Following 2017 final surrender, 9.4 million large-scale generation certificates (LGC) remained in the market, which compares to a 13.4 million surplus at the same time last year. An additional 0.57 million LGCs were pending registration and 0.73 million were pending validation, stated the Clean Energy Regulator (CER).

Under the Renewable Energy Target (RET), liable entities – generally electricity retailers – are required to surrender a number of renewable energy certificates proportional to their energy acquisition for the calendar year.

According to to the latest statistics, 7.4 GW of renewable projects have been “firmly announced” since 2016, of these 3.4 GW have reached financial close and/or under construction, and a further 1.9 GW have signed PPAs, indicating a high likelihood they will be fully financed and built this year.

As previously reported, the Clean Energy Regulator had stated that 6 GW of large-scale renewable would have to be built between 2016 and 2019 for the RET to be met.

In terms of the 2017 surrender rates, the CER said LGCs reached 93.3%, up from 89.3% in 2016. Meanwhile, small-scale technology certificate on time surrender rate was 99.9%, the same as in 2016.

What the future brings

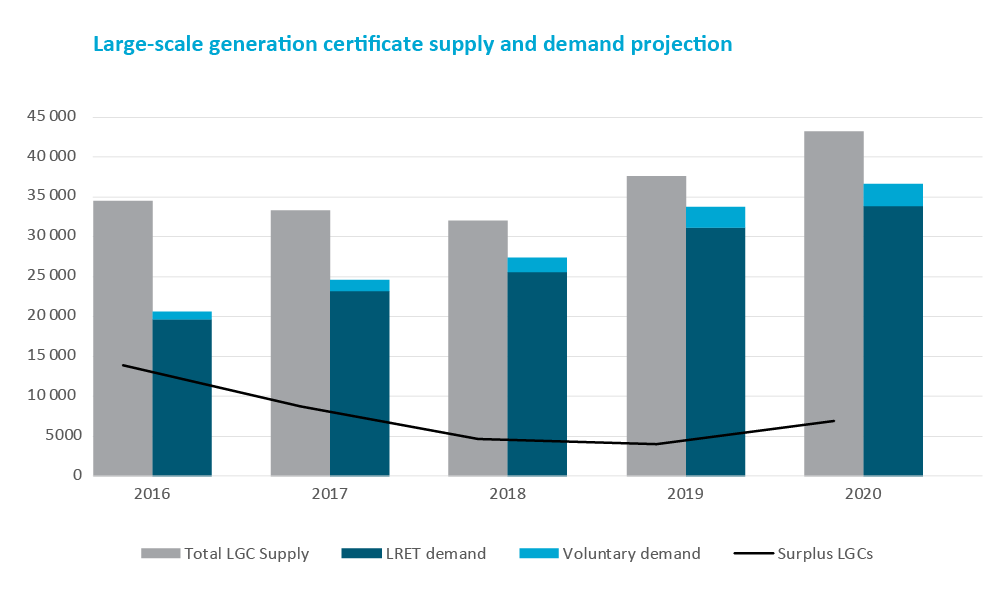

Following as described “a healthy surplus of renewable energy certificates“, the CER expects to see a significant increase in LGCs supplied to the market in 2018 and 2019 from new generation sources.

Last year had a record over 1 GW of new large-scale renewable energy projects accredited. Around 2.6 MW of new capacity will be accredited in 2018 and, because of additional announcements, at least a further 3.5 MW in 2019.

This surge in new capacity is in excess of the capacity required to meet the Large-scale Renewable Energy Target.

The CER estimates that the market will continue to operate with a surplus of around 5 million LGCs during 2018 and 2019, which should ensure sufficient liquidity in the market. The surplus is projected to increase in 2020.

Shortfall charges

Under the Large-scale Renewable Energy Target, entities which do not surrender at least 90% of their liability are required to pay a $65 shortfall charge for each certificate not surrendered.

With the high timely surrender rate in 2017, the amount of shortfall charges have substantially decreased, from $143 million last year to $89.5 million.

“Following final surrender, there remains 9.4 million large-scale generation certificates in the market for future assessment years. Contributing to the surplus, some entities have chosen to take the option to carry forward less than 10% of their liability, without paying the shortfall charge,” CER Chair David Parker said.

Commenting on the large amount of additional new build coming on this year and next, Parker says that there will be more than adequate surplus of certificates through to 2020.

“As the market starts to see the pace of build this year, and an increasing supply of certificates entering the market, we expect spot prices for certificates to moderate further,” he adds.

This article was amended on 26/2/2018 to reflect that the RET is 33,000 GWh.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.