Nextracker the largest tracker provider in 2019

The ten largest solar tracker companies accounted for 88% of the market last year, according to analyst WoodMackenzie, with the market growing 20% from 2018.

Covid-19 to wreck economics of new solar and wind projects

While the full extent of the impact of the Covid-19 pandemics on the renewable energy market is yet to reveal itself, Norwegian consultancy Rystad Energy predicts new solar and wind projects will grind to a halt this year and experience a ripple effect in the years beyond as currencies across the globe continue to fall against the US dollar.

Covid-19: IHS Markit expects demand for private and commercial storage to fall significantly

A slump in demand would weigh more heavily on the storage industry than a temporary production shutdown and IHS Markit analysts say that is where the risk lies, rather than with a temporary shortage of battery cells. A similar prediction has been made for the PV market.

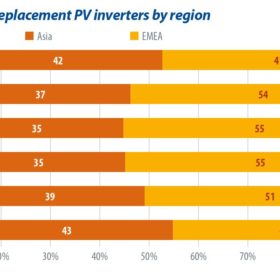

Out with old inverters, in with the new

Global demand for replacement inverters will likely grow by almost 40% to reach 8.7 GW in 2020, as a large and expanding installed base of aging solar PV installations drives deployment, writes Miguel De Jesus of IHS Markit.

Safety is paramount

When Sony first commercially introduced lithium-ion batteries in 1991, the industry recognized their potential to revolutionize portable electronics. Ever since, there have been countless efforts to improve the technology, with many researchers focusing on energy density and longevity, in line with demand from emerging applications such as electric vehicles (EVs) and on-grid energy storage. Julian Jansen and Youmin Rong of IHS Markit discuss the effect of safety concerns on this rapidly growing global market.

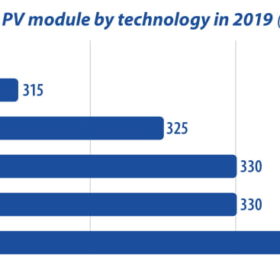

On prices, technology and 2019 trends

A maturing PV market does not automatically deliver certainty in terms of technology roadmaps and industry dynamics. Crystalizing trends and anticipating developments is the business of analysts, so pv magazine assembled four of solar’s best to talk about prices, technology and market-defining policy developments.

Long read: The dawn of megastorage

Plummeting costs, industry maturity, and the ever-increasing penetration of global renewables are expanding the use cases for battery storage technology. Over the past year and a half, storage projects are increasing significantly in both scope and capacity.

IHS Markit: Global EPC market grew 34% last year

China’s slowdown in installations last year was more than made up for by expansion elsewhere, according to IHS Markit. The news comes amid increasing market fragmentation – with the biggest engineering, procurement and construction business boasting less than 3% market share – and internationalization, with almost half of the top 15 companies operating across more than one region.

Growing interest in energy storage for maritime applications

The Electric and Hybrid Marine World Expo in Amsterdam last week highlighted growing interest in storage technology from the sea vessel industry. Leading global battery manufacturers had their latest charging technologies on display, catering to rising demand for clean, efficient electric and hybrid marine systems.

The sun rises on the bifacial module market

With market penetration exceeding expectations in 2018, bifacial technology is set to account for one third of global solar module production by 2022, writes Edurne Zoco, Research Director at IHS Markit. Bifacial and half-cell technologies are rapidly gaining momentum due to their improvements in power output, along with their low implementation barriers and minimal capex requirements.