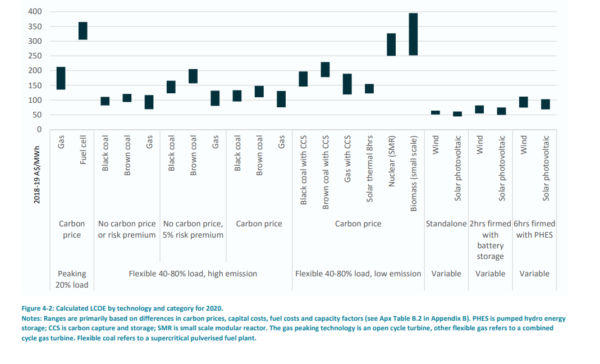

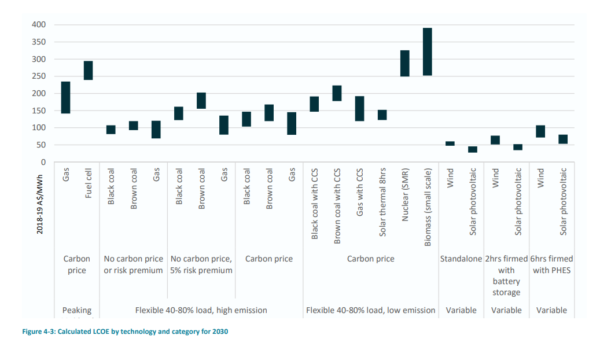

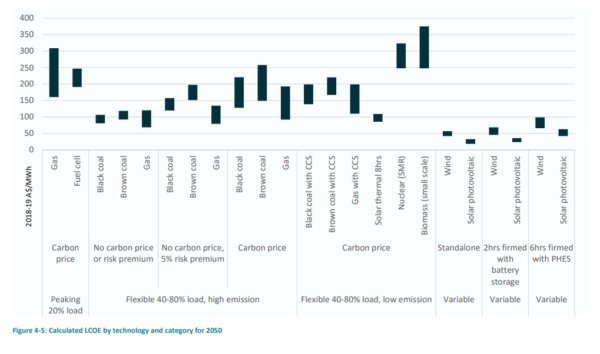

Analyzing the cost to generate electricity from new power plants in Australia, the Australian Energy Market Operator (AEMO) and the national science agency CSIRO have found solar and wind technologies to be lowest cost.

Largely based on the analysis of levelised cost of electricity (LCOE), the landmark GenCost 2018 report finds that the renewable energy sources will be cheaper even without a climate policy i.e. a carbon price.

“Our data confirms that while existing fossil fuel power plants are competitive due to their sunk capital costs, solar and wind generation technologies are currently the lowest-cost ways to generate electricity for Australia, compared to any other new-build technology,” said CSIRO Chief Energy Economist and report lead author Paul Graham.

“This also holds when the cost of fossil generation technology is adjusted for climate policy risk or not.”

While it notes that more energy storage will be needed to support the growing share of renewables on the grid, the report finds that even when the cost of batteries is added, wind and solar are still cheaper than any fossil fuel power plant.

“Data from GenCost 2018, combined with some of our previous research, indicates we may need additional flexible technologies – such as energy storage, demand management, and peaking gas plants – if the share of variable renewables increases beyond 50%,” Graham said.

This analysis will be used to guide strategic decision making, given that technology costs change significantly each year, and is particularly important in the light of scheduled coal generator shut downs, such as Liddell in New South Wales pencilled in for closure in 2022.

The report, therefore, compares costs of energy sources in the long run, meaning after the scheduled retirement of ageing coal generators across the country, and provides estimates for 2030, 2040 and 2050.

In terms of energy storage, the two institutions say it is likely they are over-estimating the amount of storage required, particularly in the early decades.

“For example, adding non-coincident renewables as a first step would likely be lower cost than adding storage,“ the report reads, but also notes that it could be the case that the amount of storage required in the context of very high variable renewable share scenarios in the later decades was underestimated.

Anyhow, according to Graham, battery storage uptake is still limited due to long payback period of 10-16 years, but the whole market is expected to truly take off once it switches from an ‘early adopter’ to ‚financially-motivated’, and make further contributions on the demand management side.

These findings will also be useful for the AEMO in its assements.

“The reports will act as the foundation for initial discussions with stakeholders when we commence our modelling inputs and scenario consultations for the next Integrated System Plan,” said AEMO Group Manager, Forecasting Nicola Falcon.

Renewables cutting power bills

In a separate report, the Australian Energy Market Commission’s annual report on electricity price trends shows a falling price outlook for the next two years owing to a pipeline of new renewables supply and flat demand.

Overall, a representative consumer will be paying around $28 less than today by July 2020 with the national average bill falling from $1367 to $1338.

On the state level, the results will be miscellaneous. South Australia (6.5%), Victoria (3.2%), south-east Queensland (2.8%), NSW (2.1%) and Tasmania (1%) will see energy prices reduce.

Meanwhile, ACT prices are estimated to increase 5% due to rising environmental and network costs, while Western Australia (4.5%) and the Northern Territory (2.7%) will also experience price rises.

But on the federal level, the AEMC calculates that over the next two years the volume of new wind and solar capacity will drive the typical wholesale component cost down by $55 – offsetting small increases in other parts of the supply chain, with network costs flat and the environmental cost component up by $4.

The reduction is driven by the estimated entry of 9,732 MW of accredited, committed or expected new generation and battery storage from 2017-18 to 2020-21, the bulk of which comes from large-scale wind and solar (8,961 MW) coupled with 205 MW of battery storage, supported by jurisdictional programs.

The AEMC also notes that the decreasing retail electricity price trend is also driven by network costs that are flat or increasing and environmental costs that are increasing, but these are outweighed by decreasing wholesale costs.

The latest reports showing the economic supremacy of renewables will hopefully be used to inform decisions for government underwriting of new power generation projects, which now appears to be heading into the wrong direction, favoring “firm” generation capacity a.k.a. coal.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.