EnergyTrend expects price shuffle after EU ends MIP

According to the Taiwanese analysts, the solar PV module market is still stable. However, EnergyTrend expects a new price war to erupt with the end of minimum import tariffs (MIPs). In particular, Taiwanese manufacturers will have to cope with increasing price pressure.

Energetica to establish gigawatt module fab in Austria

Production of high-efficiency solar PV modules in the Austrian region of Carinthia should commence as early as December 2018. Using a fully automated production line, Energetica Industries says it is well equipped for competition with Asian manufacturers.

Arctech Solar breaks into Australian market

Contracts have been inked for the Chinese manufacturer to supply a combined 377.6 MWp of tracking systems for two Australian projects. To ensure its presence in the market, the company is setting up a subsidiary Down Under.

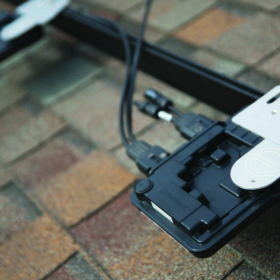

Fronius Symo Hydrid now in sync with LG Chem RESU battery

The trademark all-in-one product of the Austrian inverter specialist is now compatible with the LG Chem storage solutions.

Report shows Tesla’s battery gigafactory booming

The report found over 3,200 employees working at the factory at the end of 2017, and $3.7 billion in invested in the plant.

Enphase boosts confidence, touts technology during analyst day

While the microinverter maker is still the target of an aggressive short, Roth Capital Partners has reiterated its “buy” at $6.50 per share, describing the IQ8 as a “game changer”.

PV Info Link: Mono-cSi cell price drops below multi

According to PV Info Link, the price for monocrystalline cells in China fell below that of the usually cheaper multicrystalline products. However analysts expect it to be a blip, with multi prices expected to fall and mono to be supported by the Top Runner Program, now China’s main source of demand for the rest of 2018.

Enphase finalizes purchase of SunPower mincroinverter business

The deal gives SunPower $25 million in cash and 7.5 million shares in Enphase. Enphase also gains access to SunPower microinverter IP, and rights to SunPower’s Equinox AC modules line.

Jinko sees Q2 profits slightly increase, confirms shipment outlook for fiscal 2018

The Chinese manufacturer has seen its revenue decline significantly in the second quarter of this year, despite quarterly shipments dropping just 3.1%. This performance, which confirms a trend that was already clear in fiscal year 2017, was mainly due to lower solar module ASPs. Quarterly net profit, however, has more than doubled. Despite recent developments in the Chinese PV market, the company maintains its shipment outlook for full fiscal year 2018, in which it hopes to ship between 11.5 GW and 12 GW.

Taiwan’s Neo Solar Power narrows loss ahead of merger

Taiwanese cell producer, Neo Solar Power has posted a net loss of NT$390 million (US$12.75 million) for the second quarter of 2018. Though indicative of the difficult times currently facing Taiwan’s cell manufacturers, the figures represent a 39.3% reduction compared with the previous quarter’s loss.