Following concerns about the company’s finances, driven by uncertainty surrounding the future of Federal R&D tax concessions, losses from its microgrid operations and asset write-downs, the McGowan government has decided to axe its financial support to Carnegie Clean Energy’s Albany wave farm project.

The developer remains suspended from the Australian stock exchange for failing to post its half-yearly results by the due date. Following the ASX suspension, Premier Mark McGowan described the situation as “concerning”, noting cabinet would decide soon whether to continue support. The government has now come to a decision, assessing the company was unlikely to be able to deliver the project in reasonable time.

“Research and development projects always carry risk, and our Government won’t apologise for supporting local renewable energy R&D,” said Regional Development Minister Alannah MacTiernan. “We are committed to diversifying regional economies, and this project was just one in a suite of initiatives to drive new job opportunities in the regions.”

Despite serious questions over its ability to fund what it billed as Australia’s first commercial-scale wave farm, Carnegie received a $2.6 million government grant last October. The company was set to receive a total contribution of $15.75 million from WA taxpayers, provided it could foot its share of the development costs.

To unlock the rest of the funding, Carnegie was given a nine-week deadline to submit a detailed plan showing it could fund its $26 million share of the $53 million Albany wave energy plant. After missing the original deadline citing uncertainty around changes to federal R&D tax incentives, the developer was granted an extension to February, when it managed to come up with a funding plan at the eleventh hour.

“The unexpected proposal to change Federal R&D tax concessions created an environment of uncertainty that destabilised the company’s finances,” said MacTiernan, noting that Carnegie’s finances were in good order when the contract was signed.

In a statement to the ASX, Carnegie said it was disappointed with the government decision because its revised project funding plan outlined plans to deliver the Albany project over an extended timeline and with a reduced budget.

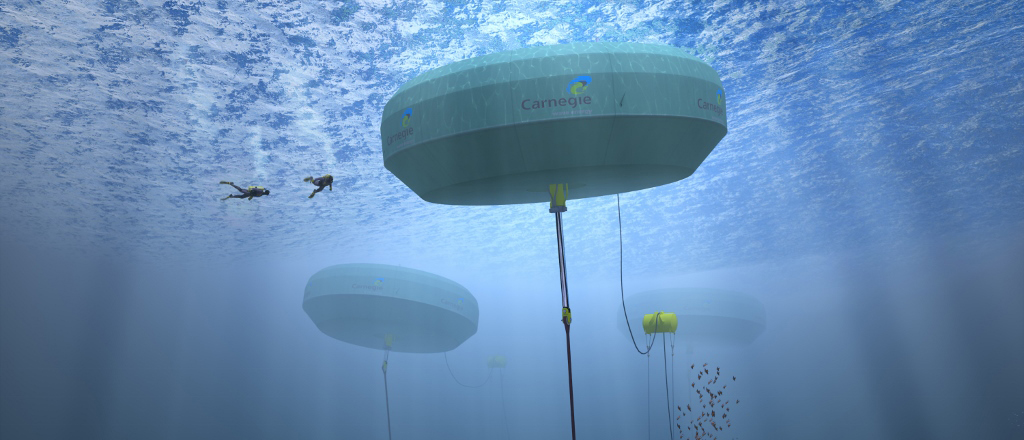

Carnegie believes the changes presented in the funding plan would make it possible to optimize the project spend profile in order to reduce the amount R&D tax incentive cash rebates that would be lost under the proposed changes, as well as provide additional time to incorporate a number of design innovations into the Albany CETO unit, which would have reduced the capital cost of the project, and the long term levelised cost of energy.

“Albany remains one of the most attractive worldwide sites to demonstrate and ultimately exploit the potential of wave energy,” the company said in a statement.

Write-downs

Last week, Carnegie posted its overdue half-year results, revealing a loss of $45 million, including write-downs on the value of its CETO wave technology and its solar microgrid business of nearly $40 million. The company’s wave technology was written down by $32 million, which came on top of a $35 million write-down it posted for the first half of 2018.

Carnegie’s troubled solar microgrid subsidiary Energy Made Clean (EMC) ended with a $6 million write-down, despite the completion of CSIRO Pathfinder and RAAF Delamere microgrid projects, a microgrid at a naval base on Garden Island, and WA’s first operational merchant utility solar project, the 10 MW Northam Solar Farm.

Identifying the EMC losses as one of the main reasons for the reduction in market capitalization, the developer said it was still looking at divestment opportunities, following a failed deal to merge its microgrid subsidiary with TAG Pacific’s M-Power. In its latest filings, Carnegie said it would continue to operate the EMC business, albeit for a finite period of time on a substantially reduced cost structure, while actively exploring all other options to reduce the cash burn. It noted potential buyers were conducting due diligence inquiries.

Carnegie is expected to make another announcement tomorrow about its solar microgrid arm and a planned capital raising program, when it also expects to recommence trading on the ASX.

The remaining cash pile

The remaining $13.125 million in the budget for the wave energy project will be directed towards delivering radiotherapy services in Albany, the state government said in a statement.

It also confirmed the co-investment in The University of Western Australia’s Wave Energy Research Centre will continue, focusing on marine renewable energy and supporting Albany’s marine industries. Works completed by Carnegie with state government funding, including geophysical and other surveys and mathematical models on wave conditions in Albany, will be made available to UWA and other interested parties.

“Our Government remains committed to research and development to ensure WA is a technology maker, not a technology taker – The University of Western Australia will continue its research work in Albany, which has already attracted scientists to the region,” MacTiernan said.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.