The potential of Australian utility-scale solar to fulfil a large proportion of the country’s post-coal energy needs is huge. With 1.4 GW having been commissioned in 2018 a further 2 GW expected to come online in 2019, the industry focus is shifting from develop-and-construct to delivery and optimisation — that is, to meeting contractual obligations, and building trust with community and financial institutions that will further fuel the transition Australia has to have.

“There are only eight thermal generators south of Queensland and they’re providing 54% of energy to the NSW-Victorian-Tasmanian-South Australian markets,” said David Leitch, head of ITK Services Australia in the scene setting for last week’s Solar Asset Management (SAM) conference held in Sydney. And the biggest issue in the market is therefore, “How the system can ensure that enough new supply is built ahead of those thermal generation closures.”

The Australian solar industry has shown itself up to tackling the speed-to-market challenge. Ensuring efficient operation of built capacity over each solar farm’s 25- to 30-year life is the ongoing opportunity that other markets such as Europe and the US have some experience in addressing.

“What does global best practice look like in terms of utility-scale solar?” asked Smart Energy Council (SEC) CEO John Grimes at SAM, which the SEC co-hosted with international solar-events organiser SolarPlaza.

A plethora of overseas expertise is gathering around the Australian industry. From European full-service asset-management providers, such as Blueshore; to technical O&M service provision by trusted players such as German inverter manufacturer SMA; to intelligent deployment of new technologies such as aerial monitoring by companies such as Raptor Maps — the range of offerings is broad.

There is still large-scale uncertainty about the best mix of asset management services, and the cost benefits of employing additional expertise in a market that is experiencing reduced margins due to numerous factors, and energy-price uncertainties.

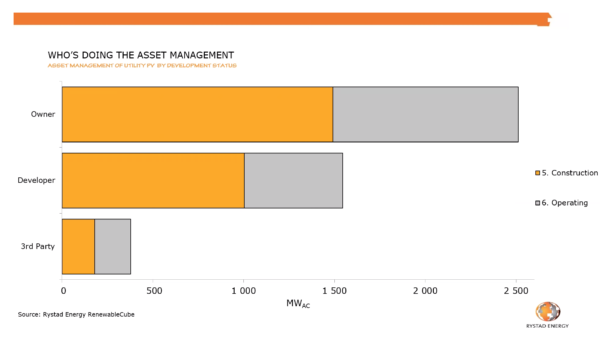

In a pre-conference webinar, David Dixon, Senior Analyst of Australian Renewables at Rystad Energy, showed that asset management of the majority of Australia’s solar plant under construction and already generating is run by the owners and developers of individual farms.

Graph: Rystad Energy RenewableCube

“There’s nothing new in asset management,” said Managing Director of innogy Renewables Australia, Alba Ruiz Leon, at the SAM conference. Innogy is the clean-tech subsidiary of German utility RWE, and is currently constructing the 349 MWp Limondale plant in NSW.

Ruiz Leon points out that other, extremely risk-averse, industries such as aviation have successfully managed the performance and safety of asset fleets for decades. There’s no need to reinvent the software wheel, she says, but there is an imperative to apply it. Application of computerised asset management systems, says Ruiz Leon, can optimise work strategies “to reduce your OPEX by between 12% and 40%”.

What you design for is what you get

Other experienced Australian solar asset managers, like Darren Docking, General Manager of Growth and Development for Renewables and Power Systems, at EPC and integrated services provider Downer, says, “What we’ve seen in the past three years in this sector is that 99% of the conversation in the developing/contracting phase is on the capital. One to five per cent is focused on the O&M phase.”

Like many conference speakers, Docking underscored that planning for O&M in the design and development phases is vital to optimising lifetime productivity of any solar plant: “If you’re thinking about ultimately driving the yield out of the project, you need to think about how you’re contracting and motivating and incentivising and specifying for that end game.”

