The report, titled ‘Fuel Tax Credit Scheme and Heavy Haulage Electric Vehicle Manufacturing in Australia,’ exposes the diesel rebate as Australia’s largest fossil fuel subsidy. Moreover, the rebate primarily benefits the mining industry and makes no contribution to road infrastructure financing, as has commonly been misrepresented.

Introducing a cap on the federal diesel Fuel Tax Credit Scheme subsidy for the mining sector at $50 million annually per consolidated group, as suggested by the report’s authors, would mean that only eight mining firms would be impacted – exactly those companies that have the resources and means to transition their fleets of mining vehicles to zero-emission vehicles produced in Australia.

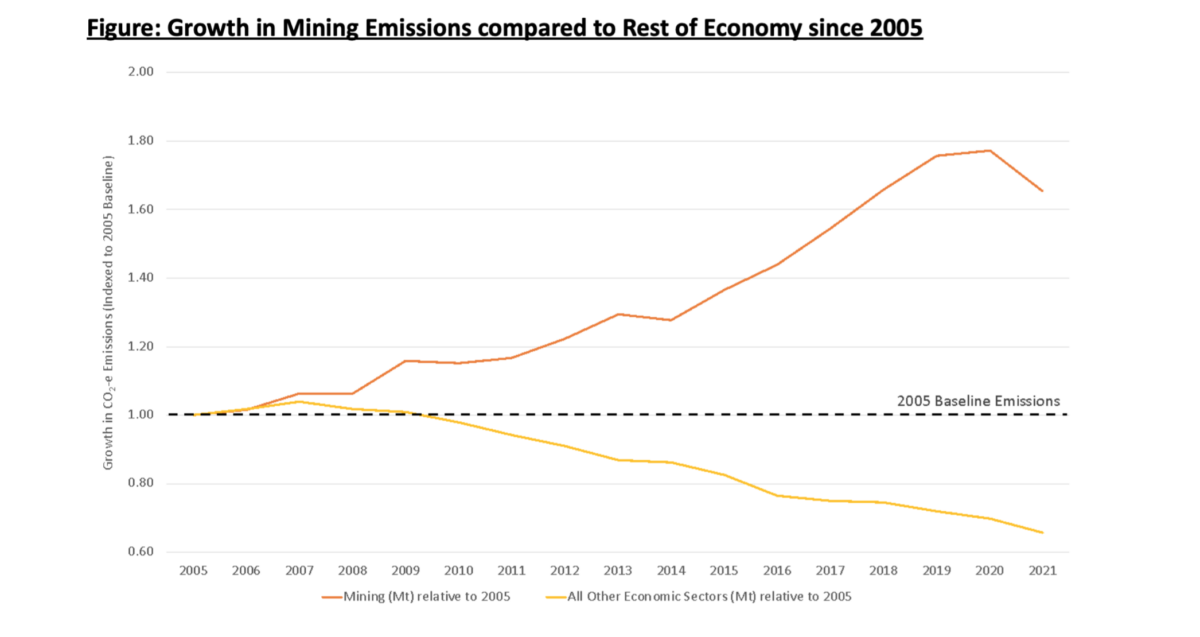

Australian fossil fuel exports are declining while critical minerals for producing and storing renewable energy are increasing exponentially. With few players in the mining industry making efforts to reduce emissions, the growth in the mining industry, driven by the world’s thirst for critical raw materials such as lithium, is clearly illustrated with a corresponding growth of emissions from that industry.

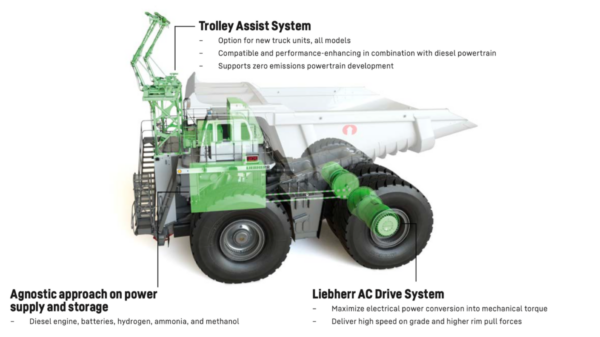

Image: Liebherr

The Climate Energy Finance (CEF) report lays bare how Australia is seriously lagging behind its international counterparts, hampered by outdated legislation from a time when fossil fuels were king.

Dispelling a false narrative

The diesel Fuel Tax Credit Scheme comes from a time when fossil fuels represented lucrative future industries in Australia. The scheme was introduced in the 1950s to finance investment in roadways as motorised transport saw exponential growth. However, the subsidy has contributed nothing to roadways investment since 1992.

