Renewable energy loans on the up

Fintech and green loan lender Plenti has recorded a 19% increase in renewable energy loans from its previous corresponding period.

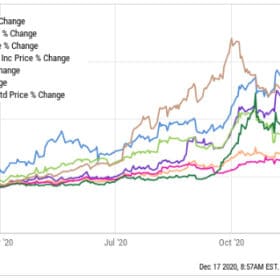

Solar stocks finish as 2020’s hot ticket

In spite of this year’s tumult, many solar companies’ stock prices have seriously soared – with a number of companies seeing their share price quadruple in the last year.

2020 Year in Review

Soon 2020 will only be a worry to future high-school history students. But when they ask us if anything good at all happened in 2020, remember this review and tell them that solar PV shone in the darkness. Despite the mess of it all, 2020 has been another good year for Australian solar. The industry has demonstrated resilience, and significant progress has been made in the fields of energy storage, green hydrogen and others.

CEFC and Aware Super commit to emissions conscious private-equity fund

The Clean Energy Finance Corporation and Aware Super, one of Australia’s largest superannuation funds, have both committed $80 million to Adamantem Capital, a private-equity fund which requires its target companies to meet strict emissions reduction targets. For the CEFC, this is the beginning of decarbonisation in a part of the economy lagging behind, namely, private equity.

New renewables fund champions the low-risk, small utility-scale solar sector

Small-footprint solar farms can get a purchase on distribution lines, they’re virtually pop-up in terms of construction time, and a smart development model can be easily repeated. The Solarion Renewable Fund wants to let investors into its clean little secret.

Asian Development Bank provides more than $1bn finance for renewables power lines

The development lender has followed up a $600 million loan for distribution infrastructure in eastern Indonesia with a $430 million credit line for installations in India.

New WoodMac report forecasts renewables cheaper than coal by 2030 across Asia-Pacific

A new Wood Mackenzie report has forecasted a massive swing in the levelised cost of electricity across the Asia-Pacific over the course o the next decade. Before 2030, renewables will be cheaper than new coal and gas almost everywhere, and significantly cheaper in Australia.

Japanese owner of WA’s Bluewaters coal plant reports worst ever loss in face of energy transition

The Sumitomo Corporation has reported a stunning ¥26bn (US$251m) loss on its Western Australian Bluewaters coal fired power investment. The loss assures the company’s worst ever annual performance and comes as a result of international and financial pressure against coal funding.

Vast array of global banks revealed as green financiers of 460 MW Western Downs Green Power Hub

Neoen announced last month that it had completed the financing of its 460 MW Western Downs Green Power Hub, but today it has been revealed that said green finance came about through a wide reaching international effort, including seven global banks, a salutary sign that green finance is accelerating as fossil fuel divestment continues.

Danish investment fund backs 5 GW WA renewable hydrogen project

Danish investment firm Copenhagen Infrastructure Partners has given its partnership to Hydrogen Renewables Australia as it looks to develop the 5,000 Mw Murchison Renewable Hydrogen Project near Kalbarri in Western Australia. The project looks to utilise Australia’s best wind and solar resources to produce hydrogen fuel for export to nations such as Japan and Korea.