IRENA highlights solar critical to ASEAN energy transition

Indonesia will have to get to work installing more than 24 GW of solar this year – and every year – if the region is to achieve the 2.1 TW to 2.4 TW of photovoltaics the International Renewable Energy Agency has estimated it will require to achieve a net zero carbon energy system by 2050.

Singapore regulator issues fresh appeal for clean power

Singapore’s Energy Market Authority has already attracted proposals for 1.2 GW of renewable electricity, to be generated in four southeast Asian nations, and wants to raise that figure to 4 GW by 2035.

‘Clear winds of change’ in Southeast Asia

After a decade of under-delivering on its potential, there are changes afoot in Southeast Asia’s renewable energy development, says Assaad W. Razzouk, the CEO of Singapore-based developer Gurin Energy. Razzouk points to success stories in the region and notes that political will and clear regulations for developers are needed.

Thailand’s CK Power set to double in size through 2.8GW renewables investment

One of Southeast Asia’s biggest generators of renewable electricity, Thailand’s CK Power, is set to double in size over the next three years after announcing plans to add 2.8GW of new renewable electricity generation, including a ten-fold increase in its solar capacity.

Weekend read: Solar-plus-storage for aquaculture aeration

Recent research from Thailand has shown that solar-plus-storage on floating platforms could be the cheapest option to power energy-intensive aeration systems in aquaculture projects. The battery accounts for around 54% of the capital costs, which is why system sizing would be key for economic viability.

Corporate renewable PPAs are on the rise in Asia Pacific, says WoodMac

Corporate power purchase agreements are the second most adopted purchasing method in the world, and they’re growing fast. With the U.S. and Europe picking up the pace in the last year, the Asia Pacific is not going to be left behind, with Wood Mackenzie estimating corporate PPAs in the region doubled in the last year.

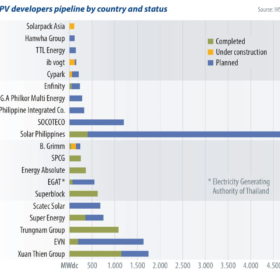

Saturday read: Southeast Asia’s big PV plans – 27 GW by 2025

PV markets in Southeast Asia have picked up over the past two years, driven by the astounding growth of Vietnam. Regional policies, combined with growing demand for renewable power in the manufacturing industry, will result in 27 GW of new PV installations across the region over the next five years, writes IHS Markit analyst Dharmendra Kumar. PV installations in these countries are driven by attractive feed-in tariffs, net energy metering, tariff-based auction mechanisms, and other incentives.

Saturday read: Five trends to watch in Southeast Asia

Minh K Le, senior renewables analyst at Rystad Energy, examines five key trends to watch in Southeast Asia utility-scale solar, as mega-scale projects ramp up, Indonesia emerges, and Vietnam steps back.

Thai plans for 8 GWh lithium battery gigafab

The 1 GWh first phase of a planned 8 GWh lithium battery factory in Thailand is likely to be up and running during 2023.

Thailand’s first floating PV project goes online

The 2 MW plant is installed at the historic site of agro-food group SPM, in Thailand. With 2.8 GWh/year of low-carbon electricity, it will cover up to 20% of the site’s annual energy consumption.