The 120 MW shovel-ready solar project near Wagga Wagga in New South Wales will be the first renewable energy asset in the portfolio of network owner Spark Infrastructure. The acquisition of the Bomen Solar Farm was announced as a “logical and prudent first step” in delivering what the company calls its Value Build strategy.

The move marks a major shift in the electricity sector beyond owning regulated network assets towards renewables. Spark Infrastructure explains the investment strongly aligns with its existing risk and return profile producing attractive and accretive returns.

“Bomen has highly contracted cash flows and attractive risk-adjusted returns which will exceed current regulatory returns,” says Spark Managing Director and CEO, Rick Francis.”The project is our first step towards our goal of building a business platform in adjacent essential service infrastructure focused on renewable energy.”

According to Francis, the acquisition is evidence of the company’s commitment to invest in Australia’s renewable energy future, and adds to its commitment to renewables through its existing electricity transmission and distribution businesses.

The Boman Solar Farm was acquired from developer Renew Estate, which is partly owned by German developer Wirsol Energy. It is located close to the Wagga North substation where it will connect into TransGrid’s transmission network. The project includes a 40 MWh battery storage component.

The Boman Solar Farm was acquired from developer Renew Estate, which is partly owned by German developer Wirsol Energy. It is located close to the Wagga North substation where it will connect into TransGrid’s transmission network. The project includes a 40 MWh battery storage component.

Construction is scheduled to commence in Q2 2019 and will be carried out Melbourne-based Beon Energy Solutions, which is owned by Victoria Power Networks (in which Spark Infrastructure has an ownership interest of 49%). A total cost at completion is expected to amount to approximately $188 million. Commercial operations are slated to commence in Q2 2020.

The project will feature PV panels supplied by Jinko Solar, inverters from SMA and trackers from Nextracker. It is expected to employ around 250 workers in the construction phase.

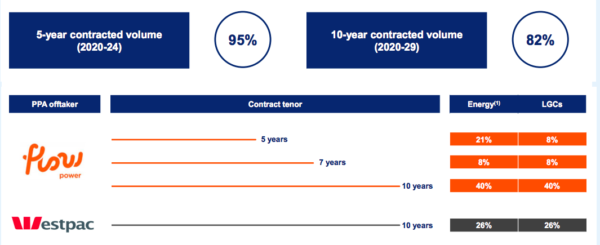

The project has an inked PPA with commercial electricity retailer Flow Power. Under the deal announced in December, Flow Power contracted 69 MW of the farm’s output to power munchies producer Snack Brands and winemaker Australian Vintage, which previously became the first Australian wine producer to sign a large-scale hybrid renewable corporate PPA.

The second PPA, which was announced on the same day as the project acquisition, was inked with Westpac, as part of its commitment to a 100% renewables target.

Westpac’s 100% renewables commitment

Westpac has become the latest Australian company and the third major bank to sign up to the to the global initiative RE100. To advance towards the goal, Westpac has signed a PPA to purchase over a quarter of the output from the Bomen Solar Farm, under a 10-year contract, covering both the electricity and LGCs.

The PPA is forecast to put the bank on track to reach 45% of renewable energy use by 2021 and move towards its ultimate target to source 100% of its energy from renewable sources by 2025.

Aside from its environmental benefits, Ceri Binding, head of energy and utilities in Westpac’s property team, said the PPA would deliver “greater cost certainty for the bank’s NSW electricity cost base”, although she didn’t disclose the contract price.

“It is economically the right thing for Westpac to do,” she says, noting that the current cost of renewable electricity is less than the current wholesale price of electricity.

Westpac, in partnership with Spark Infrastructure is also committing $1 million to support the community over the term of the contract. This includes STEM scholarships as well as providing support for youth facilities, local biodiversity and vegetation regeneration programs.

“We’re proud to be supporting the local Wagga Wagga community,” said Gary Thursby, Chief Operating Officer at Westpac Group, noting that the advancement of technology and reduction in cost has presented a great opportunity to make the transition to renewable energy in a cost effective way.

“As the largest financier to greenfield renewable energy projects in Australia – renewables make up 71% of Westpac’s lending to the electricity generation sector – becoming a customer to this industry is an important step for us,” he said.

Westpac’s declaration to become 100% renewable sees the bank join 171 other companies globally to have joined to RE100 – an initiative launched in 2014 by The Climate Group in partnership with CDP.

The RE100 members include Atlassian, which became the first Australian tech company to sign up last week and commit to sourcing 100% renewable electricity for its global operations by 2025. Earlier this month, Bank Australia pledged to go 100% renewable by next year. The first Australian business to join RE100 in November was Commonwealth Bank of Australia. On the back of a 12 year PPA, CBA is sourcing energy from the largest wind farm in New South Wales – the 270 MW Sapphire Wind Farm – as of January this year, and is moving towards 100% renewable power by 2030.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.