Flying in the face of Prime Minister Scott Morrison’s claim of record levels of renewable investment, a new analysis from the Clean Energy Council (CEC) finds the level of new spending on large-scale renewable energy projects has collapsed by more than 50%. Earlier announcements, surveys, and reports have already unmistakably suggested a massive drop in investor confidence, and the CEC figures are the latest wake-up call to regulators to begin taking the urgent action needed to boost confidence and deliver an affordable, reliable and clean energy system for all Australians.

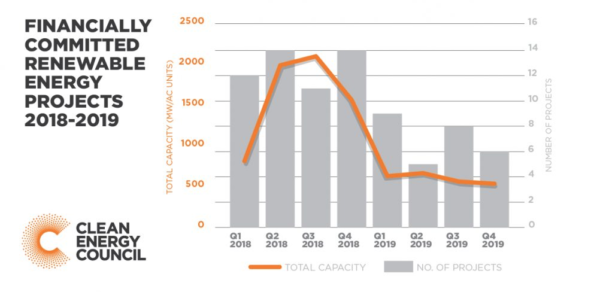

The CEC analysis reveals a fall from 51 projects worth $10.7 billion in 2018 down to 28 projects worth $4.5 billion in 2019. In stark contrast to the strong flow of projects that were committed in 2017 and 2018 and are now coming online, the pipeline of new projects commencing construction has dropped significantly due to last year’s stalling of commitments.

A policy vacuum beyond 2020 remains a major roadblock, while under-investment in network capacity to address congestion and constraints and concerns about falling marginal loss factors (MLFs) add to the long list of headwinds. The CEC warns that many of the rules relating to grid connection, network investment and market design are no longer fit-for-purpose and are a significant deterrent to potential investors.

“These issues need to be resolved urgently if Australia hopes to attract investors and ensure the necessary level of new energy generation capacity,” CEC CEO Kane Thornton said. “New investment is critical to replacing these coal-fired power stations and delivering on Australia’s emission reduction targets.”

The CEC figures echo the findings from Bloomberg New Energy Finance (BNEF) showing investment in utility-scale renewable energy assets fell 56% year-on-year, to just US$3.2 billion, its lowest level since 2016. Investment in onshore wind farms plunged to just US$1.6 billion from US$3.7 billion, while investment in utility-scale solar fell to US$1.2 billion from US$3 billion in 2018. The figures posted by the rooftop solar sector were the only bright spot in the final tally, reducing the overall drop in renewables investment to 40%, BNEF finds.

“Australia’s major political parties took ideologically opposed clean energy platforms to the May 2019 federal election, once again stymieing any hope of long-term policy certainty,” Leonard Quong, an energy analyst at BNEF, said. “Conditions across Australia’s thinly spread out electricity network continued to deteriorate. Falling loss factors cut revenue expectations for many, curtailment began to bite for some and connection delays were a major source of pain for a few.”

With no mention of the widely-reported massive drop in renewable energy investment, Federal Minister for Energy and Emissions Reductions Angus Taylor recently hailed 2019 as a new record year for renewables in Australia. A known wind energy opponent, Taylor claimed that there was already too much wind and solar on the Australian grid when appointed in 2018. However, he was ready to claim the credit for the new installation records set last year.

“In 2019, we set new records for renewable capacity installation and total electricity generated from renewables,” he said. The minister quoted the Clean Energy Regulator’s estimates that a record 6.3 GW of new renewable capacity was installed in 2019, 24% above the previous record set in 2018.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.