NSW solar farm approved with ‘strict’ conditions following community outcry

The NSW Independent Planning Commission on Monday approved the 215 MW Oxley Solar Farm and coupled 50 MW/50 MWh battery in Armidale, enforcing a number of conditions on the project in response to significant community backlash.

Union alleges EnergyConnect workers face unsafe conditions

Australia’s largest electricity transmission project has hit a snag with a major union alleging transmission line workers delivering the New South Wales stretch of the $2 billion-plus (USD 1.32 billion) Project EnergyConnect electricity interconnector have been working in unsafe and non-compliant conditions.

Australian lithium, critical minerals, with Chinese ties unlikely to cash in on US IRA subsidies

A number of Australian critical minerals, including lithium, miners and refiners will likely be ineligible for IRA subsidies after the US government published its draft rules forbidding access to enterprises with over a 25% stake held by Chinese companies or “cumulatively” by Chinese investors.

Piling subcontractor fined $40,000 after explosion on Western Downs solar farm

A Queensland court has fined a subcontractor providing piling services at Columboola Solar Farm* $40,000 (USD 26,300) for failing to comply with a health and safety standards after an aerosol can explosion caused a metal bar to strike a worker.

Origin deal collapse ends Australia’s corporate climate-takeover era

Origin shareholders have voted down the Brookfield-led takeover bid, likely ending what would have been one of Australia’s largest corporate buyouts. The failure of the deal concludes 18-months of bids by private capital to accelerate the sluggish transition of Australia’s two biggest ‘gentailers.’

BP to take full control of Lightsource BP

Energy giant BP announced today it would take full ownership of solar and wind energy developer Lightsource BP once a deal – pertaining to the purchase of the remaining renewables company’s shares BP does not own – goes through next year.

Victorian EV owners to receive road-user charge refunds, including interest

The Victorian government will repay, with interest, electric vehicle owners who paid a road-user charge later deemed unconstitutional by Victoria’s High Court.

Weather risk up, margins down: solutions to future-proofing big solar

Extreme weather is a growing risk to solar farms. Future-proofing through advanced technologies, leveraging data from novel sources, and by building both collaboration and acceptance of risk is vital, but rarely achieved today for a number of reasons. Insurers, lenders, developers, contractors and manufacturers come together here to discuss solutions to the intractable problem of weather risk.

Solar installers, designers, have 3 months to move to new accreditation scheme after CEC stripped of role

Australia’s Clean Energy Regulator has selected a new body to take over the role of accrediting solar installers and designers, a position previously held by the Clean Energy Council. The new organisation will be formally announced in February, 2024, with solar installers given three months to transition to the new scheme at no extra fee.

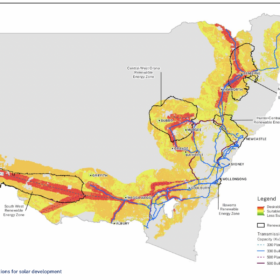

NSW gov proposes ‘standard’ benefit sharing and revised approval pathways to accelerate renewables

The NSW government has published a suite of draft guidelines for renewable projects, most notably proposing community benefit sharing fees of $850/MW per annum for solar, and $1050/MW for wind. While the guidelines are an attempt to level the playing field between communities, local councils, and big developers, some fear the proposed rules could undercut ongoing negotiations.