AirTrunk, ib vogt sign virtual PPA for 29.9 MW of solar in Malaysia

Data center specialist AirTrunk has signed a virtual power purchase agreement (VPPA) under which it will procure energy from a 29.99 MW solar farm that ib vogt is now developing. Construction on the project is set to begin later this year.

Weekend read: the ‘next big thing’

The PV industry in Southeast Asia has come a long way since guest author Ragna Schmidt-Haupt, partner at Everoze, reported on solar financing innovation in the region more than a decade ago. In this article, she outlines five factors for success, the newest of which has the potential to become a game changer, and not only in Southeast Asia.

Malaysian oil-backed company targets up to 8 GW in Australia, latest international player to invest multi-billions

Gentari, a subsidiary of Malaysian state-owned oil company Petronas, plans to build between 5 GW to 8 GW of solar, wind and battery projects in Australia by 2030. The ambition follows its acquisition and rebranding of Wirsol Energy, which marked the Malaysian company’s entry into the Australian renewable energy market.

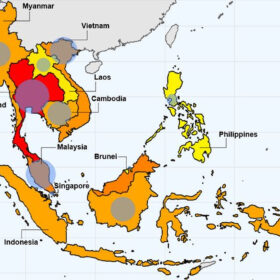

Southeast Asia has technical potential to deploy over 1 TW of floating PV

A group of researchers from the US National Renewable Energy Laboratory assessed the potential for floating PV (FPV) plants at reservoirs and natural waterbodies in 10 Southeast Asian countries. It found that the overall FPV technical potential for the region ranges from 477 GW to 1,046 GW.

TOPCon PV modules outperform PERC by more than 5% in energy yield tests

A study by TÜV Nord in Malaysia shows that the latest generation of tunnel oxide passivated contact (TOPCon) modules surpass their older rivals on energy yield. The researchers compared n-type TOPCon modules with older p-type PERC modules, both manufactured by JinkoSolar over a three-month period earlier this year. The newer product showed an energy yield 5.69% higher than its PERC counterpart.

TotalEnergies, Gentari to co-develop 100 MW Queensland solar farm

French oil and gas supermajor TotalEnergies has signed an agreement with Gentari Renewables, the clean energy arm of Malaysia’s state-owned oil company Petronas, to jointly develop a 100 MW solar farm in southwest Queensland.

Southeast Asia solar markets set for growth this year

New PV capacity additions in Southeast Asia are expected to bounce back this year for the first time since 2020, according to the Asian Photovoltaic Industry Association. The market is expected to grow by 13% in 2023, for 3.8 GW of new installations.

Malaysia opens its renewable energy market to PPAs, cross-border trade

The Malaysian government is developing a new strategy to expand renewable energy use in the country and also boost the domestic renewable energy industry.

Australia singled out as key investment market for Asian majors

Executives from Gentari, the clean energy subsidiary of Malaysia’s state-owned oil company Petronas, and Japan’s biggest steelmaker, Nippon Steel, are eying Australia for future investments in renewables projects and green-steel manufacturing.

BayWa’s lessons from expanding into Southeast Asia

In recent years, global renewables developer BayWa re has been turning its attention to the Asia Pacific, expanding into Southeast Asia. Junrhey Castro, the company’s director of solar distribution in Southeast Asia, sat down with pv magazine Australia to discuss its experiences in the emerging markets of the Philippines, Thailand, Malaysia, and Vietnam.