The recently unveiled policy settings for 50% renewables by 2030 have been criticised by some as being too ambitious. However, a new report shows that 50% by 2030 is, in fact, low given the current installation rate.

According to the latest RE Index by Green Energy Markets, aiming for just 50% renewable energy share would result in a major market contraction in construction activity and employment in the renewable energy industry.

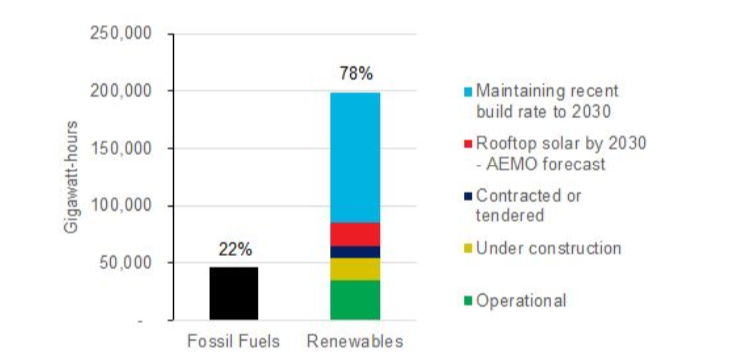

If Australia maintained over the next decade the record rate of both rooftop solar installations and wind and solar farm construction commitments that have prevailed since 2017, then renewable energy would represent 78% of electricity supply across Australia’s west and east coast main grids, the report finds. By comparison renewables made up 22.5% in October this year.

Graphic: Green Energy Markets

“I think most of us had thought a while back that 50% by 2030 would be a pretty massive task for the industry to scale-up to meet. But given the spectacular level of construction and rooftop solar installation activity since 2017, the industry is now facing a rather massive contraction in activity and employment even if Labor are elected nationally,” Tristan Edis, Director of Analysis & Advisory Services at Green Energy Markets, tells pv magazine Australia.

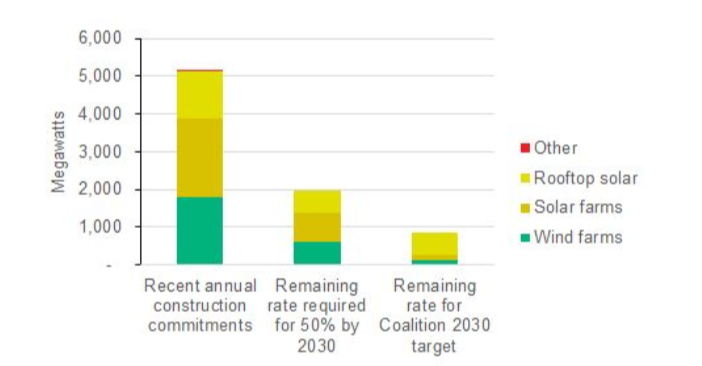

In terms of new renewable capacity added each year, the 50% target would involve around 1,850 megawatts, which would lead to a precipitous drop from the current average rate of construction commitments and rooftop solar installs running at almost 5,150 MW per year recorded over January 2017 to October 2018.

Graphic: Green Energy Markets

Meanwhile, the Coalition’s 2030 emissions target under the prior National Energy Guarantee would involve a collapse to 839 MW per year, the report finds.

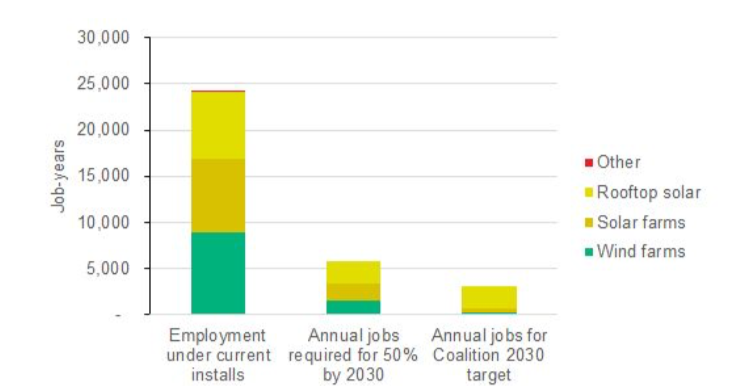

In terms of employment, the rate of installations required to deliver 50% renewable energy would see employment drop by three quarters to just under 5,900 jobs per annum, down from over 24,000 jobs per annum.

The Coalition’s target under the NEG would see more than 20,000 jobs lost in the renewable energy industry, with annual jobs dropping to 3,039, GEM finds.

Graphic: Green Energy Markets

October figures

While Australia’s future energy policy will clearly need an overhaul to keep the renewables industry unharmed, current installations figures continue to set new records.

Rooftop solar broke a record in October with 150 MW installed. This is 76% greater than the monthly average of last year – which itself was a record year for installations.

The 2017 record has already been smashed this year with the current installs now standing at 1,243 MW. GEM notes that this exceeds the Liddell coal power station’s average capacity over last summer’s peak period, while by the year’s end the total capacity installed in 2018 is in line to exceed the peak capacity of the recently closed Hazelwood coal power station.

According to GEM calculations, such an amount of capacity could be expected to save solar system owners close to $3 billion in energy costs over the next ten years.

Large-scale projects (wind and solar farms) also show strong figures. There were 412 MW committed to construction in October, bringing the year to date total to just over 3,200 MW. This comes on top of 3,933 megawatts committed in the prior year, GEM finds.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.