar leads Australia’s energy transition as renewables set new record

In 2019, renewables continued to undermine the dominance of coal on the Australian grid and surged on the back of a massive 46% year-on-year jump in solar power, according to the latest data from the federal Energy Department.

Cultana Solar Farm ramps up for construction start

Work on the long-awaited 280-megawatt Cultana Solar Farm in South Australia could begin as early as July.

Sun Cable survey contract awarded to Guardian Geomatics

The Sun Cable megaproject is moving from strength to strength with last week’s announcement of the awarding of its cable route survey contract to Guardian Geomatics Pty. Ltd.

Gransolar Group to build Molong Solar Farm in NSW

The Spanish EPC contractor has signed its fourth contract in Australia to build the 39 MW PV array 40 kilometers north-west of Orange.

Big rooftop solar in the cities: dynamic switching is key

Epho Commercial Solar has developed a proof point for urban solar power stations that can flexibly deliver clean energy behind the meter to commercial customers and replace fossil fuels at the heart of the NEM.

Amazon announces 105 MW solar farm in NSW

The e-commerce giant will add a second utility-scale PV project to its renewables portfolio in Australia as it seeks to offset its local carbon footprint.

Australia’s technology roadmap to lower emissions: Gas, CCS, coal and nuclear on the cards

A national Technology Investment Roadmap, which is intended to drive a successful shift to secure, more affordable energy and lower emissions, has flagged support for new gas investments, carbon capture and storage, and “emerging nuclear technologies”. The long-awaited document has prompted a flurry of reactions.