Macquarie sets up unit to build 8 GW solar project pipeline in Europe

Green Investment Group, owned by Macquarie, has launched Cero Generation, which will operate on a European scale and carry out both ground-mounted and commercial scale power generation projects. It will also provide integrated energy storage solutions.

Global mineral processor invests in CopperString 2.0

Korea Zinc Company Ltd., parent company of Townsville-based Sun Metals, has entered into a $17 million financing agreement with the 1,100km CopperString 2.0 transmission line project across North Queensland. The project, which received an $11 million boost from the Federal Government recently, would open up enormous tracts of land for the development of renewable projects and minerals.

US alternative investment fund backs Social Energy for rapid Australian expansion

UK-based Social Energy launched in Australia with the help of shareholder Shane Warne back in 2019. Now the smart energy firm is being backed with a significant investment from US-based alternative investment fund manager CarVal Investors in order for the company to rapidly grow Down Under.

Weekend read: No dummies as Chase cuts through solar’s jargon

There’s more to read in the solar world than pv magazine alone, as much as we may hate to admit it. Looking back across some of the industry’s seminal works, leading analyst Jenny Chase’s 2019 book is too valuable, and entertaining, to be ignored.

Green finance innovation caters for ‘Virtual Storage’ market

Hydro Tasmania and buyers Macquarie Group and ERM Power have signed a ‘Virtual Storage’ deal which will see the pumped-hydro company sell the rights to its highest priced periods of ‘discharge’ and buying a fixed MW block of low-priced ‘charge’. The innovative contract is the product of the ARENA-funded Renewable Energy Hub.

Renewable energy loans on the up

Fintech and green loan lender Plenti has recorded a 19% increase in renewable energy loans from its previous corresponding period.

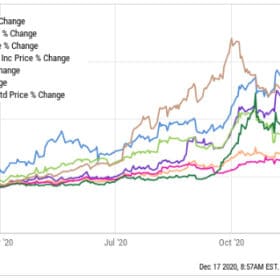

Solar stocks finish as 2020’s hot ticket

In spite of this year’s tumult, many solar companies’ stock prices have seriously soared – with a number of companies seeing their share price quadruple in the last year.

2020 Year in Review

Soon 2020 will only be a worry to future high-school history students. But when they ask us if anything good at all happened in 2020, remember this review and tell them that solar PV shone in the darkness. Despite the mess of it all, 2020 has been another good year for Australian solar. The industry has demonstrated resilience, and significant progress has been made in the fields of energy storage, green hydrogen and others.

CEFC and Aware Super commit to emissions conscious private-equity fund

The Clean Energy Finance Corporation and Aware Super, one of Australia’s largest superannuation funds, have both committed $80 million to Adamantem Capital, a private-equity fund which requires its target companies to meet strict emissions reduction targets. For the CEFC, this is the beginning of decarbonisation in a part of the economy lagging behind, namely, private equity.

New renewables fund champions the low-risk, small utility-scale solar sector

Small-footprint solar farms can get a purchase on distribution lines, they’re virtually pop-up in terms of construction time, and a smart development model can be easily repeated. The Solarion Renewable Fund wants to let investors into its clean little secret.