Best fire safety practices for rooftop PV system installations

Compiled by an international research group, the best practices were collected from all available guidelines published by national agencies, regulatory bodies, and trade associations.

Singaporean FPV firm targets offshore expansion plans

Floating PV is a growing niche in the solar sector, but its offshore segment has proven more difficult to activate, largely because of the difficulty of open-water energy generation. Nevertheless, the potential of offshore floating PV is almost unlimited, and one Singaporean firm, G8 Subsea, is looking to leave the safety of harbours and reservoirs.

Malaysia launches scheme enabling consumers to buy renewable energy

Through the Green Electricity Tariff (GET) program, the government will offer 4,500 GWh of power to residential and industrial customers each year. These will be charged an additional MYE0.037 (AU$0.012) for each kWh of renewable energy purchased.

Australian startups join forces to develop 1.3 GW hydrogen export facility in Malaysia

Two Australian companies, hydrogen fuel cell startup H2X and emerging renewables developer Thales New Energy, have signed an agreement with a Malaysian state-owned corporation to develop a 1.3 GW hydrogen export facility powered by hydroelectricity in the Malaysian state of Sarawak.

Corporate renewable PPAs are on the rise in Asia Pacific, says WoodMac

Corporate power purchase agreements are the second most adopted purchasing method in the world, and they’re growing fast. With the U.S. and Europe picking up the pace in the last year, the Asia Pacific is not going to be left behind, with Wood Mackenzie estimating corporate PPAs in the region doubled in the last year.

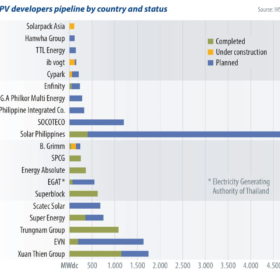

Saturday read: Southeast Asia’s big PV plans – 27 GW by 2025

PV markets in Southeast Asia have picked up over the past two years, driven by the astounding growth of Vietnam. Regional policies, combined with growing demand for renewable power in the manufacturing industry, will result in 27 GW of new PV installations across the region over the next five years, writes IHS Markit analyst Dharmendra Kumar. PV installations in these countries are driven by attractive feed-in tariffs, net energy metering, tariff-based auction mechanisms, and other incentives.

Saturday read: Southeast Asian solar markets emerging from the back of the pack

Southeast Asia could well become the global engine room of renewable energy expansion. Population and economic growth is expected across the three decades in which the world has to decarbonise, but the brimming bounty of renewables deployment will force developers to navigate the region’s systems. As it turns out, that could be a treacherous task.

Risen Energy makes $13.35 billion move into Southeast Asia

China-based Risen Energy is expanding its global footprint, the solar PV manufacturer and project developer announcing plans to construct a $13.35 billion mega production facility in Malaysia.

Malaysian green hydrogen project opts for Perth-based flow batteries

Perth-based TNG Limited has signed an agreement with Malaysian green hydrogen company AGV Energy which will see its vanadium redox flow batteries integrated into the HySustain project to store solar energy for green hydrogen production.

Saturday read: Five trends to watch in Southeast Asia

Minh K Le, senior renewables analyst at Rystad Energy, examines five key trends to watch in Southeast Asia utility-scale solar, as mega-scale projects ramp up, Indonesia emerges, and Vietnam steps back.