All Energy Australia Day 2

Welcome to Australia’s largest national showcase of renewable energy at the Melbourne Convention and Exhibition Centre. Follow pv magazine live to keep updated on the latest Aussie solar PV and storage developments and trends from this year’s event, as they happen. Stay tuned!

Jinko launches Tiger module Down Under

The Chinese manufacturer has officially unveiled its high-efficiency product in Melbourne after celebrating a 13.6 MW panel order from the nascent Hungarian PV market.

AEMO brings up staged approach to energy transition

The Australian Energy Market Operator (AEMO) has undertaken a review on how Australia compares with other international power systems and suggested that the theoretical limits on wind and solar penetration may need to be defined with an eye on the power system stability.

All Energy Australia Day 1

Welcome to Australia’s largest national showcase of renewable energy at the Melbourne Convention and Exhibition Centre. Follow pv magazine live to keep updated on the latest Aussie solar PV and storage developments and trends from this year’s event, as they happen. Stay tuned!

SMA showcases solutions for all applications at All Energy

Visitors at the All-Energy event will have the opportunity to find out about the German inverter maker’s latest PV system technology and comprehensive solutions for home, business and large-scale applications.

City of Sydney unveils $60 million green energy deal

The City of Sydney has unveiled the biggest standalone renewables deal for an Australian council. Valued at over $60 million, the plan will see the City meet its electricity needs using only wind and solar.

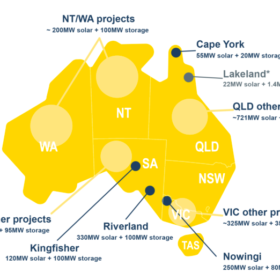

Major projects on sale as three Lyon Solar companies enter liquidation

Creditors of Brisbane-based solar and storage developer Lyon Group have announced that three of Lyon Solar’s companies are now in liquidation after their directors failed to meet a deadline. Deloitte is now looking for buyers for the Companies’ projects.

Commercial rooftops will lead renewables growth in the next five years

Although the International Energy Agency’s latest renewables report forecasts impressive solar growth there is still a nagging feeling it has produced conservative estimates and the emphasis on sharing costs with grid operators is predictable.

Sonnen earns Australian Made label

Almost a year after the opening of its assembly and manufacturing facility at the site of the old Holden factory, German battery manufacturer Sonnen can now officially say its products are made in the land of kangaroos.

Tesla’s all-electric ute verging on reality

Telsa CEO Elon Musk has continued to tease the upcoming November release of the company’s all-electric ute. In a tweet Musk suggested the design resembled an “armored personnel carrier”.