But the strength of lobbies in fossil fuel industries has a legacy. The CEF report points out that Allianz Economic Research identified Australia, alongside Venezuela, the Middle East and North Africa, as regions with exceptionally high fossil fuel subsidies. This fact has been obfuscated in Australia by fudging definitions of subsidies.

Tax rebates are acknowledged as subsidies the world over and are being implemented in industrial policy for ‘carrot and stick’ incentives in industrial policies internationally, with measurable effects.

Australia currently produces more lithium than any other country in the world. Australia also has optimal conditions for producing renewable energy – ideal for creating new industries in a world increasingly fraught by energy scarcity. The mining industry has an exceptionally high and growing demand for mining vehicles and equipment. That means, for manufacturing these products onshore, the domestic market already has the demand to create a thriving low and zero-emission mining vehicle manufacturing industry.

Investing in growing industries

The CEF report finds that a diesel rebate cap would save $14 billion to 2030 and kickstart onshoring mining EV industry in Australia. The thinktank proposes 100% of the tax revenue gained from a diesel subsidy cap be directed into a special purpose fund within the federal National Reconstruction Fund.

While manufacturing is a clear win for economic stability and growth, the question for Australia is what exactly it should manufacture with its mineral resources. In June this year, pv magazine looked into how much Australia can realistically achieve with its critical minerals. The CEF report advocates for an electric vehicle battery montage industry in Australia and vehicle and equipment manufacturing for zero emission machinery and vehicles.

Here, the report identifies fairly immediate investment opportunities for emerging Australian industries. “Electric vehicle battery pack assembly for mining equipment provides a consistent demand base for developing Australia’s first mobility-oriented battery industry. This is a stepping stone to onshoring Australia’s heavy road transport electrified powertrain industry,” the report points out.

According to the CEF report, the electrification of Heavy Mining Equipment (HME), such as excavators and dozers, also provides a significant boost to the annual battery demands of the mining industry as it transitions to net zero. “The electrification of rail systems, both in urban areas and extended networks connecting mining to ports in the Pilbara, New South Wales and Queensland, provide further baseline demand for onshoring an Australian battery industry,” the report reads.

Not only is there a demand for mining vehicles in Australia, but there is more demand than anywhere else in the world. This in turn, drives demand for Australia’s abundant renewable energy sources as transportation sectors become increasingly electrified. As the report points out, “Electrifying Australia’s non-road diesel fleet across remote regions will require a significant uptick in renewable energy generation and transmission.”

Image: Liebherr

The report gets quite specific about its recommendations for investment, suggesting that the fossil fuel subsidy cap, affecting only the largest and wealthiest mining industry players, would allow the mining haulage electric vehicle (EV) industry to be, “turbocharged with $14 billion of tax funding recouped via our proposed cap on the FTC [subsidy] Scheme to incentivise the world’s most advanced battery and haulage vehicle manufacturers – Liebherr, Komatsu and Caterpillar – to leverage Australia’s world leading mining sector.”

That said, Australian companies have also garnered international attention for zero-emission mining vehicles. Although not filling the gap for extra large mining vehicles, two Australian manufacturing and technology companies Ampcontrol and PPK Mining Equipment aim to deliver a range of battery-electric vehicle solutions for underground mining applications. The two are installing Ampcontrol’s electric drive systems into PPK personnel carriers. Australian fast-charger specialist Tritium has also redesigned a DC fast charger for mining operations.

“As a consequence of the absence of emissions standards, the particulate matter pollution of the approximate 700,000 non-road diesel engines in Australia is almost double that of the 20.1 million registered on-road vehicles across all types in Australia,” notes the CEF report. These negative statistics also give an idea of the enormous potential for growth in electric mining vehicles, not to mention their significant impact for reducing overall emissions in Australia.

International landscape will not wait

Internationally, governments are subsidising low- and zero-emission technologies, spurning an international competition for talent and manufacturing capacity. The CEF report highlights this environment that has accelerated significantly in the last couple of years with US Inflation Reduction Act (IRA), while Europe, among others, has implemented policies that similarly accelerate low and zero-emission technologies in industry.

The ‘Fuel Tax Credit Scheme and Heavy Haulage Electric Vehicle Manufacturing in Australia’ is a carefully researched and detailed report presenting a moderate proposal that would leverage just a portion of the diesel Fuel Tax Scheme. Irrespective of how the funds freed up by means of a cap should or could be spent, the report highlights Australia’s potential to further lead in low and zero-emission mining vehicles and equipment that represents a globally competitive market lead, and exposes an outdated bit of legislation that is urgently in need of change.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.