Asset management as distinct from O&M

Full asset-management providers such as Blueshore integrate management of the 20 or more contracts involved in solar farm construction and maintenance into a suite of services that includes remote monitoring of plant.

Speaking to pv magazine, Blueshore Senior Manager of Asset Management Services, Beatriz Toribio López defined asset management as it is widely employed in Europe, as the ongoing management of financial, commercial and administrative tasks that will ensure optimal financial performance of an asset.

In Europe, an overarching asset-management contract is a prerequisite when applying to banks for finance, adds Toribio López. The banks’ experience is that risks can be mitigated and generation and profit maximised when a project is managed holistically by an entity with expertise in technical performance, contractual compliance, asset monitoring and energy-market trading.

Blueshore principal in Australia, Mike Rand, said at SAM, that it is not in the nature of shorter-term O&M contractors to always act in the interests of the long-term life of a solar project — decisions are typically made based on the life of their contract.

As an asset-management services provider, Rand says, “An extensive part of our focus is performance, and we drive that by identifying where any performance is being lost, and making sure that our asset owner or investor is getting value out of contracts that they’ve spent weeks and plenty of money on lawyers and technical advisors getting signed. If nobody runs the calculations, no contractor is going to pay you damages or do the work. You have to understand how your plant is performing in order to get the value out of your contracts.”

Data drives better use of resources in asset maintenance

All service providers agree that data is key to successful management of solar plant for the long haul, both in terms of running plant to comply with contractual deadlines and obligations, and in terms of condition and performance monitoring. Many incoming overseas service providers have archives of comparable data in monitoring platforms that help them correctly interpret the data and diagnose faults, defects and anomalies in equipment performance.

“When you’ve got a portfolio of plant you can actually see trends and if you build knowledge from those trends, you can get actual outcomes across portfolios including here in Australia,” said Frank Teofilo, Senior Director of Energy Services & O&M for First Solar in Australia.

Early identification of the reasons for under-performance is key to efficient preventive maintenance and avoiding costly loss of generation when critical components are allowed to deteriorate, ultimately causing failures.

Variations on the asset management theme

SMA is among companies offering technical asset management of solar farms as distinct from commercial asset management (which includes contractual and financial management). Felix Scheftschik, Global O&M Commercial Solutions Manager at SMA, told pv magazine, “The difference between poor man’s O&M” — which might involve only preventative maintenance — “and including corrective maintenance and availability guarantees in the contract, is that things like inverter or module replacement are then borne by the O&M provider.” Naturally, he says, fees for such inclusive services are higher, “but the asset manager or investor has greater financial stability; they don’t have to allow for significant variance in future corrective maintenance.”

Two benefits of the influx of overseas service providers are the upskilling of local subcontractors in this next phase of solar jobs creation, since virtually all incoming providers agree on the value in hiring local; and the cost reductions in services due to increased competition.

Says Brian Lonergan, Associate Director of the Clean Energy Finance Corporation (CEFC), “As a result of those firms coming in, we’ve seen maybe 30% to 50% reduction in O&M in the past three years.”

He adds that, no matter what kind of maintenance a solar farm chooses to contract, owners/investors need to understand the services they expect the firm to provide, and critically assess the provider’s capabilities and track record in that area.

Future finance

The interests of all parties are served by considered contracting and managing contracts well throughout the life of the asset, says Lonergan, because “You need to be able to prove that it’s been adequately maintained over its lifespan and that it’s a good, well-functioning asset, capable of driving value, which will increase its chances of being refinanced in future.”

It’s worth working towards financing renewables expansion in a post-PPA world, where solar energy is the standalone, hands-down cheapest source of energy — no government-secured market, no guaranteed offtake. Edwin Koot, SolarPlaza CEO, says Europe is beginning to see solar projects financed without such securities — “where an investor builds the plant, full equity, on their own and they’re going to sell the power on the spot market; and within two years the investor expects financiers will line up to buy that plant,” because it’s a good business.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.